As we arrive at a new week, DB's Henry Allen writes that the focus is still on Ukraine this morning, as the world reacts to the Trump-Putin summit in Alaska last Friday. The main headline was that no deal was reached on a ceasefire, but multiple outlets reported that Putin wanted Ukraine to withdraw from the Donetsk and Luhansk regions, and he offered Trump a freeze across the rest of the frontline in return. Moreover, Trump himself posted that he now wanted to “go directly to a Peace Agreement, which would end the war, and not a mere Ceasefire Agreement, which often times do not hold up.”

After the summit, Trump then spoke with European leaders, although the joint statement from the European leaders made clear that “It will be up to Ukraine to make decisions on its territory.” Then today, Trump is meeting President Zelensky at 1:15pm ET, before a multilateral leading with European leaders at 3:00pm ET. That group will include UK PM Starmer, French President Macron, German Chancellor Merz and Commission President Von der Leyen. In his post, Trump also said that “If all works out, we will then schedule a meeting with President Putin.”

Clearly, we’ll have to wait and see what happens today, but Trump was saying yesterday morning that there had been “BIG PROGRESS ON RUSSIA. STAY TUNED!” And separately, Trump’s envoy Steve Witkoff said on CNN that “We got to an agreement that the US and other nations could effectively offer Article 5-like language to Ukraine”, which is the NATO article which says that an attack on one member will be considered an attack on all. Trump has also been calling on Zelensky to make a deal, and just a few hours ago, he posted that Zelensky “can end the war with Russia almost immediately, if he wants to, or he can continue to fight.” However, US Secretary of State Marco Rubio downplayed expectations of a deal yesterday, saying that “We are not at the precipice of a peace agreement.”

In terms of the week ahead, the main focus away from the White House will be the Fed’s symposium at Jackson Hole, where we’ll hear central bankers including Fed Chair Powell and ECB President Lagarde. Bear in mind that the Fed Chair’s speech at Jackson Hole has often been used to send important policy signals, and it was last year that Powell said the “time has come for policy to adjust” before they then cut rates at the next meeting for the first time since the pandemic. This time around, we don’t have the full agenda yet, but the subtitle for Powell’s speech on the Fed’s website says “Economic Outlook and Framework Review”, so we can expect some insight on those topics.

The last time the Fed had a review in 2020, that resulted in a shift towards average inflation targeting. In essence, they said that after periods when inflation had been persistently beneath 2% (like the 2010s), then monetary policy could seek to reach inflation a bit above 2% to counteract that. The Fed also reinterpreted their approach to full employment, in that a tight labor market alone wasn’t a reason to raise rates. So that implied a move away from the pre-emptive approach whereby the Fed would tighten policy to get ahead of future inflation as the labour market tightened. Of course, we now know that shortly after the framework review, there was then a major burst of inflation, and although it had many drivers, our US economists concluded in a Friday note (link here) that the new framework was a contributor to that overshoot. So this time around, they expect Powell’s speech to call for rolling back the 2020 modifications and restoring a primary role for pre-emption.

When it comes to the near-term path for policy, futures are still pricing in a September rate cut as the most likely outcome. But there was a clear shift last Thursday, as the PPI inflation release for July showed the fastest monthly inflation since March 2022. So that made it clear that a September cut still wasn’t a done deal, particularly with the emerging signs of tariff-driven inflation. And we still know there’s more to come on the tariff front, as Trump said on Friday that he'd be “setting tariffs next week and the week after, on steel and on, I would, say chips — chips and semiconductors, we’ll be setting sometime next week, week after”. So that’s one to keep an eye on, and Trump also suggested that the semiconductor rate could be as high as 300%.

Staying on inflation, we’ve got some more releases out this week, including from Japan, the UK and Canada. The UK will be an important one, as the June reading was unexpectedly strong, with headline inflation rising to +3.6%. Moreover, our UK economist expects it to take another step up in July to +3.8%. By contrast in Japan, our economist sees headline inflation easing a bit to +3.1% in July, down from 3.3% in June. Otherwise, the main data release will be the August flash PMIs on Thursday, which will offer an initial indication on the global economy’s performance this month, particularly with the latest tariffs that have been imposed.

Elsewhere this week, we’ve got a few more earnings releases coming out, although it’s very much the end of the current season with over 90% of the S&P 500 having reported by now. This week’s highlights include several US retailers, including Walmart and Target, which should offer a fresh insight into consumer spending. Last Friday, the US retail sales numbers were pretty robust in July, with the headline reading up +0.5% (vs. +0.6% expected), alongside an upward revision to June as well. However, the University of Michigan’s consumer sentiment index painted a weaker picture for August, with the headline index unexpectedly falling to 58.6 (vs. 62.0 expected), alongside an uptick for inflation expectations.

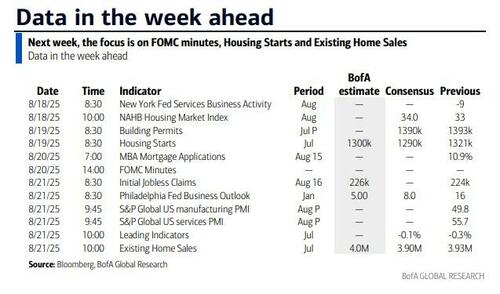

Courtesy of DB, here is a day-by-day calendar of events

Monday August 18

Tuesday August 19

Wednesday August 20

Thursday August 21

Friday August 22

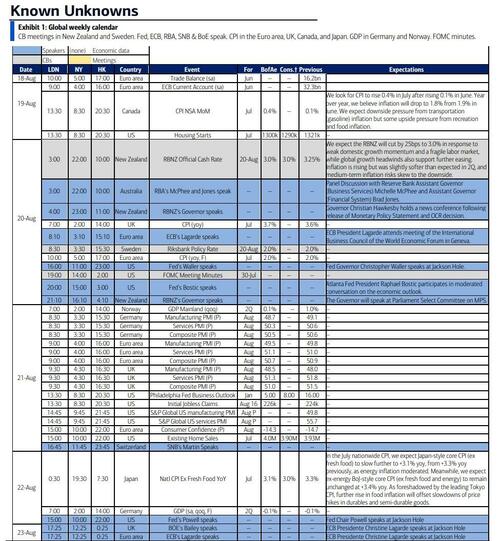

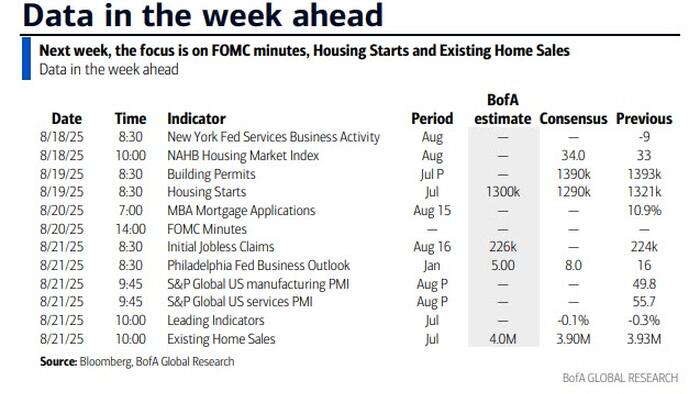

Finally, looking at just the US, the key economic data release this week is the Philadelphia Fed manufacturing index on Thursday. The minutes to the FOMC's July meeting will be released on Wednesday. There are several speaking engagements by Fed officials this week, including Governors Bowman and Waller, and remarks from Chair Powell at the 2025 Jackson Hole Economic Policy Symposium.

Monday, August 18

Tuesday, August 19

Wednesday, August 20

Thursday, August 21

Friday, August 22

Source: BofA, Goldman