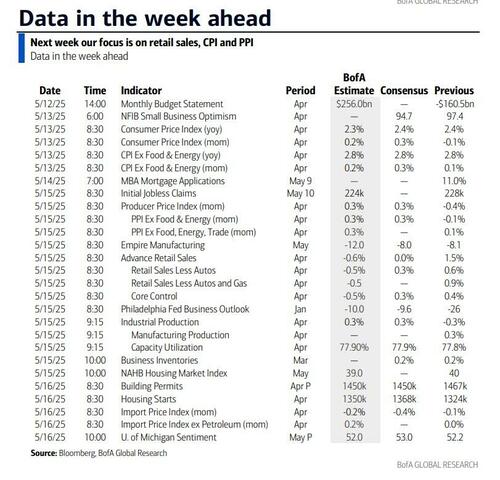

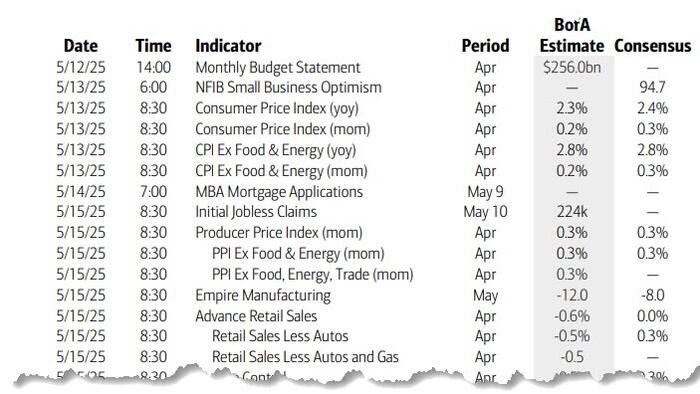

With markets euphoric over the US-China trade war truce, which in turn has made all economic data meaningless as all recent and upcoming data reports will have to be viewed on a pro forma basis, one which no longer reflect the post-truce world, one can discount the key macro events on deck this week, which are the CPI report on Tuesday, the retail sales report on Thursday, and the University of Michigan report on Friday.

There are also several speaking engagements by Fed officials this week, including a speech on the Fed’s framework review by Chair Powell on Thursday. Still, the market will need catalysts to kneejerk to, so let's go over the week's macro agenda.

Looking into the main US upcoming data in more detail, for US CPI tomorrow, DB expect the headline (+0.26% forecast vs. -0.05% previous) number to be slightly below that of core (+0.29% vs. +0.06%) with consensus for both at 0.3%. Both DB and consensus expect the YoY rate to remain unchanged at 2.4% and 2.8%, respectively. One of the main reasons the economists are expecting a firm core goods print is due to strong gains in vehicle prices after robust new vehicle sales in recent months. The risk to this month though is that dealers refrained from price rises in April knowing that with tariffs coming they will have to raise them soon. So we know auto price rises are coming but it may not be April.

Indeed, as DB's Jim Reid writes, April overall may be too early for tariff price rises to show up - especially now that tariffs with China have been pushed back - but the bank's economists advise looking out for any early signs in some of the import-heavy categories such as apparel and household furnishings and supplies.

In addition food prices could be another place to look for any early signs of the tariffs that went into place in February. The effects from the washing machine tariffs in early 2018 took about two months to start showing up in the CPI data.

For PPI on Thursday, DB and the consensus expect a 0.3% monthly print on headline and core but we'll pay more attention to the components that feed into core PCE as usual. Retail sales on the same day will be the other big release of the week: here economists expect slight dips in auto sales and gasoline prices to weigh on headline (unch. vs. +1.5%) and ex-autos (+0.2% vs. +0.6%) sales. However they expect retail control (+0.4% vs. +0.4%), which feeds into GDP, to remain solid. The potential curveball is if consumers have front loaded purchases ahead of tariffs and we get strong data.

Thursday is a busy day as Powell speaks and this will provide him with an opportunity to comment on the data if he's sees anything meaningful within it. So one to watch especially given that Powell said last week that "we don't know which way this is going to shake out".

Courtesy of Deutsche Bank, here is a day-by-day calendar of events

Monday May 12

Tuesday May 13

Wednesday May 14

Thursday May 15

Friday May 16

Finally, looking at just the US, Goldman notes that the key economic data releases this week are the CPI report on Tuesday, the retail sales report on Thursday, and the University of Michigan report on Friday. There are several speaking engagements by Fed officials this week, including a speech on the Fed’s framework review by Chair Powell on Thursday.

Monday, May 12

Tuesday, May 13

Wednesday, May 14

Thursday, May 15

Friday, May 16

Source: DB, Goldman