After the busiest week of Q1 earnings season, and a blockbuster week for macro, which included a stronger than expected jobs report, we enter a week that should see attention turn back towards central banks, with the latest Fed (Wed) and BoE (Thu) decisions due. These come as markets have largely shaken off the tariff-driven stress of the past few weeks, as rising optimism on tariff de-escalation and Friday’s solid US payrolls print brought the S&P 500 back above its pre-Liberation Day level, with the index posting its longest winning streak since 2004. Admittedly, the recovery has been far from even across asset classes. A notable laggard is the US dollar, trading nearly -4% below April 2 levels this morning. Investors will continue to keenly watch the tariff headlines and peruse the latest evidence of tariff impacts in this week’s data ranging from the US April ISM services (today) to German factory orders (Wed) and China’s April trade data (Fri).

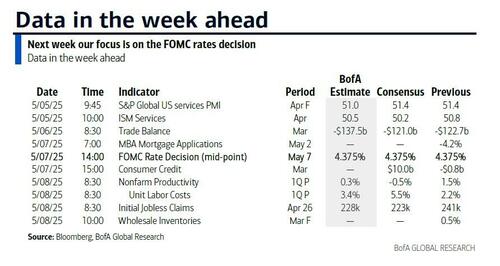

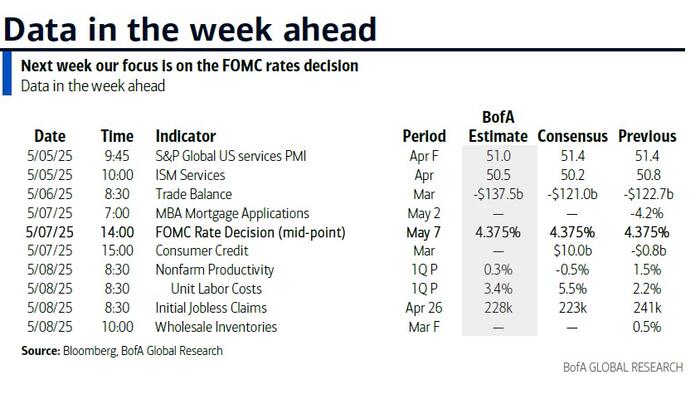

The full day by day week ahead is at the end as usual, but the main highlight will be the Fed's decision on Wednesday and Chair Powell's press conference afterwards. Most economists expect the Fed to keep rates steady and avoid explicit forward guidance about the policy path ahead. They see the overall tone as likely to echo recent Fed comments that the administration's policies are likely to push the economy away from the Fed's dual mandate objectives for a period of time but that monetary policy is "well positioned" to respond to the evolving outlook. Rate cut expectations were pushed back after the strong jobs report, with risks for further easing contingent on a weaker labor market rather than the Fed delivering pre-emptive cuts. Fed funds futures are pricing a 37% chance of a cut by the next meeting in June, with a full 25bp cut priced by July.

In terms of the rest of the week ahead, central banks will also be in focus in Europe, with policy decisions from the UK, Norway and Sweden all due on Thursday. The BoE is expected to deliver a 25bp cut that would take the Bank Rate to 4.25%, while Norges and Riksbank are expected to keep rates on hold. Meanwhile, the ECB will hold an informal meeting on May 6-7 to discuss its 2025 monetary policy strategy assessment, which our European economists preview here.

Turning to economic data, in the US the main test ahead of the Fed will be today’s April ISM services reading, which economists see declining to 50.3 from 50.8. That comes as the April data so far, including a decent US ISM manufacturing print last week, have shown few signs of either the US or the global economy ‘breaking’ from the tariff turmoil even as sentiment indicators paint a worrying picture.

It will be a pretty quiet data week in Europe, with Germany’s factory orders (Wed) and industrial production (Thu) prints the highlights, while in Asia the April trade figures out of China (Fri) are expected to show a material slowing amid the tariff disruption.

In corporate earnings, key US releases include Palantir, AMD, Walt Disney and Uber. In Europe, earnings from the likes of Novo Nordisk, Siemens Energy, AP Moller-Maersk, BMW, AB InBev and Rheinmetall will be of extra interest in light of the trade tensions.

Courtesy of DB, here is a day-by-day calendar of events

Monday May 5

Tuesday May 6

Wednesday May 7

Thursday May 8

Friday May 9

Earnings: Mitsubishi Heavy Industries, Recruit Holdings, Commerzbank, Cellnex

Finally turning to the US, the key economic data release this week is the ISM services report on Monday. The May FOMC meeting is on Wednesday. The post-meeting statement will be released at 2:00 PM ET, followed by Chair Powell’s press conference at 2:30 PM. There are several speaking engagements by Fed officials on Friday, when the blackout period for the May FOMC meeting ends.

Monday, May 5

Tuesday, May 6

Wednesday, May 7

Thursday, May 8

Friday, May 9

Soruce: DB, Goldman