As DB's Jim Reid sets the scene in his weekly preview, "welcome to Valentines' week" and a reminder that you have two days to prepare the right gift. Turning to markets, the big question is whether the sharp inflation falls of the last few quarters have been a double bluff? We'll find out a bit more this week with US CPI tomorrow the obvious focal point. Elsewhere in the US the main highlights will be the NY Fed 1yr inflation expectations (today), Retail Sales/Industrial Production/Factory Orders (Thursday), housing data through the week, and the University of Michigan consumer survey (Friday). There is also plenty of Fed speak that you can see, alongside the other global highlights, in the week ahead calendar at the end as usual. Today sees three Fed speakers; Bowman (hawk), Barker (neutral) and Kashkari (hawk).

In Europe, UK inflation on Wednesday will be a highlight and will be preceded by UK employment numbers tomorrow and followed by Retail Sales on Friday. On the continent, the German ZEW survey is out tomorrow, with Eurozone Q4 GDP on Wednesday. In Asia we have Chinese New Year which will keep things quiet but Japanese Q1 GDP (Wednesday) might be of note with the end of NIRP potentially on the horizon. This is the same day as the election in Indonesia.

Asia will remain quiet as most markets are shut for Chinese New Year. Half-term season also kicks off in Europe today so this might not be the most active week unless CPI shatters the silence.

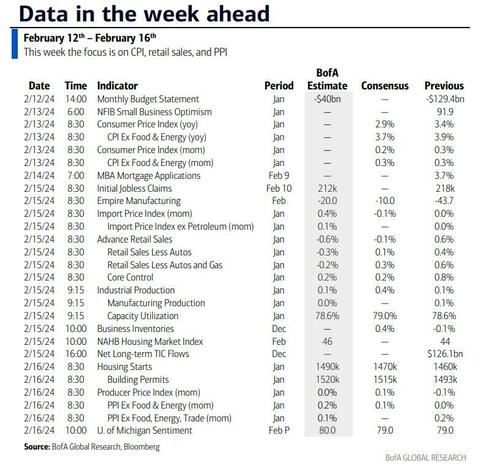

With regards to US CPI tomorrow DB economists' expect seasonally adjusted gas prices to be down almost -2.5% from December, and expect headline CPI (+0.15% forecast vs. +0.23% previously, consensus +0.2%) to undershoot core (+0.27% vs. +0.28%, consensus +0.3%). This would equate to core YoY CPI inflation falling two-tenths to 3.7%, while that for headline would fall by four-tenths to 2.9% (both in line with consensus). The three-month annualised rate would rise two-tenths to 3.5% while the six-month annualised rate would tick up a tenth to 3.3% largely due to base effects. PPI on Friday is also important as some of the subcomponents inform forecasts for the core PCE and an hour or so later the inflation expectations in the UoM consumer survey will round up the big week for US inflation.

Here is a day-by-day calendar of events courtesy of Deutsche Bank

Monday February 12

Tuesday February 13

Wednesday February 14

Thursday February 15

Friday February 16

Finally, looking at just the US, Goldman writes that the key economic data releases this week are the CPI report on Tuesday, the retail sales report on Thursday, and the PPI report on Friday. There are several speaking engagements by Fed officials this week, including Vice Chair for Supervision Barr, Fed Governors Barkin and Waller, and Presidents Barkin, Kashkari, Goolsbee, Bostic, and Daly.

Monday, February 12

Tuesday, February 13

Wednesday, February 14

Thursday, February 15

Friday, February 16

Source: DB, Goldman, BofA