After a very quiet week for markets and newsflow, this week steps up the action with the FOMC on Wednesday the obvious highlight, although tomorrow's US CPI print is probably the event of the week in terms of potential vol as it could impact final pricing for the FOMC and impact terminal pricing as well. The ECB (Thursday) and the BoJ (Friday) are also making policy decisions.

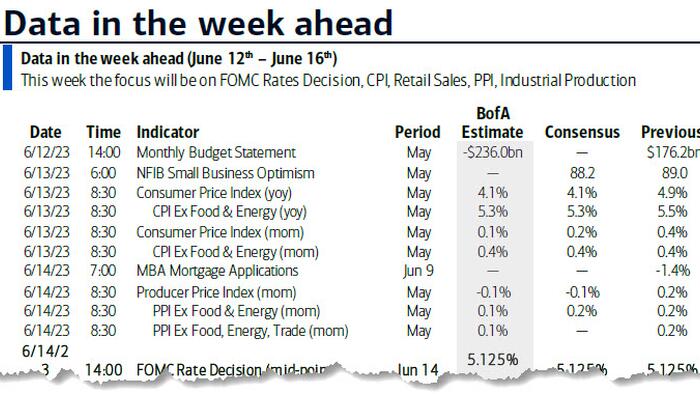

Rounding out the week's main events, DB's Jim Reid writes that in Asia investors will be hotly anticipating China's key monthly activity indicators (Friday) including industrial production and retail sales after recent disappointing data releases. In other US data, the key releases outside of CPI are PPI (Wednesday), retail sales and industrial production (Thursday) and the UoM Michigan survey (Friday) with the important inflation expectations series thrown in for good measure. Key European data releases include UK GDP and labor market indicators and the German ZEW survey (both tomorrow).

Going through some of this in more detail, there is around a 30% probability priced into the FOMC this week. DB expect them to hold but raise rates in July (we will do a full preview tomorrow). Economists expect the meeting statement, Summary of Economic Projections (SEP), dot plots, and Chair Powell's press conference to skew hawkish, signalling the likely need for further policy tightening as soon as the July 26 meeting.

The last swing factor for the FOMC will clearly be CPI tomorrow. Here consensus expects a +0.2% month-over-month advance for headline CPI (vs. +0.37% previously) and a +0.4% increase for core (vs. +0.41%). This would lead the former to drop by about a full percentage point to 4.1% YoY, with the latter down -0.3% to 5.2%, with the 3, 6 and 12 month core readings all still struggling to gain much downward momentum below 5% at the moment. For PPI the day after, DB expect the headline series (-0.2% vs. +0.2) to underperform the core component (+0.2% vs. +0.2%) due to energy prices.

Staying with prices, another insight into inflation pressures will come from the University of Michigan's consumer survey for June, with inflation expectations especially in focus after the gauge for the next 5-10 years climbed to an 11-month high of 3.1% last month, albeit revised down (as it often is) 0.1pp from the first print. For the sentiment index itself, consensus sees a 60.1 reading, a jump from 59.2 in May but still below the 63.5 reading in April.

On the other side of the Atlantic, the ECB is expected to deliver another +25bps hike, followed by an additional one in July that would take the terminal rate to 3.75% with the risk of moving towards 4.00-4.25% in the autumn and more hawkish messaging.

According to Rabobank, "unlike the Fed, the ECB is widely expected to continue its streak of rate hikes – it is still lagging a few steps, of course. So here too, the actual rate decision will draw less attention than the central bank’s communication about the path forward. The new staff projections may help in this communication effort. Given our current economic outlook, we like the market-implied pricing of a 3.75% terminal rate, and we mainly disagree with the markets pricing in rate cuts very early in 2024. The ECB seems to be of a similar mind, and keeping the medium-term inflation forecast a smidge above 2% may help signal that markets are pricing rate cuts too early."

But the ECB’s peak rate also remains subject to upside risks. One of the reasons we expect that the Governing Council can soon stop tightening policy further is the expected headwinds from abroad. So, if the US recession does not materialise as early as expected, that might not only force the Fed to go higher; it could also put more pressure on the ECB, if it adds to the strength of Eurozone activity.

The BoJ will round out the busy week for central banks on Friday. Virtually nobody expects changes to the current policy. Given there won't be an Outlook Report, the central bank is likely to continue to focus on downside inflation risks while inflation and currency are among key catalysts for a policy change.

The one central bank that may be bucking the trend of racing to the top is the PBOC. Speculation that the Chinese central bank may cut its MLF rate by 5-10 basis points this Thursday already is increasing. In addition to the several structural challenges facing the Chinese economy, the latest inflation data hinted at a further deceleration of both consumer and producer prices. Rabobank's China strategist does not expect a cut in June quite yet, but it does have two rate cuts pencilled in for early Q3 and Q4; this has already contributed to CNY weakness. Indeed, the PBOC’s room to cut rates may be somewhat limited by the remaining upside potential for US policy rates, and the impact that further widening of rate differentials would have on the currency

Courtesy of DB, here is a day-by-day calendar of events

Monday June 12

Tuesday June 13

Wednesday June 14

Thursday June 15

Friday June 16

Finally, looking at just the US, Goldman writes that the key economic data releases this week are the CPI report on Tuesday and the retail sales and Philly Fed manufacturing reports on Thursday. The June FOMC meeting is this week, with the release of the statement at 2:00 PM ET on Wednesday, followed by Chair Powell’s press conference at 2:30 PM.

Monday, June 12

Tuesday, June 13

Wednesday, June 14

Thursday, June 15

Friday, June 16

Source: DB, Goldman, BofA