One week down, 207 to go of Trump 2.0 and what have we learnt so far?

According to DB's Jim Reid, it’s hard to say we’ve learnt too much, even with the best part of a hundred executive orders already signed. The market has been relieved that tariffs haven’t been issued on “day one” as previously promised but its only five days until the February 1st date Trump suggested could be the point he puts tariffs on Mexico, Canada and China. So that will be the gorilla in the room this week. In addition, he’s ordered departmental reviews of existing trade practises with an April 1st deadline. So no news on tariffs isn’t necessarily good news. Yesterday Columbia was the latest to feel the wrath of Mr Trump as he ordered an emergency 25% tariff on the country, to be doubled in a week, over the country's refusal to allow two planes of undocumented migrants returning from the US to land. However, in the early hours of this morning, the US removed the threat after the Colombian leader agreed to grant entry to US military flights deporting migrants. This 12 hour incident feels like a template for how the US will now deal with its foreign policy issues.

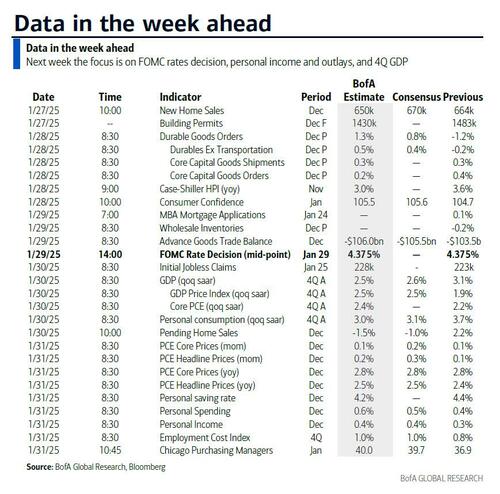

Outside of Trump watching, there’s a lot going on this week with rate meetings from the Fed and Bank of Canada (Wednesday), and the ECB (Thursday); inflation data in Europe (Thursday/Friday), US (core PCE Friday), Japan (Tokyo CPI Thursday), and Australia (Wednesday); and Q4 GDP in the US, Germany, France, Italy and Euro Zone (Thursday). If that wasn’t enough, earnings season starts to take off in both the US and Europe with 102 S&P 500 and 53 Stoxx 600 companies reporting with four of the Magnificent 7 (Microsoft, Meta and Tesla on Wednesday, and Apple on Thursday) being the obvious highlight. In the AI world there's been a lot of chatter in the last few days around Chinese firm DeepSeek's announcement that it's produced an open-source AI model that rivals some of the US tech giant's equivalents for a fraction of the costs and using less sophisticated chips. As this story builds, NVDA is down a whopping 18%, translating in a record market cap loss of $600 billion, driving the S&P 500 down -2%. These are big moves for this time of day. It will be interesting if this story gets momentum and whether the Mag-7 loses some of their luster.

In theory the main event this week would normally be the Fed but most economists expect a relatively quiet meeting with no rate move and limited guidance about future policy decisions. While Chair Powell may not rule out a March cut as he did last January, the broad signals from the meeting should confirm that such a cut is not likely with Powell possibly emphasizing the underlying strength of the economy and signs of stabilisation in the labour market that would require patience in removing further restriction. When asked about Trump’s policies and their impact on inflation expect Powell to play a straight bat and say that the committee wont prejudge policies in advance (even though they clearly have been doing just that).

After the Fed we get Q4 US GDP on Thursday (consensus expects 2.7%), and then the core PCE deflator on Friday, which is expected to rise from 0.1% to 0.2% in December which should keep the YoY rate at 2.8%. The employment cost index (ECI) is also out on Friday and this will be a key release for the Fed as more subdued labour market pressure has given them comfort in recent months.

Over in Europe, the ECB is expected to deliver another 25 bps cut on Thursday taking the policy rate to 2.75% and see the description of the policy stance unchanged relative to December. The ECB will also release its bank lending survey tomorrow and the consumer expectations survey on Friday. Optimism is creeping back into Europe this year and the December 2025 ECB contract has gone up from 1.56% in early December to 2.07% on Friday implying less than four cuts from here. Much of course will depend on the extent that Europe is in the Trump crossfire and so far the market is relieved that nothing specific was announced last week but note that Trump on at least two occasions called out the European Union and said at his virtual Davos address that the EU treats the US "very unfairly" and "very badly". So it would be wise to brace yourself for more news on this front.

Elsewhere in Europe, this week the focus will also be on flash January CPIs starting with Spain on Thursday. Prints for Germany and France are due Friday, with Eurozone-wide numbers out a week today. DB economists expect headline and core Eurozone HICP to decline by 0.1pp to 2.3% YoY and 2.6% YoY. Their forecasts for Spain, Germany and France are 2.38%, 2.79% and 1.85%, respectively. Don't forget the GDP prints in Germany, France and the Eurozone on Thursday, as well as Sweden on Wednesday. Other highlights include the Ifo survey in Germany today as well as Sweden's Riksbank rates decision on Wednesday.

The day-by-day week ahead calendar is at the end as usual with a fuller list of key events, including the main earnings to be realised.

Courtesy of DB, here is a day-by-day calendar of events

Monday January 27

Tuesday January 28

Wednesday January 29

Thursday January 30

Friday January 31

Finally, looking at just the US, Goldman writes that the key economic data releases this week are the Q4 advance GDP report on Thursday and the employment cost index and core PCE inflation reports on Friday. The January FOMC meeting is this week. The post-meeting statement will be released at 2:00 PM ET on Wednesday and will be followed by Chair Powell’s press conference at 2:30 PM ET.

Monday, January 27

Tuesday, January 28

Wednesday, January 29

Thursday, January 30

Friday, January 31

Source: DB, Goldman