It's a relatively quiet week. According to DB's Henry Allen, the data highlight this week will be Friday's US core PCE deflator which should print softer than feared a few weeks ago given the recent inputs from other inflation releases. The main events outside of this will be a series of Fed speakers (at least 16 this week, with 4 on deck today) who can give their own spin on a complicated FOMC last week where the dots were a little all over the place. The global flash PMIs tomorrow will be the other main highlight but its not likely to be a major mover with most main economies seemingly fairly stable at the moment.

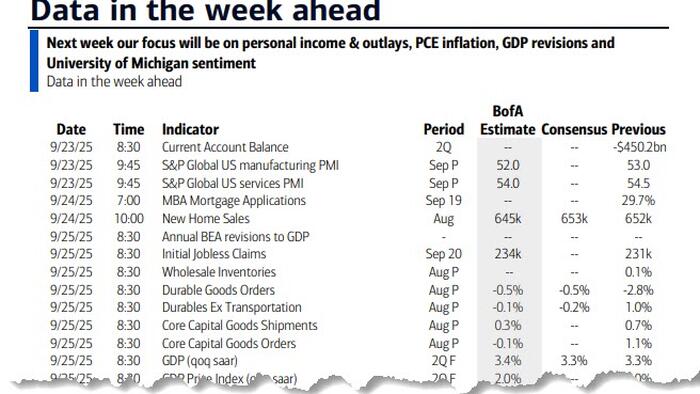

Friday's personal income (+0.3% est. vs. +0.4% last) and consumption (+0.5% vs. +0.5%) data will include the all-important core PCE deflator which DB expects to come in at a relatively tame +0.22% vs. +0.27% last time. Thursday sees the final print on Q2 GDP (3.3% final vs. 3.3% prelim) and will also feature the annual update to the national accounts in which the BEA incorporates more complete and detailed source data covering the prior five years, allowing for revisions. So, another chance for history to be rewritten. Other notable US releases will include tomorrow's existing home sales; Wednesday's new home sales; Thursday's durable goods orders, and the advanced trade balance; and Friday’s University of Michigan consumer sentiment index.

In terms of those Fed speakers this week, we'll highlight the current voters. Today kicks off with Williams who should mirror the views of Powell last week. Musalem will also give an outlook speech later and new Governor Miran will be on the tapes with his thoughts likely to be fascinating to hear. Tomorrow, Chair Powell will give an outlook speech which will likely be similar to his FOMC rhetoric. Governor Bowman will also speak. Thursday sees Goolsbee, Williams, Governors Bowman and Barr, and Daly who votes next year. Governor Bowman also speaks on Friday. As DB's economists point out, the Supreme Court has asked Governor Cook to respond by Thursday to President Trump’s appeal, which seeks to overturn lower court rulings preventing her immediate removal from office.

Trump will likely be in the news earlier in the week as he addresses the 80th UN General Assembly in New York tomorrow. We'll also get a better idea of where we are with US exceptionalism on Friday with the Ryder Cup starting in New York. It will also be interesting to see the reaction from corporate America to Trump's weekend plans to impose a $100,000 application fee for the widely used H-1B visa for foreign workers in speciality occupations. It's caused a huge amount of uncertainty over the weekend for those that rely on it.

Outside of the US, Sweden (tomorrow) and Switzerland (Thursday) central banks are meeting with markets pricing in a 30% chance of a cut from the Riksbank, but with only a 4% chance for the SNB. A cut for the Swiss would lead the country back into negative rate territory if it did happen. Staying in Europe, sentiment gauges out include the Ifo survey in Germany on Wednesday as well as consumer confidence across major European economies, including Germany and France on Thursday.

Elsewhere, rounding out notable data releases, highlights include the Tokyo CPI for September in Japan and the July GDP report in Canada both on Friday, as well as the August CPI in Australia on Wednesday. For the Tokyo CPI, economists see an acceleration in core inflation ex. fresh food to 2.8% YoY (2.5% in August) and a slowdown in core-core inflation ex. fresh food and energy to 2.9% (3.0%).

Below is the day-by-day calendar for the full week ahead, courtesy of DB.

Monday September 22

Tuesday September 23

Wednesday September 24

Thursday September 25

Friday September 26

Finally, looking at just the US, the key economic data releases this week are the durable goods report on Thursday and core PCE inflation on Friday. There are several speaking engagements by Fed officials this week, including events with Fed Chair Powell on Tuesday and New York Fed President Williams on Monday

Monday, September 22

Tuesday, September 23

Wednesday, September 24

Thursday, September 25

Friday, September 26

Source: DB, Goldman