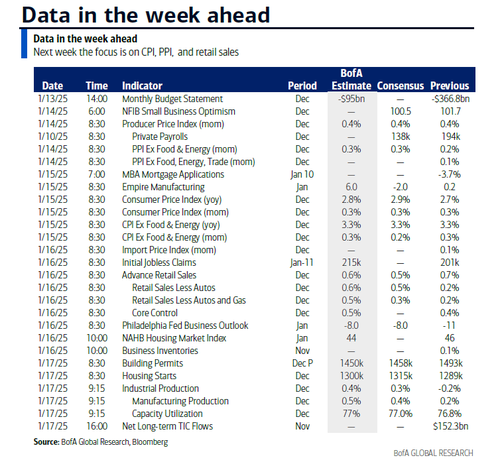

As DB's Jim Reid writes in his weekly preview note, it's hard to determine what's icier at the moment, global bond markets or the weather across much of Northern Europe and even New York where sub zero temperatures have been the norm in recent days. But as the weather warms up a bit, whether the deep freeze in bond markets continues may be determined by how US CPI on Wednesday materializes after Friday's blockbuster payrolls report. Elsewhere in the US the main highlights are the New York Fed 1-yr inflation expectations (today), PPI (tomorrow), retail sales (Thursday), building starts and permits and industrial production (Friday), and the unofficial start of earnings season on Wednesday with a selection of big banks reporting. Outside of the US, the key events are UK CPI and European Industrial production (Wednesday), UK monthly GDP and the ECB account of the December meeting (Thursday) and China GDP on Friday.

The full calendar of events, including central bank speakers, is at the end as usual but lets now go through the main highlights in more details.

There’s nowhere else to start other than Wednesday’s US CPI that occurs after 10yr UST yields climbed +16.1bps last week to close Friday at their highest since October 2023. DB's economists expect headline (+0.40% mom forecast vs. +0.31% last month) to be impacted by strong food and energy and eclipse a tamer core (+0.23% vs. 0.31%). This would ensure a YoY rate of 2.9% (+0.2pp) and 3.3% (unch) respectively. The core rate’s steady decline from late 2022 petered in the second half of 2024 around current levels and that’s before Trump’s policies take effect. DB economists also eye how rents will boost this month’s release but with signs of rental disinflation ahead. The curve ball going forward will of course be policy.

For US PPI on Tuesday, headline (+0.4% vs. +0.4%) and core (+0.2% vs. +0.2%) will likely be similar in magnitude to CPI but as ever we will be most focused on the PPI categories that feed into the core PCE deflator namely, health care services, airfares and portfolio management. Elsewhere Thursday's retail sales is likely to be strong given holiday spending trends in December with headline (+0.6% vs. +0.7%), ex auto (+0.5% vs. +0.2%), and retail control (+0.3% + 0.4%) all firm.

In terms of earnings, the kick-off on Wednesday sees JPMorgan, Goldman Sachs and BlackRock report. Bank of America and Morgan Stanley will follow on Thursday, when investors will be also closely watching the Taiwanese semiconductor company TSMC. DB's equity strategists expect S&P 500 earnings growth near 13% in Q4, similar to the low double-digit growth seen in recent quarters.

There are also a few political points of interest this week with Senate confirmation hearings for Trump's cabinet nominees including Secretary of Defense, Secretary of State and Attorney General among others. In France, the new Prime Minister Bayrou will deliver his General Policy Statement tomorrow which will likely be followed by a vote of no confidence which at this stage he will likely win due to abstentions from the far right and the socialist party.

Here is a day-by-day calendar of events, courtesy of DB.

Monday January 13

Tuesday January 14

Wednesday January 15

Thursday January 16

Friday January 17

Finally, the key economic data releases this week are the CPI report on Wednesday and the retail sales report on Thursday. There are several speaking engagements by Fed officials this week.

Monday, January 13

Tuesday, January 14

Wednesday, January 15

Thursday, January 16

Friday, January 17

08:30 AM Housing starts, December (GS +3.0%, consensus +2.8%, last -1.8%): Building permits, December (consensus -2.2%, last +5.2%)

09:15 AM Industrial production, December (GS +0.1%, consensus +0.3%, last -0.1%): Manufacturing production, December (GS +0.3%, consensus +0.2%, last +0.2%)

Capacity utilization, December (GS 76.9%, consensus 77.0%, last 76.8%): We estimate industrial production increased +0.1%, reflecting strong natural gas production but weak electricity and oil production. We estimate capacity utilization increased to 76.9%.