Although it’s Veterans' Day today, with US bond markets closed (equities are open), it's another important week with US CPI (Wednesday) the focal point, even though many will argue that the year is now basically over with the biggest events in the rearview mirror. Indeed, as DB's Jim reid writes, US data may not be as heavily scrutinized as usual at the moment as with the Trump victory, the market might conclude that there may be changes in animal spirits in the near-term and policy in the medium-term. On this, any clues on Trump's appointments may be market moving. Case in point the Dollar's rise immediately after the FT reported late Friday afternoon UK time that Robert Lighthizer would be asked to be the US Trade Representative in the new administration. Given how central he's been to Trump's views on trade it was surprising that the market was surprised. However there has been no confirmation of this appointment and other wires have suggested no such approach has been made.

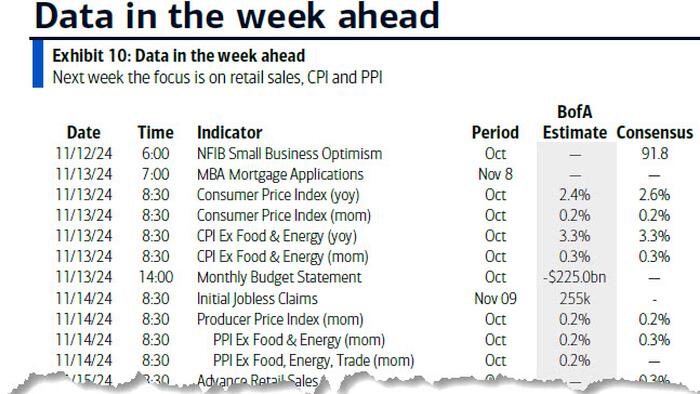

Having said that US data might not be the most important events of the week, outside of CPI the US highlights are the Fed's senior loan officers survey (SLOOS) tomorrow, PPI on Thursday and retail sales, on Friday. There are a lot of Fed speakers so their view of policy post the election will be interesting after Powell navigated this uncertainty well last week. Powell himself speaks again on Thursday.

Internationally the key events will be UK employment and the German ZEW tomorrow, Japanese and Eurozone GDP alongside the ECB account of the October meeting on Thursday, and China's main monthly data dump on Friday. See the full week ahead in the day-by-day calendar at the end as usual.

In terms of US CPI, DB's economists suggest that softer energy prices should lead headline CPI (+0.20% forecast vs. +0.18% previously) to be weaker than core (+0.26% vs. +0.31%) leading to a YoY rate that picks up a tenth in the headline to 2.5% but with core staying steady at 3.3% even if the 6-month rate would dip a tenth to 2.5%. Remember though that in the last several years the second half has been more seasonally favorable to inflation so it's possible we're coming towards the end of that help.

For context, and due to the election result, DB's economists are leaning towards core PCE inflation being upgraded from 2.2% in 2025 to around 2.5% and by around 0.5pp to 2.5% in 2026 as tariffs kick in. For growth the 2025 upgrade is likely to be from 2.2% to 2.5-2.75% but with 2026 downgraded a few tenths to 2% as tariffs offset the fiscal boosts. So the outlook becomes more complicated from here with most uncertainty around how aggressive the tariff regime will be. As a result, DB's economists believe now that the Fed may not be able to cut below 4%. Back in mid-September Dec 2025 Fed futures contracts were pricing in 2.78% so this is yet another example (around the 8th time) in this cycle where the market has got far, far too optimistic in terms of how much the Fed will be able to cut rates.

Courtesy of DB, here is a day-by-day calendar of events

Monday November 11

Tuesday November 12

Wednesday November 13

Thursday November 14

Friday November 15

Finally, looking at just the US, Goldman writes that the key economic data releases this week are the CPI report on Wednesday and the retail sales report on Friday. There are several speaking engagements from Fed officials this week, including speeches by Chair Powell and New York Fed President Williams on Thursday.

Monday, November 11

Tuesday, November 12

Wednesday, November 13

Thursday, November 14

Friday, November 15

Source: DB, Goldman