We're currently in-between US payrolls from last Friday and US CPI this Thursday which will be the highlight of this week.

As DB's Jim Reid reminds us this morning, the first of these was a knockout report with the headline number up +254k as against expectations of +150k and with the unemployment rate falling a tenth to 4.1% (4.05% unrounded), which however was due to a record surge in 785,000 government jobs. Still, even though the monthly payrolls report is better known as a "random number generator", even with that caveat it was an impressive report and completely against recent fears, sending the dollar and yields soaring. The main impact was a +21.6bps increase in 2yr US yields on Friday and the probability of a 50bps cut next month declining from around 33% to effectively zero in the process. Reid's own view was always that the amount of rate cuts priced in since mid to late summer was only likely if we had a recession, and if we didn't, then the rates market overall was too pessimistic. He would still say that today.

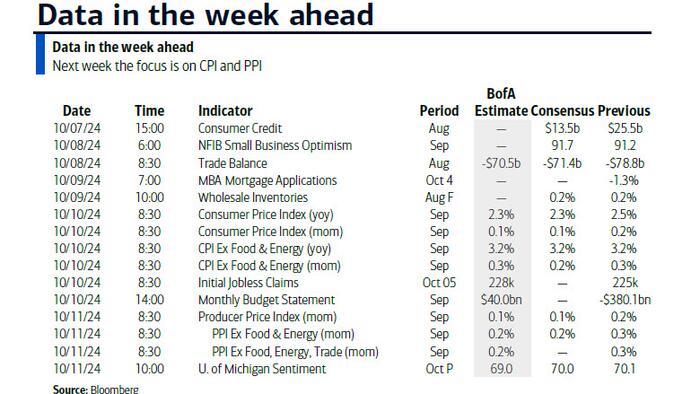

In terms of moving this argument on, it's a relatively quiet week in the US apart from Thursday's CPI but in terms of the main global day-by-day highlights we have the following. Today sees Germany factory orders - which cratered - and Eurozone retail sales, tomorrow sees German Industrial Production, and Swedish CPI, Wednesday sees the last FOMC minutes and a 10yr UST auction, Thursday sees the release of the account of the last ECB meeting, France present its budget proposal, Japanese PPI, German retail sales, Italian industrial production, Norway and Denmark CPI, and a 30yr UST auction, with Friday home to US PPI, the US University of Michigan survey, UK August monthly GDP and US Earnings season kicking off with JPMorgan, Wells Fargo, BlackRock, Bank of New York Mellon all reporting.

In terms of this week's US CPI, consensus expects headline CPI of +0.1% vs. +0.19% previously, to come in tame with core +0.2% (down from +0.28%) edging lower but more elevated than headline. Headline YoY CPI would dip a couple of tenths to 2.3%, with core staying around the same level at 3.2%. However, the six-month annualized core rate would fall from 2.7% to 2.4%. Rents will again take center stage after recent strength. As for PPI on Friday, DB and consensus expect headline (+0.1% vs. +0.2% last month) and core (+0.2% vs. 0.3% last month) to be directionally similar to CPI. The market will as ever pay closest attention to the categories that feed into the core PCE deflator – namely, health care services, airfares and portfolio management. Staying with inflation, Friday's preliminary University of Michigan consumer sentiment survey will have inflation expectations which last month picked up a tenth to 3.1% for the long-run measure but fell the same amount to 2.7% for the 1yr measure.

As you'll see in the day-by-day calendar of events, it's also a busy week of Fed speakers. So it'll be interesting to see how they all react to the bumper payrolls print. The last FOMC meeting minutes on Wednesday will be a bit stale but may give us a better understanding as to how policy might evolve under various scenarios.

As noted above, Friday will mark the start of the Q3 earnings season with several US banks releasing results. Samsung, PepsiCo and BlackRock also report throughout the week.

DB strategists expect S&P 500 earnings growth to slow from 11.8% in Q2 to 9% in Q3, driven by a narrow group of sectors such as energy and mega cap growth & tech, with growth for the others staying steady in the mid-single digits.

Day-by-day calendar of events courtesy of DB:

Monday October 7

Tuesday October 8

Wednesday October 9

Thursday October 10

Friday October 11

Finally, looking at just the US, Goldman writes that the key economic data release this week is the CPI report on Thursday. There are many speaking engagements from Fed officials this week, including remarks by Vice Chair Philip Jefferson on Tuesday and Wednesday and by New York Fed President John Williams on Thursday.

Monday, October 7

Tuesday, October 8

Wednesday, October 9

Thursday, October 10

Friday, October 11

Source: DB, Goldman