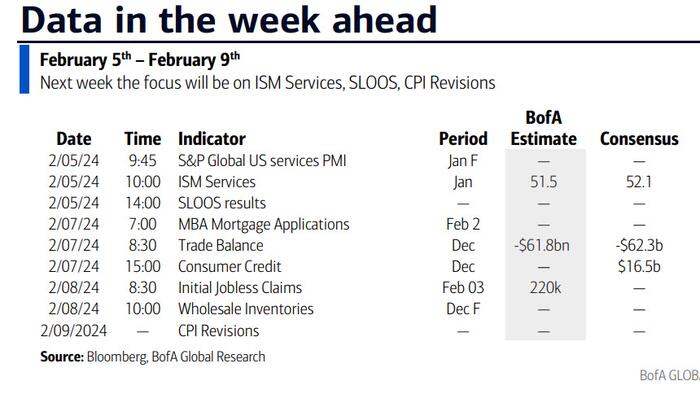

After last week's epic central bank/payrolls/QRA/earnings juggernaut, there's not a lot of US data this week, as is usually the case immediately post payrolls, but as DB's Jim Reid notes, the highlight could be the annual BLS revisions to the seasonal factors for CPI on Friday. Both Waller (pre FOMC blackout) and Powell (at the FOMC) noted that these are an important landmark to get past before potential rate cuts can be better calibrated. Last year, these revisions lowered H1 inflation and increased H2 which changed the momentum profile of inflation.

Before we get there, today we get the services ISM (53.4. consensus 52.0, with the prices paid component soaring to 64.0) which negatively surprised a month ago (at 50.6 and below all estimates), with the employment series the lowest since July 2020 (down from 50.7 to 43.3). That clearly was completely at odds with payrolls on Friday, so today's much stronger prints are a return to normalcy. Also anomalous has been the recent creep higher in initial jobless claims of late with continuous claims only having been higher for one week since November 2021. So another number to watch.

Today's Fed Senior Loan Officer's survey (SLOOS) should also be very important, but very tight bank lending in recent quarters hasn't so far translated into reduced activity as it has done in the past. Reid admits that he doesn't know why this is the case. It's possible that excess savings or cash are still high enough in the economy that business and consumers don't need much access to what would be very tight bank lending. This wouldn't be able to carry on forever so the survey results today are still important to see if banks are becoming less restrictive after some improvements last quarter. You can find the other US data in the diary at the end.

Outside the US, China inflation numbers on Thursday are worth watching. Current estimates on Bloomberg suggest the CPI is expected to fall further into negative territory from -0.3% YoY in December to -0.5% YoY in January. The PPI is seen marginally edging higher but staying in negative territory (-2.6% vs -2.7% YoY in December). The Chinese CSI index closed at 5-yr lows on Friday so marching to a very different beat to the US at the moment.

In Europe, the focus will be on economic activity in Germany with indicators due including industrial production (Wednesday), factory orders (tomorrow) and the trade balance (today). There will also be industrial production (Friday) and retail sales for Italy (Wednesday) and trade balance data for France (Wednesday). From the ECB, investors will keep an eye on the consumer expectations survey (CES) on Tuesday and the economic bulletin will be due on Thursday.

Elsewhere earnings season soldiers on but after the mega caps from last week, the main highlights this week, which we detail in the calendar at the end, are not going to move the macro needle.

Day-by-day calendar of events

Monday February 5

Tuesday February 6

Wednesday February 7

Thursday February 8

Friday February 9

Finally, looking at just the US, the key economic data release this week is the ISM services report on Monday. There are several speaking engagements from Fed officials this week.

Monday, February 5

Tuesday, February 6

Wednesday, February 7

Thursday, February 8

Friday, February 9

Source: DB, Goldman,BofA