In terms of the holiday-shortened week ahead, the main data highlights are US retail sales tomorrow, UK CPI on Wednesday, and Japanese inflation and the global flash PMIs on Friday. For central banks, we have meetings concluding in Australia (tomorrow), UK, Switzerland and Norway (Thursday) with a few additional EM meetings spread through the week. There is also a fair degree of Fed and ECB speak to throw into the mix.

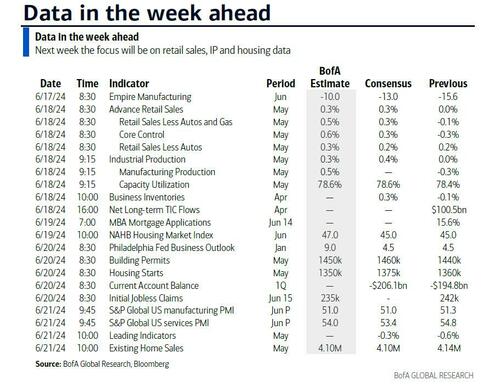

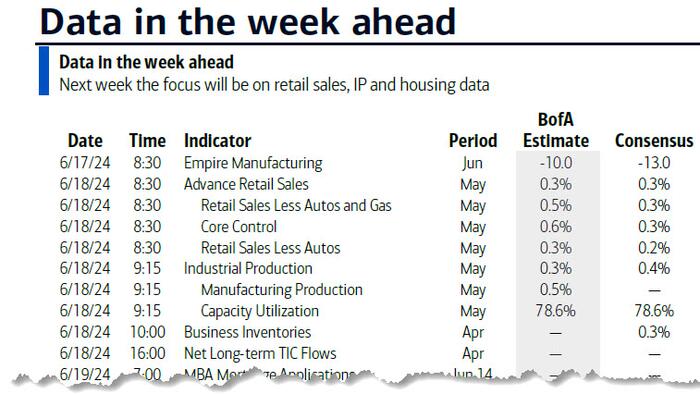

Tomorrow's US retail sales will likely be the focal point in the US and even with a pretty poor UoM consumer sentiment figure from Friday, most economists think we'll see a decent tick up in retail control (+0.3% consensus vs. -0.3% last month) which would equate to around 3% annualized for Q2 (vs. 1.5% in Q1). There have been some signs recently that the US consumer is starting to show some fatigue so this will be an important data point. Also keep a watchful eye on initial jobless claims on Thursday. While consensus expects a modest drop from 242K to 235K, DB's economists see a further rise from 242k to 250k but so far it seems the rise is concentrated in similar states to that seen last year and is likely to be due to difficulties seasonally adjusting to the end of the school year. For more on the week ahead, the full day-by-day week ahead calendar is at the end as usual.

This morning, Asian equity markets are struggling at the start of the week with majority of the region’s markets trading lower this morning. As DB's Jim Reid notes, across the region, the Nikkei (-1.82%) is the biggest underperformer dragged down by energy and real estate stocks while the KOSPI (-0.40%), the Shanghai Composite (-0.56%) and the CSI (-0.13%) also trading trade in negative territory. However, the Hang Seng (+0.50%) is the notable exception, having reversed its opening losses. In overnight trading, US equity futures are struggling to gain momentum with those on the S&P 500 (-0.05%) just below flat and those tied to the NASDAQ 100 (+0.06%) just above flickering near the flatline. Meanwhile, yields on the 10yr USTs (+2.32 bps) have moved upwards to trade at 4.24%.

Staying on China retail sales rose +3.7% y/y in May, exceeding market expectations for a +3.0% gain and increasing pace from a +2.3% increase in the previous month. However, other economic metrics failed to surpass market forecasts with industrial output growing +5.6% y/y in May (v/s +6.2% expected), down from an increase of +6.7% in April. Meanwhile, the nation’s real estate crisis continued to weigh on investment in fixed assets with the overall YTD investment figures expanding +4.0%, just shy of Bloomberg forecast of +4.2% gain. Additionally, new home prices dropped at the fastest pace since October 2014, falling -0.7% m/m in May (v/s -0.58% in April) and marking the 11th straight decline despite the government’s stimulus to support the property market.

Courtesy of DB, here is a day-by-day calendar of events

Monday June 17

Tuesday June 18

Wednesday June 19

Thursday June 20

Friday June 21

Finally, looking at just the US, the key economic data releases this week are the retail sales report on Tuesday and the Philly Fed manufacturing index on Thursday. There are several speaking engagements from Fed officials this week.

Monday, June 17

Tuesday, June 18

Wednesday, June 19

Thursday, June 20

Friday, June 21

Source: DB, Goldman, BofA