Prepare to be disorientated this holiday shortened week, as payrolls sees a rare Thursday print ahead of the Independence Day holiday on Friday, with both JOLTS and ADP labor reports ahead of the Payrolls report. We also have the US ISMs tomorrow and Wednesday, and the various global PMI numbers from tomorrow which will give us a good guide to global economic momentum in June.

Elsewhere, DB's Jim Reid notes that a highlight will be the ECB forum in Sintra starting today and the European inflation numbers today and tomorrow. The US tax bill should be finalized this week although at the moment it needs to pass the Senate today (or possibly tomorrow), after a drama filled weekend of horse trading, and then back to the House for final approval. The President wants it done by Friday's holiday. At that point attention will swiftly focus to the July 9th deadline extension for reciprocal tariffs, but not before we first hear from Powell again tomorrow during the ECB Sintra conclave. Indeed you'll probably get headlines build up this week and the risk to the market is that with the S&P 500 hitting a new record high at the end of last week, with Treasury yields more becalmed, and with a new tax cutting bill, it's possible that the Trump Administration feels emboldened to be aggressive again. On Friday the US announced that they were stopping trade talks with Canada in retaliation for their digital service taxes and that new tariffs would be launched within a week. However, overnight Canada has dropped this tax to enable talks to restart. This is perhaps a warning shot for the world. So before next Wednesday a lot of water will flow under the global trade bridge.

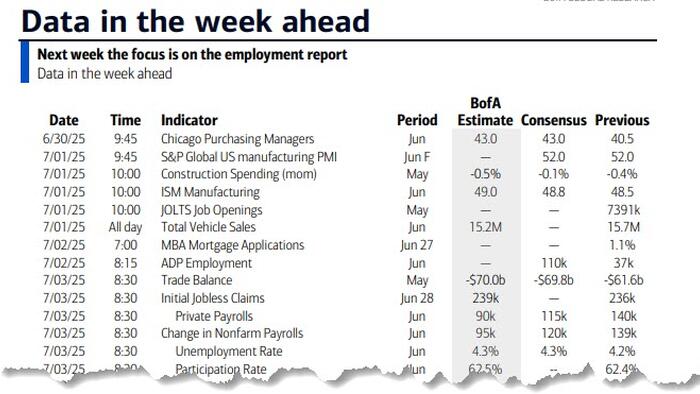

Let's go through a few of the week's main highlights of the week ahead, but remember the full day-by-day calendar is at the end as usual.

For payrolls, DB expects the headline number (+100k forecast vs. +139k previously) to be slightly below the consensus of +113k, with a similar story for private payrolls (DB +100k, consensus +110k, vs. +140k previously). This would also be below the three-month average of 135k and 133k, respectively. Their rationale is based on 1) initial jobless claims being up 8.8% during the June survey week relative to May; and 2) their observation of a recent pattern of subdued summer payroll gains. They also expect the unemployment rate to edge up a tenth to 4.3% but with the risks skewed to it staying unchanged.

Although 100k on payrolls seems low, economists think the breakeven rate which keeps the unemployment rate steady, is around 100k at the moment and could even be as low as 50k given the Trump Administrations' migration policies. If correct, we could have a situation where low payroll growth still tightens the labor market.

Leading up to payrolls we have JOLTS tomorrow, ADP on Wednesday and also watch out for the employment components in today’s Chicago PMI, tomorrow’s manufacturing ISM, and Wednesday’s Services ISM.

In Europe, the big event will be the ECB's forum on central banking in Sintra running from today through to Wednesday. The policy panel tomorrow will feature heads of the Fed, the ECB, the BoJ, the BoE and the BoK. So plenty of potential headlines there. The ECB will also release its account of the June policy meeting on Thursday and their consumer expectations survey is due tomorrow. Elsewhere in Europe, the BoE will publish its DMP, bank liabilities and credit conditions surveys on Thursday.

In terms of European data, June CPI will continue to be in focus after Friday's prints for France and Spain showed a slight uptick in inflation. Reports for Germany and Italy are out today, with the Eurozone-wide release scheduled for tomorrow. Swiss inflation data is due on Thursday. We also have May German retail sales (today) and factory orders (Friday), Italian retail sales and French IP on Friday.

In Japan the BoJ's Q2 Tankan survey results come out tomorrow with our economists forecasting that the business condition index for large manufacturers in the Tankan survey will worsen -3 points to +9. They expect a similar gauge for large non-manufacturers to slip -2 points to +33. This could be one of a few factors that help influence whether the BoJ hikes again in July, although there's lots of moving parts at the moment including trade agreements with the US.

Courtesy of DB, here is a day-by-day calendar of events

Monday June 30

Tuesday July 1

Wednesday July 2

Thursday July 3

Friday July 4

-

- *

Finally, turning to the US, Goldman writes that the key economic data release this week is the employment report on Thursday. There are a few speaking engagements by Fed officials this week, including Chair Powell on Tuesday.

Monday, June 30

Tuesday, July 1

Wednesday, July 2

Thursday, July 3

Friday, July 4

Source: DB, Goldman