With the (ridiculously manipulated propaganda) jobs report now in the history books, this week the whole financial world will be focused on Wednesday with two big events occurring: the latest FOMC and CPI (with PPI to follow on day later). Below, DB's Jim Reid previews the first two below but other events this week include NY Fed 1-yr inflation expectations today, UK employment data, US small business optimism and a 10yr UST auction tomorrow, China CPI and Japanese PPI on Wednesday, waking up to a mid-life crisis on Thursday alongside US PPI and a 30yr UST auction, with the BoJ decision and the US UoM consumer sentiment on Friday.

Before we delve deeper, it is fascinating to see the negative reaction of French bond markets this morning after the surprise news last night that Macron has called for snap legislative elections which will take place in two rounds on June 30th and July 7th. This is after his party trailed with 15% in the European Parliamentary (EP) elections with Le Pen's National Rally (RN) winning 32%. Although this was broadly in line with expectations, Macron is likely hoping to win back some momentum and hope a notable part of the EP results were a protest vote and also encourage other centrist parties to help rally round to limit the charge of Le Pen. His other hope would be that if RN have a bigger part in government, their appeal may diminish before the next Presidential elections in 2027. So a big gamble.

In terms of the wider EP elections the main takeaway is that even with the uncomfortable results in France and Germany, the centrist majority is holding as the far-right didn’t outperform expectations in aggregate. As the results have started to materialise the Euro is -0.44% lower as I type, at 1.0753 against the dollar, its weakest level in nearly a month.

Moving forward, Reid previews the main events of the week in more detail now. According to the DB strategist, it's not very often you have a US CPI released on the same day as a FOMC meeting and the former will certainly factor into the latest Fed Summary of Economic Projections (SEP). On Friday, a few US houses who were expecting summer Fed cuts pushed back their projections after the strong payroll number and this release will also influence the tone of the meeting. DB economists believe the new SEP forecasts are likely to revise core PCE inflation higher this year (2.8%), and move the median dot from three rate cuts to two with a desire for optionality for September perhaps the only thing preventing this moving nearer to DB's long standing expectation of a cut only arriving in December. The DB econ team also expects the 2025 median dot to move up by 25bps as well and the long-run dot to 2.75% (with risks it moves even higher).

Powell's press conference will no doubt offer nuances around any changes and will have the ability to put a dovish or hawkish spin on them. At this stage optionality will likely be preferred with little specific guidance.

May's CPI release hours earlier will cast a long shadow over the meeting. The DB Econ team expects headline CPI (+0.12% forecast vs. +0.31% previously) to come in softer than core (+0.27% vs. +0.29%), helped by declining gas prices last month. This would reduce the core YoY rate by a tenth to 3.5%, with the headline remaining steady at 3.4% (in-line with consensus). Under these forecasts the three-month annualized core rate would fall three-tenths to 3.8%, while the six-month annualized rate would remain at 4.0%. Obviously as ever rents will get a lot of attention to see if they are falling as the models suggest they should be and then for PPI on Thursday, the components that feed directly into core PCE (namely health care services, domestic airfares, and portfolio management) will be the main thing to watch.

For the Fed to cut rates in September (unlikely in our eyes), or earlier (only in an imminent crisis), inflation must fall sharply, or employment needs to weaken considerably. For the latter, Friday's payroll suggested that this will be tough to see in the data quickly enough. May's headline (+272k) and private (+229k) payroll gains were well above the +180k and +165k expected respectively with a 0.4% gain in average hourly earnings a tenth higher than expected. The diffusion index (63.4) was the highest level since January 2023 which shows that job growth has broadened out after narrow gains for a lot of the last year.

The other two big events of the week are the Chinese inflation and the BoJ. For the former, current median estimates on Bloomberg suggest the CPI may improve to +0.4% YoY in May from +0.3% in April, with the PPI also coming in higher relative to the previous reading (-1.5% vs -2.5% in April). For the latter, economists expect the target short-term interest rate to remain unchanged but highlights that the focus will be on guidance for JGB purchases. They also see changes including a reduction of the central bank's purchases from the current 6tn yen per month to 5tn yen.

Courtesy of DB, here is a day-by-day calendar of events

Monday June 10

Tuesday June 11

Wednesday June 12

Thursday June 13

Friday June 14

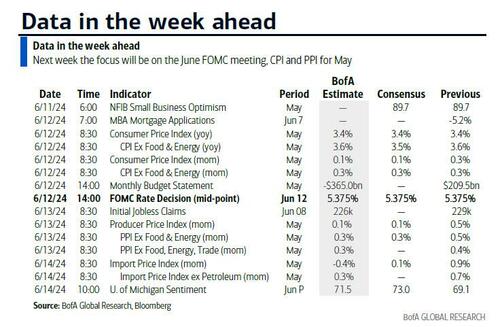

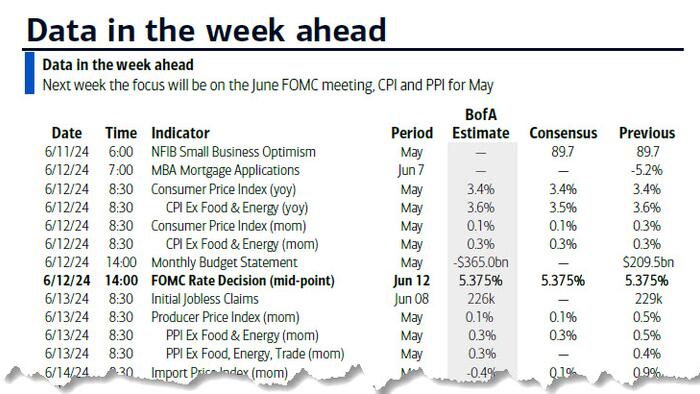

Finally, focusing on just the US, Goldman notes that the key economic data releases this week are the CPI report on Wednesday and the PPI report on Thursday. The June FOMC meeting is on Wednesday. The post-meeting statement will be released at 2:00 PM ET, followed by Chair Powell’s press conference at 2:30 PM.

Monday, June 10

Tuesday, June 11

Wednesday, June 12

Thursday, June 13

Friday, June 14

Source: DB, Goldman, BofA