Welcome to what is without doubt the busiest two-week stretch of the year, starting with a barrage of earnings, payrolls, JOLTS, GDP, PCE and the Treasury refunding, and concluding with next week's presidential election.

But first a look at the recent action, which as DB's Peter Sidorov wraps up, saw the festive mood that dominated this fall suffer a mini-scare last week, as the S&P 500 fell for the first time in six weeks while the bond sell-off continued apace. And there’ll be plenty to test the market nerves with this week's bumper set of data releases, including US payrolls on Friday, and earnings reports, with five of the Magnificent 7 reporting. Meanwhile, the tight US election campaign will enter its final stretch.

One market fear that has eased over the weekend is escalation risks in the Middle East. This comes as overnight into Saturday Israel carried out retaliatory strikes against Iran, but with these targeting military facilities and avoiding oil or nuclear installations. The targeted scope of the attack and the absence of an immediate retaliation signal have seen markets price out some of the geopolitical risk premium. Brent crude is down around -6% lower to below $72/bbl, reversing all of last week’s rise; Gold is down -0.60% from Friday’s record high, while US equity futures are posting decent gains.

Meanwhile, Treasuries extended their recent decline, with 10yr yields at one point rising as high as 5bps to 4.29% as I type, their highest level since July, having now risen by 65bps from their September lows, although the move is now reversing. This rise has come amid both rising term premia, partly driven by concerns about US fiscal deficits, and growing skepticism that the Fed will deliver rapid rate cuts given solid US data. Indeed, Fed funds futures for end-25 are up to 3.53% this morning, having priced out three 25bps cuts over the past six weeks.

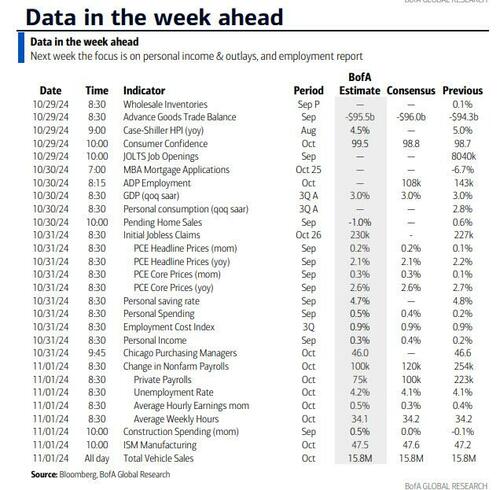

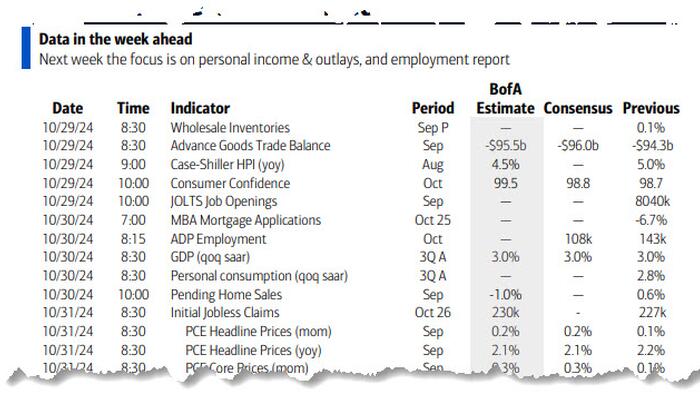

With the Fed now in the blackout period ahead of next Thursday’s meeting, the data will be doing the talking this week, with the marquee release being the October payrolls report on Friday. Most economists foresee a sizeable slowing in headline (consensus expects +110k jobs vs. 254k previously) and private (+90k vs. 223k) payrolls. However, this envisages a nearly -70k drag due to striking workers (mostly Boeing) and the weather impact of Hurricane Milton. The weather effect will have less of an impact on average hourly earnings (+0.3% vs. +0.4%), while unemployment is expected to remain unchanged at 4.1% amid unchanged labor force participation. Given the likely noise in the payrolls, the market may pay extra attention to Tuesday’s JOLTS report for September. Given the strong September payrolls, the hiring rate may pick up from the historically low 3.3% in August. The last JOLTS print also saw the quits rate, one of the best leading indicators of wage growth, fall to 2.1%, its weakest since 2015 if one excludes the first few months of Covid. Other labor market data will include the Q3 Employment Cost Index reading (DBe: +0.9% vs. +0.9%), which is the Fed's preferred measure of wage growth.

In other US data, traders will pay attention to the September personal income release on Thursday, which includes the Fed’s preferred core PCE inflation measure. Consensus expects core PCE inflation to rise by +0.3% (vs. +0.13% previously), its strongest since March. And Wednesday's advance Q3 real GDP is expected to show continued solid growth (+3.0% vs. +3.0% in Q2). On the fiscal side, we have the US Treasury refunding announcement, with borrowing estimates on Monday and the refunding policy statement on Wednesday.

Over in the euro area, the highlights will be the Q3 GDP print on Wednesday and the October flash inflation release on Thursday, with the latter preceded by the Spain and Germany CPI prints on Wednesday. Our European economists see headline euro area inflation rising from 1.7% to 1.9% but with core inflation slowing by a tenth to +2.6%, which would be its lowest level since January 2022. See our economists Inflation Chartbook here for more.

In the UK, the focus will be on the Autumn Budget on Wednesday. This will be the Labor Government's first budget in almost 15 years and as reviewed last week, it will literally change the definition of debt so the UK can raise more of it. Over in Asia, we will have the latest BOJ decision on Thursday, where a hold is widely expected despite the plunge in the yen today. And in China, the official PMIs on Thursday and the Caixin manufacturing PMI on Friday will be closely watched to gauge the effectiveness of the stimulus measures outlined by Beijing over the past month.

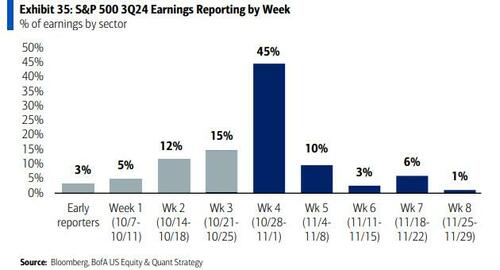

It will be a bumper week for earnings, with more than 40% of the S&P 500 by market cap expected to report.

Following on the blockbuster earnings report from Tesla last week, five more of the Magnificent 7 are reporting this week, including Alphabet (Tuesday), Microsoft and Meta (Wednesday), Apple and Amazon (Thursday). See the rest of the week’s earnings and data releases in the day-by-day calendar at the end.

Last but certainly not least, the US election campaign will enter its final week ahead of the next Tuesday’s vote. Over 40 million early votes have already been cast and the latest polls continue to show a very tight race. The FiveThirtyEight average gives Harris a 1.5pp lead in national polls, but with a 0.6pp lead for former President Trump on average across the seven swing states, all of which see leads of less than 2pp for either candidate. The RealClearPolitics betting average now has former President Trump with a 61% likelihood of victory. That’s the highest it’s been since President Biden dropped out of the race in July, though it has largely stabilized in the past week.

Courtesy of DB, here is a day-by-day calendar of events

Monday October 28

Tuesday October 29

Wednesday October 30

Thursday October 31

Friday November 1

Looking at just the US, Goldman writes that the key economic data releases this week are the Q3 GDP advance release on Wednesday, the core PCE inflation and the employment cost index on Thursday, and the employment report on Friday. There are no policy-related speaking engagements from Fed officials this week, reflecting the blackout period ahead of the November FOMC meeting.

Monday, October 28

Tuesday, October 29

Wednesday, October 30

Thursday, October 31

Friday, November 1

Source: DB. Goldman