As trade letters from the US continue to get mailed out, DB's Jim Reid writes that April 2nd has become July 9th which has become August 1st for an ever increasing list of countries. In the early hours of Saturday, Trump’s stationary cupboard was opened again and a letter was sent to the EU and Mexico informing them that they would face 30% tariffs on August 1st. To be fair, a month ago Trump threaten the EU with a 50% tariff so you might argue this is an improvement! The market will generally think this is mostly a negotiating tactic and that we’re unlikely to see such rates. The EU have been measured in their response so far and have extended the suspension of trade countermeasures that were supposed to kick-in tomorrow night. This will now be aligned to the August 1st deadline. So the EU and the market are hoping and expecting diplomacy to win out.

However at some stage, the DB strategist warns that someone’s bluff could be called. Trump is under less pressure to back down with US risk markets around their highs and bond markets relatively stable at the moment. If huge tariffs do get imposed on August 1st, in thin holiday markets, we could get a sizeable market reaction. So the next three weeks of negotiating will be key to restful holidays everywhere.

One thing is certain: much will still depend on the inflation trajectory. If all is calm on this front then we could move on but if we start to see slippage here, then a removal of a Fed Chair could be a big problem, at least initially, for a country with huge twin deficits.

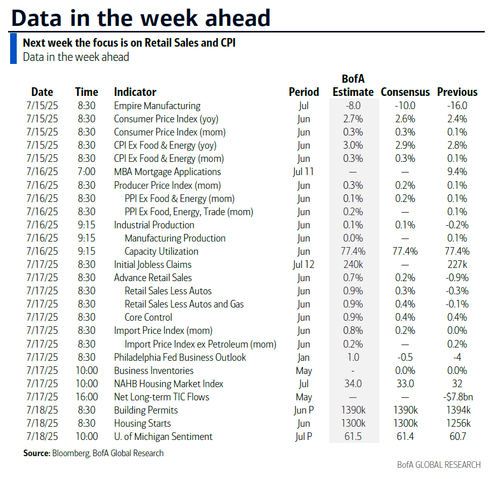

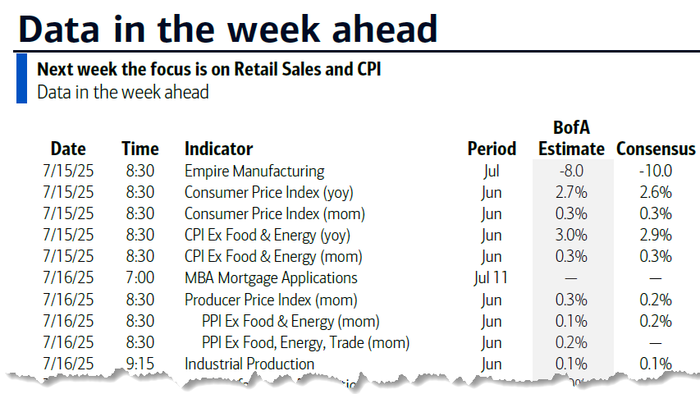

Given the above, this week is important as we see the latest US CPI numbers (tomorrow) with PPI (Wednesday) following. Before we preview these, the other key global releases are the other CPI numbers in Canada (also tomorrow), the UK (Wednesday) and Japan (Friday). In the US, there will also be retail sales (Thursday) and industrial production (Wednesday) reports for June, along with the preliminary University of Michigan survey (Friday) for July. Claims on Thursday corresponds to payroll survey week so it’ll be interesting to see whether the recent improvements continue given the payroll implications. Growth will also be in focus in China, where Q2 GDP and June activity data are out tomorrow. Also important will be the US banks kicking off the Q2 earnings season tomorrow, with semiconductor firms ASML and TSMC also reporting this week.

Lets now delve into the main upcoming US data, especially the inflation numbers. According to DB's US economists’ preview they expect a +0.9% increase in seasonally adjusted gas prices and solid food inflation to boost the headline CPI (+0.34% forecast vs. +0.08% previous) slightly above that of core (+0.32% vs. +0.13%) which would increase the year-over-year growth rate by three- and two-tenths respectively (to 2.7% and 3.0%), and the three- and six-month annualized rates by 1.1 percentage points (to 2.8%) and three-tenths (to 2.9%), respectively. The economists will be looking mostly at signs of tariff related inflation in the core good categories. Wednesday’s PPI data will also be important for the categories that feed through into core PCE, the Fed’s preferred inflation gauge.

Fed speak will be active after the CPI numbers with a host of appearances so there could be plenty of reaction to the data. See those listed in the day-by-day calendar at the end alongside all the other key events from around the world this week. This includes a G20 finance ministers and central bank governors meeting on Thursday and Friday.

On the start of Q2 earnings, JPMorgan, Wells Fargo and Citi kick off the Q2 earnings season tomorrow. Bank of America, Morgan Stanley and Goldman Sachs will follow on Wednesday. Blackrock, American Express and Charles Schwab will also be among financials reporting. Investors will also focus on messages from results of semiconductor firms ASML (Wednesday) and TSMC (Thursday), with the Philadelphia Semiconductor index now up 15.2% YTD. Other S&P 500 companies reporting this week will include Johnson & Johnson, Netflix, General Electric and PepsiCo. In Europe, notable names include Novartis, Volvo, Sandvik and Saab.

10% of the S&P market cap is set to report on the week (43% of financials market cap). Focus for the banks will be around NII guides given changing rates backdrop (less cuts, steeper curve), improving loan growth, as well as commentary around capital returns post SLR reforms + SCB decline.

According to Goldman, the S&P implied move through next Friday (7/18) is 1.39%.

Finally, watch for headlines out of "Crypto Week" where the House is set to deliberate on a series of crypto bills that aim at providing a clearer regulatory framework for digital assets.

Courtesy of DB, here is a day-by-day calendar of events

Monday July 14

Tuesday July 15

Wednesday July 16

Thursday July 17

Friday July 18

Looking just at the US,

The key economic data releases this week are the CPI report on Tuesday, the retail sales report on Thursday, and the University of Michigan report on Friday. There are several speaking engagements by Fed officials this week, including an event with New York Fed President Williams on Wednesday.

Monday, July 14

Tuesday, July 15

Wednesday, July 16

Thursday, July 17

Friday, July 18

Source: DB, Goldman