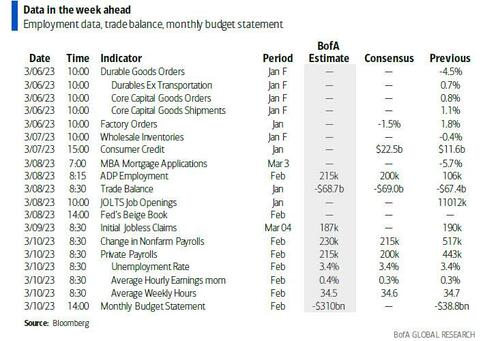

After a somewhat lazy start to March, we get a very busy 8 days for markets, culminating in the US CPI next Tuesday after payrolls this Friday, JOLTS and ADP on Wednesday, Claims on Thursday, and Powell getting things rolling tomorrow with his semi-annual monetary policy report to Congress. Here is a handy snapshot of the upcoming blizzard of events:

As DB's Jim Reid writes in his weekly preview, it's fairly uncontroversial to say that the last payrolls report published on February 3rd was a huge moment, and one that started a series of events that has meant that the last month has been a struggle for most financial assets, especially bonds (the worst February on record for the Global Agg). Remember that 36 hours before that payroll print, the relatively "dovish" FOMC had led to 10yr US yields hitting 3.33%. Last week at their peak they hit 4.08% before closing out at 3.95% on Friday.

As such if you thought the relatively random number generator that is payrolls is usually overhyped, you've seen nothing yet as we approach Friday's big number. For those who have been on a sabbatical to another planet, last month it came in at +517k against +223k expected with fairly substantial upward revisions from the previous year as part of the annual review; most expectations however are for a reversal of the downward trendline as the January print was greatly influenced by one-time factors and seasonals.

Before we preview this, we should also say that other big highlights this week are the RBA (tomorrow), BoC (Wednesday) and BoJ meetings (Friday), and Powell's semi-annual congressional testimony before House and Senate committees tomorrow and Wednesday. As discussed further below the BoJ is unlikely to change tack at this stage but every meeting is potentially live given what they did in December. We'll review this and the rest of the week ahead after a brief payrolls preview.

For Friday DB's economists expect +300k for both headline and private payrolls (consensus for both at +215k). As with January, February was also mild weather wise for the survey week (which can mean less leisure, hospitality and retail layoffs), although not as much as in the prior month. So the temperature will likely still be an influence. There was a reasonable question mark about seasonal distortions in the last report so who knows how that will impact this week's report. Unemployment is expected to stay at 54-year lows of 3.4% with the risks it ticks down a tenth. We'll give a fuller preview of average hourly earnings and the work week on Friday.

Don't forget the JOLTs report on Wednesday which is viewed by many as a more accurate reflection of the tightness of the labor market with the main problem it always being a month behind the payroll report (we will have a note on this later today). Maybe it can help shed some light on how accurate January's payrolls report was though. If it was accurate you should see an uptick in the hiring rate. Also important will be the job openings as usual to highlight the tightness in demand for labour.

Going back to the other highlights this week, Fed Chair Powell semi-annual testimony to the Senate Banking Committee tomorrow and to the House Financial Services Committee on Wednesday will of course be pored over for every subtle policy nuance. As they come before payrolls and next week's equally crucial CPI report, it's hard to see how he can be too confident about where the Fed is going to land. He may provide clues as to what employment and inflation numbers need to do to make the Fed act in a particular way, especially how it pertains to whether 50bps hikes are back on the table. Staying with central banks the RBA is seen as hiking 25bps tomorrow but the BoC seen as holding to their planned policy pause on Wednesday. Regarding this week's BoJ meeting, consensus if for the central bank to adhere to its present monetary policy, with YCC removal seen unlikely, although you can't rule it out given December's surprise. This will also be the last monetary policy meeting for Governor Kuroda.

Other notable economic data releases in the US this week include factory orders (DB forecast -0.5% vs +1.8% in December) today, consumer credit tomorrow and the ADP and trade balance on Wednesday.

Turning to Europe, the focus will be on the UK with the release of the monthly GDP report on Friday, ahead of the March 23 BoE meeting. Elsewhere in the region, key releases include factory orders (tomorrow), retail sales and industrial production (Wednesday) for Germany and trade balance data for France (Friday).

In Asia the highlight might be the Chinese CPI and PPI reports due on Thursday. These will be released after last week's blockbuster PMI readings showed a robust recovery and thus will be important to assessing the path of economic stimulus going forward. Our economists expect a 1.3% reading for the CPI (vs 2.1% in January) and a further YoY decline of -1.0% for the PPI (vs -0.8% in January).

On the earnings front, Q4 reporting season is now mostly over, but a few stragglers remain as shown in the table below.

Courtesy of DB, here is a day-by-day calendar of events

Monday March 6

Tuesday March 7

Wednesday March 8

Thursday March 9

Friday March 10

Looking at just the US, Goldman writes that the key economic data releases this week are the JOLTS job openings on Wednesday and the employment situation report on Friday. Chair Powell will appear before the Senate Banking Committee on Tuesday and the House Financial Services Committee on Wednesday.

Monday, March 6

Tuesday, March 7

Wednesday, March 8

Thursday, March 9

Friday, March 10

Source: DB, BofA, Goldman