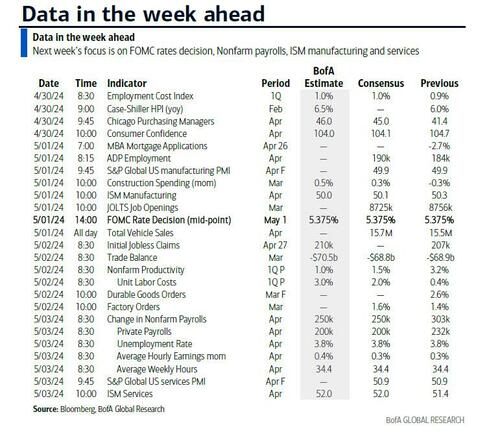

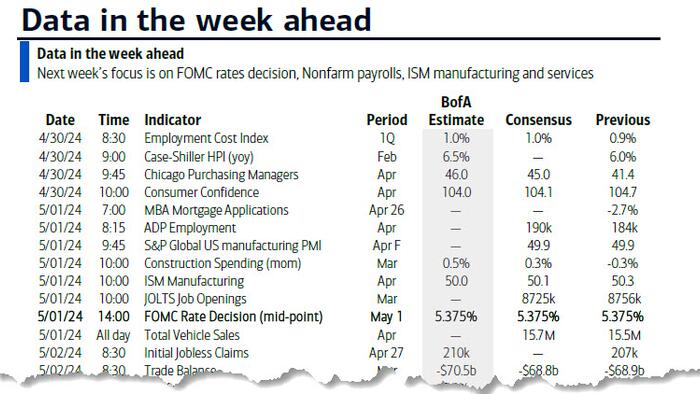

As DB's Jim Reid notes, with just two days left in a rollercoaster April for markets - and FX - last week actually saw the best week for the S&P 500 (+2.67%) and NASDAQ (+4.23%) since November, following several weeks of declines, as earnings gave markets a boost even if the US inflation data was on net worrying. And while the month is almost over, the new week is just starting and as Reid notes, it's shaping up an exceptionally busy week of important events.

The FOMC on Wednesday is the obvious highlight of the week, but we also have payrolls on Friday to look forward to. DB expect a more hawkish-leaning Fed this week. While our economists expect the Committee will maintain an easing bias, they do expect the statement and press conference to echo Chair Powell’s view that firmer inflation prints suggest it will take longer to gain confidence about disinflation. The press conference will be fascinating to see the nuances in Powell’s responses as he justifies a likely unchanged easing bias, even if the rhetoric is more hawkish, in the face of rising inflation.

In terms of the jobs report on Friday, our US economists see payrolls gaining +240k in April (consensus +250k), down from +303k in March. The consensus expects the unemployment rate and the hourly earnings growth rate to stay at 3.8% and +0.3% MoM, respectively, although DB expects the former to tick up a tenth. Overall the market sees a solid report.

Other key data in the US includes consumer confidence tomorrow, the manufacturing ISM, JOLTS, and ADP on Wednesday, and the services ISM on Friday. We also see the latest US Treasury quarterly refunding announcement on Wednesday, after the borrowing estimate is due today. This was a big pivot point for global markets back in August (negative) and October (positive) but since then a commitment not to increase auction sizes has reduced its importance.

Finally in the US, earnings season maintains its peak pace as 174 report in the S&P versus 180 last week with Amazon (Tuesday) and Apple (Thursday) the obvious highlights. Meanwhile, 66 Stoxx 600 companies will report this week.

In Europe, preliminary CPI reports for Germany and Spain today, and the Eurozone tomorrow will have a lot of significance for the June ECB meeting and whether we will see the first cut. Our European economists preview the release here. For the Eurozone, they expect the headline HICP to fall one-tenth to 2.31% yoy, its lowest value since August 2021 and see core inflation slowing further to 2.45% yoy, 0.50pp lower than in March 2024. Staying in Europe the latest GDP data for Germany, France, Italy and the Eurozone are due tomorrow. In Asia, various China PMIs (tomorrow) will be a big focus and in Japan, several key economic indicators are also due, including industrial production and labour market data tomorrow.

Day-by-day calendar of events:

Monday April 29

Tuesday April 30

Wednesday May 1

Thursday May 2

Friday May 3

Looking at just the US, Goldman writes that the key economic data releases this week are the Employment Cost Index on Tuesday, ISM manufacturing and JOLTS job openings on Wednesday, and the employment report on Friday. The May FOMC meeting is on Wednesday. The post-meeting statement will be released at 2:00 PM ET, followed by Chair Powell’s press conference at 2:30 PM. Treasury will release its Q2 financing estimates on Monday and the Quarterly Refunding Statement on Wednesday.

Monday, April 29

Tuesday, April 30

Wednesday, May 1

Thursday, May 2

Friday, May 3

Source: DB, Goldman