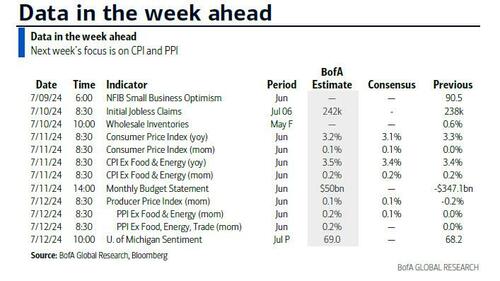

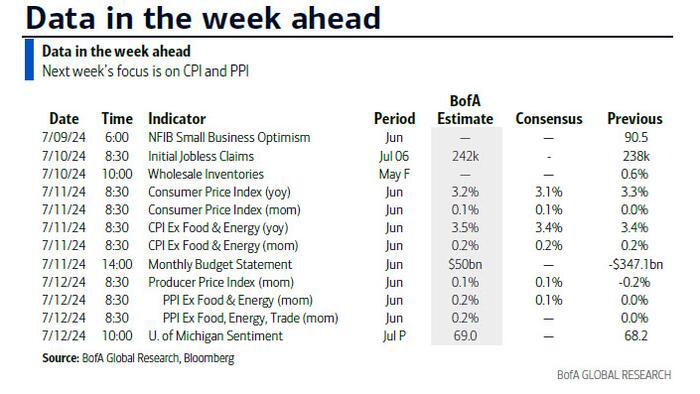

Usually the macro calendar goes quieter the week after payrolls but that's not the case now as there’s a lot to digest this week with the US CPI report (Thursday) and Fed Chair Powell's testimonies to the Senate and House committees (Tuesday and Wednesday) the obvious highlights alongside PPI and the start of US Q2 earnings season on Friday with JP Morgan, Citi and Wells Fargo reporting. Besides Powell, we will also get numerous other Fed speakers this week.

Outside of these the day by day highlights are NY Fed 1-yr inflation expectations today, tomorrow’s US small business optimism survey to see if the “K” shaped recovery continues. Wednesday sees China’s CPI and PPI, Japan’s PPI, Norwegian and Danish CPI, Italian IP and a US 10yr Treasury auction. Thursday sees the latest US monthly budget numbers alongside jobless claims which will continue to get close attention given recent mixed signals on the US labor market. There is also a 30yr Treasury auction. On Friday the University of Michigan survey and Swedish CPI will be the highlight outside of the main events mentioned above. In geopolitics, there is a NATO summit Tuesday through Thursday, and Indian PM Modi visits Russia today and tomorrow both of which may generate headlines. The full week ahead is at the end as usual.

Let's now preview the US CPI and PPI releases and review a mixed payroll print on Friday. The headline CPI should print soft (+0.09% MoM Deutsche Bank forecast vs. +0.01% previously) thanks to falling gas prices. However core is expected to edge up (+0.25% MoM vs. +0.16%).

If DB economists are correct, YoY headline CPI will fall by two-tenths to 3.1%, with core edging up a tenth to 3.5%. However three-month annualized core would fall four tenth to 2.9%, though the six-month annualized rate would stay at 3.7%. For the PPI we always look at the categories feeding into core PCE, namely health care services, airfares and portfolio management. The final of these three should be firm given the recent rally in equities and airfares could bounce back after a weak May. This also could be the end of easy comps as weak July and August prints will soon roll out of the YoY numbers. This is important as if markets do want a September cut then a bit more progress is needed on inflation absent an “unexpected weakening” (in Powell’s words) in the employment situation.

Finally, as noted above, Q2 earnings season begins Friday when JPM, Wells, Citi and BNY all report.

Finally, courtesy of DB, here is a day-by-day calendar of events

Monday July 8

Tuesday July 9

Wednesday July 10

Thursday July 11

Friday July 12

Finally, looking at just the US, Goldman writes that the key economic data releases this week are the CPI report on Thursday and the PPI and University of Michigan reports on Friday. Chair Powell will testify to congressional committees on Tuesday and Wednesday, and there are several other speaking engagements from Fed officials this week, including Governors Barr, Bowman, and Cook and Presidents Goolsbee, Bostic, and Musalem.

Monday, July 8

Tuesday, July 9

Wednesday, July 10

Thursday, July 11

Friday, July 12

Source: DB, BofA