As DB's Jim Reid writes in his weekly preview, "in terms of what the market has been through in recent weeks we could all do with a lie down and there are some hopes of that this week given the scarcity of front line data. However as we know the headlines will keep coming, especially with regards to trade."

Sure enough, it‘s likely that fiscal developments in Washington will take center stage with the House expected to vote on its reconciliation package this week just as Moody's removed the US's last remaining triple-A rating late on Friday night. As DB's economists discussed last week, though the specific components of additional tax cuts on top of the TCJA extension differed from what they had previously outlined, the JCT score of the Ways and Means mark-up was largely in line with top-line deficit assumptions. Assuming House Republicans are able to resolve their outstanding policy disagreements and vote on the tax package this week, the Senate will then start to mark up the bill, where even more policy disagreements await. One thing stands out though, and that is that at this stage there are no signs of any serious deficit restraint.

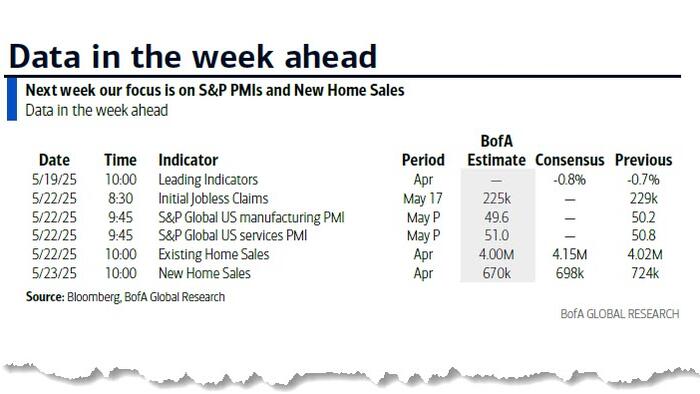

The flash global PMIs for May released on Thursday will be the main data focal point this week given that it should fully cover a period of trade uncertainty. European numbers are expected to edge up with US numbers broadly flat. Elsewhere inflation in Canada (tomorrow), the UK (Wednesday) and Japan (Friday - preview here) will be of note. Other things to watch are the RBA decision tomorrow, where DB expect a 25bps cut (preview here), the account of the April ECB decision, the German Ifo and US jobless claims, all on Thursday.

This week’s jobless claims corresponds to payrolls survey week so it will allow banks to refine their current forecast for May. The full day-by-day week ahead is at the end as usual but there’s not a lot of high profile releases. There are though plenty of central bank speakers and these are also highlighted in that calendar. Many are speaking at the Atlanta Fed's annual Financial Markets Conference in Amelia Island, Florida which starts today through to Thursday. Other things to note are the UK-EU summit will be in London today. Then tomorrow, G7 finance ministers and central bankers convene in Canada (through May 22) and the EU's foreign and defence ministers meet in Brussels.

Courtesy of DB, here is a day-by-day calendar of events

Monday May 19

Tuesday May 20

Wednesday May 21

Thursday May 22

Friday May 23

Finally, looking at just the US, Goldman notes that the key economic data releases this week are initial jobless claims on Thursday and new home sales on Friday. There are many speaking engagements by Fed officials this week, including Chair Powell, Vice Chair Jefferson, and Governors Kugler and Cook.

Monday, May 19

Tuesday, May 20

Wednesday, May 21

Thursday, May 22

Friday, May 23

Source: BofA, Goldman