As we move into mid-August, markets are bracing for a surprisingly busy week, with several key events and data releases likely to shape sentiment; of these, the most closely watched will be tomorrow’s US CPI report, which after the last week of July which had both the jobs report and the Fed meeting, could prove to be one of the larger events of the summer for markets, according to Deutsche Bank's Peter Sidorov.

And as DB's Jim Reid notes, also on the radar is Friday’s high-stakes meeting between Donald Trump and Vladimir Putin in Alaska as the US has pushed for a ceasefire in Ukraine. Last Friday Trump said a deal would involve “some swapping of territories” with reports suggesting that it would see Ukraine ceding Russia the parts of Donbas that it still controls. Ukraine’s President Zelenskiy was quick to reject the idea and European leaders have called for any peace talks with Russia to include Kyiv. Bloomberg reported yesterday that European leaders are seeking to speak with Trump before his meeting with Putin.

Elsewhere, tomorrow marks the deadline for the pause in levies between the US and China, and markets will be watching closely to see whether the truce is extended. There are also expectations that the long awaited pharmaceutical and semiconductor sector tariffs will be announced by the US.

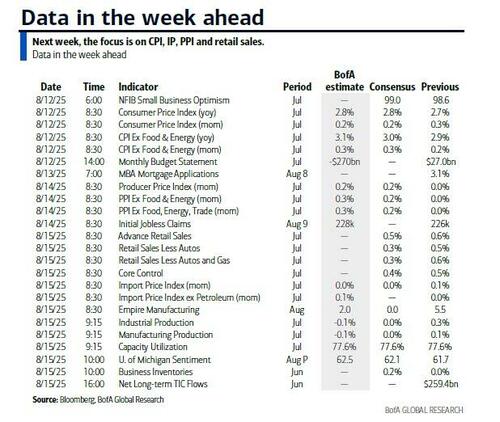

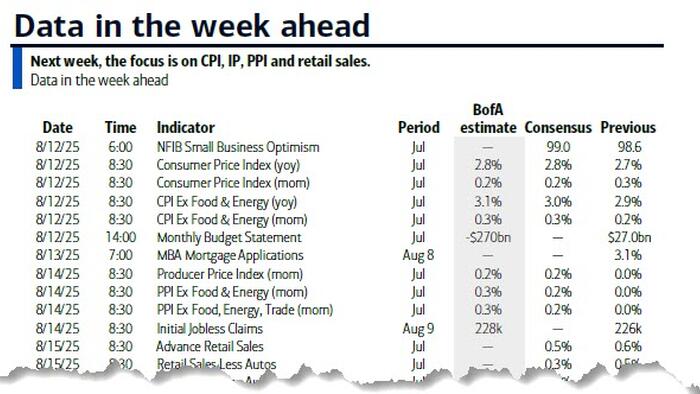

Beyond geopolitics, the economic calendar is busy even beyond the CPI release. In the US, we’ll also get PPI data on Thursday, retail sales figures that may show a boost from Amazon’s extended four-day Prime Day event (up from two days previously), and industrial production numbers on Friday.

Internationally, Japan’s PPI is due Wednesday, while China’s monthly data dump arrives Friday. Tomorrow also brings Germany’s ZEW survey and UK labor market statistics, followed by Q2 GDP releases for the UK on Wednesday and Japan on Friday.

Central banks will also be in focus. Australia announces its rate decision tomorrow, with Deutsche Bank expecting a cut, while Norway follows on Thursday, after CPI releases today from both Denmark and Norway.

Turning to tomorrow’s US CPI, DB economists expect a 2.4% decline in seasonally adjusted gas prices to weigh on the headline figure, forecasting a +0.24% monthly increase versus +0.29% previously. In contrast, core CPI is expected to rise +0.32%, up from +0.23%. This would push year-over-year growth rates for headline and core CPI up by a tenth to 2.8% and 3.0%, respectively, with a risk that core rounds up to 3.1%.

Shorter-term trends for core inflation are expected to be mixed. The three-month annualized rate is projected to rise three-tenths to 2.7%, while the six-month rate is seen falling by the same amount to 2.4%. DB Economists also anticipate a notable increase in core goods categories (+0.42% vs. +0.20%), which are already showing signs of tariff-related price pressures. This impact is expected to extend to vehicle prices as well. It’s worth recalling that last month’s headline CPI appeared soft, but rates still sold off as the underlying details revealed growing evidence of tariff-driven inflation.

Thursday’s PPI report is expected to show a +0.2% increase for both headline and core, with attention focused on categories feeding into core PCE. Deutsche Bank is currently tracking a +0.31% increase for July’s core PCE, which would lift the year-over-year rate to 2.9%, with rounding risks toward 3.0%.

Fed commentary will also be in the spotlight: Richmond Fed President Thomas Barkin (non-voter) speaks tomorrow following the CPI release. On Wednesday, Chicago’s Austan Goolsbee (voter) and Atlanta’s Raphael Bostic (non-voter) will share their views. Bostic recently reiterated his expectation for one rate cut this year, despite increased risks to the labour market outlook following the July employment report. Markets are likely to pay closer attention to Goolsbee, given his voting status at the upcoming September 17 FOMC meeting and his previous concerns about the inflationary impact of tariffs.

Rounding out the week, corporate earnings in the US will feature Cisco, Applied Materials, Deere and CoreWeave. In China, investors will be watching results from Tencent, JD.com and Lenovo.

Courtesy of DB, here is a day by day list of key events

Monday August 11

Tuesday August 12

Wednesday August 13

Thursday August 14

Friday August 15

Finally, focusing on just the US, Goldman writes that the key economic data releases this week are the CPI report on Tuesday and the retail sales and the University of Michigan reports on Friday. There are a few speaking engagements by Fed officials this week.

Monday, August 11

Tuesday, August 12

Wednesday, August 13

Thursday, August 14

Friday, August 15

Source: DB, Goldman