After a very slow week, the key event for markets this week will be US inflation data with April’s PPI (Tuesday) and CPI (Wednesday) the highlights. We’ll see if the higher-than-expected US inflation seen in Q1 extends into Q2 or not. Markets will also hear from Powell (tomorrow) and Vice Chair Jefferson (today) as the highlights of a busy Fedspeak calendar that are included in the day-by-day list at the end. The next most important US data release is Retail Sales on Wednesday.

Elsewhere China’s monthly activity numbers (Friday) are important, and staying in Asia, we also have Japanese PPI (tomorrow) and Q1 GDP (Thursday). In Europe tomorrow’s ZEW survey in Germany and UK labor market stats are highlights. Swedish CPI (Wednesday) may get a little extra attention after last week's Riksbank cut, only the second G10 currency to ease this cycle after Switzerland earlier in the year. Earnings season quietens with only 7 S&P 500 companies and 69 Stoxx 600 companies reporting.

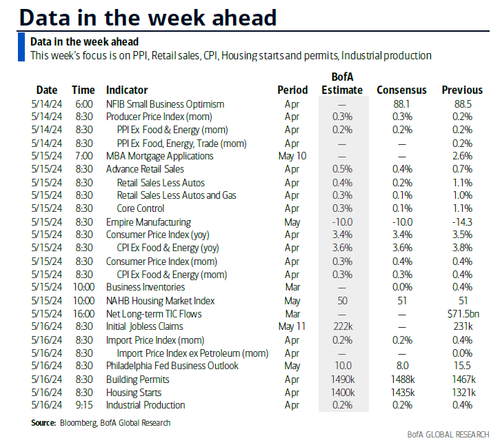

Previewing the main events now and let’s start chronologically with regards to US inflation. For PPI tomorrow, the headline (+0.3% consensus, vs. +0.2% previously) and core (+0.2% consensus vs. +0.2% last month) are always less important than the key components that feed into the core PCE deflator – namely, health care services, portfolio management and domestic airfares. As DB economists point out, whilst the March health care services print was relatively soft (+0.1%), the six-month annualized growth rate of 3.5% was still higher than at any point in the decade prior to the pandemic. They also highlight that with respect to portfolio management, the strength in asset market performance leading up to March should result in a strong print for April, given the typical lags.

With regards to CPI, DB economists think that given the 3% rise in seasonally adjusted gas prices, headline CPI (+0.37% forecast vs. +0.38% previously) should grow faster than core (+0.29% vs. +0.36%). This would lead to core YoY CPI falling two-tenths to 3.6%, and headline falling a tenth to 3.4%, both in-line with consensus. The three-month annualized rate under this scenario would fall by four-tenths to 4.1%, but the six-month annualized rate would tick up a tenth to 4.0%. As ever all eyes will be on whether rents finally respond more in keeping to the numerous models that have suggested they should already be well below where they currently are.

For Wednesday's US Retail Sales, DB’s headline (+0.5% vs. +0.7% previously), ex-autos (+0.4% vs. +1.1%) and retail control (+0.3% vs. +1.1%) forecasts suggest some payback from a strong March release. There will be a few extra eyes on initial jobless claims this week given the spike to +231k last week after months of relative stability around the +210k level. DB economists think the spike could have been mostly due to NY school holiday dates having been shifted and would therefore expect much of the spike to reverse. We also have US housing starts and permits on Thursday which include a 2019-2024 seasonal revision which could be of note. Various regional factory surveys are out which will help fine tune PMI forecasts.

Courtesy of DB, here is a day-by-day calendar of events

Monday May 13

Tuesday May 14

Wednesday May 15

Thursday May 16

Friday May 17

Focusing on just the US, Goldman writes that the key economic data releases this week are the CPI and retail sales reports on Wednesday and the Philadelphia Fed Manufacturing Index on Thursday. There are several speaking engagements from Fed officials this week, including an event with Vice Chair Jefferson and Cleveland Fed President Mester on Monday and an event with Chair Powell on Tuesday.

Monday, May 13

Tuesday, May 14

Wednesday, May 15

Thursday, May 16

Friday, May 17

Data Sourced from DB, Meta and GS