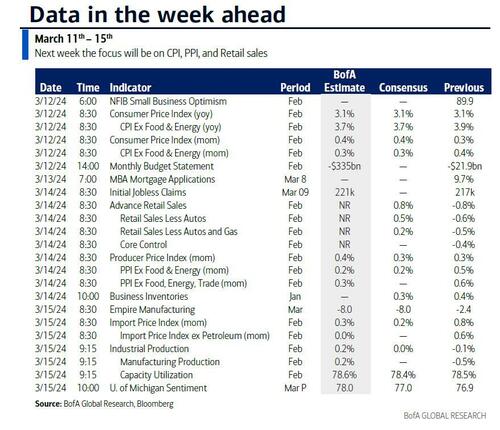

With 10yr US yields around -10bps lower, and the S&P 500 around +2% higher than where they were just before last month’s higher-than-expected CPI, DB's Jim Reid concludes that "it’s fair to say that markets have shrugged off this upside print alongside the high PPI and core PCE prints that followed." The question now is whether this week we get to do it all over again, but before we preview the US CPI (tomorrow) and PPI (Thursday), the other main US highlights are the NY Fed 1-yr inflation expectations survey (today), retail sales (Thursday) and UoM consumer sentiment (Friday). There are also 3-, 10- and 30-yr UST auctions today through Wednesday.

Expanding on the main event - tomorrow's CPI print - with gas prices up around 4.1% from January, DB's economists expect headline CPI (+0.41% forecast, consensus +0.4%, vs. +0.31% previously) to grow faster than core (+0.30%, consensus +0.3%, vs. +0.39% previously). This would bring YoY core CPI two-tenths lower to 3.7%, with headline flat at 3.1%. Of some concern would be the three-month annualized rate 'only' ticking down a tenth to 3.9% while the six-month annualised rate would rise a tenth to 3.7%. See our economists preview and post-print webinar registration details here.

For Thursday's PPI, the main interest will be the sub components that feed into core PCE forecasts. One of the more important will be the PPI for portfolio management and investment advice, which tends to follow equity prices with a one-month lag. We've seen a further equity rally since last month so it could be firm again. This remarkably added about 8bps to the January core PCE print despite only being about 1.6% of the basket. Also keep an eye on the PPI for selected health care industries, as this category currently has the highest weight in core PCE.

In Europe, the monthly UK GDP for January on Wednesday and labor market indicators tomorrow come a week before the next BoE meeting. In Asia, we have China's 1-yr MLF rate where DB economists think we will see a 15bps cut. In Japan, the 1st survey results from the important shunto wage negotiations will be released on Friday, which will be key ahead of the BoJ meeting a week tomorrow where speculation mounts that negative rates will end. These are the main highlights but see the full week ahead at the end for all the week's key global events.

here is a day-by-day calendar of events

Monday March 11

Tuesday March 12

Wednesday March 13

Thursday March 14

Friday March 15

Fianlly, looking at just the US, Goldman writes that the key economic data releases this week are the CPI report on Tuesday and the retail sales and PPI reports on Thursday. There are no speaking engagements by Fed officials scheduled this week, reflecting the blackout period in advance of the FOMC meeting on March 19-20.

Monday, March 11

Tuesday, March 12

Wednesday, March 13

Thursday, March 14

Friday, March 15

Source: DB, Goldman, BofA