It's a huge macro week ahead, with an avalanche of earnings, data and central banks. But, as has been the case since April's Liberation Day, we start with trade.

This week’s key August 1st trade deadline has largely become a non-event. As DB's Jim Reid writes, the last of the significant agreements was concluded yesterday, with the US and EU reaching a deal that mirrors the structure of the recent US-Japan accord. The agreement, as noted before, includes a 15% tariff on autos, excludes pharmaceuticals, and maintains the existing 50% tariffs on steel and aluminium. In a significant gesture, the EU has pledged to import $750 billion worth of energy, invest $600 billion into the US economy, and purchase “vast quantities” of military equipment. Additionally, the EU has committed to opening its markets to US goods at zero tariffs. On pharma there was some confusion as to whether the EU will be exempt from the upcoming Section 232 investigation on the sector. For now, there is mixed commentary on this from both sides.

Meanwhile, US-China negotiations are underway in Stockholm today and tomorrow. While the August 12th deadline looms, early reports, so far only from Chinese press headlines, suggest a 90-day extension has been granted. This development, if confirmed, would further reduce the urgency surrounding this week’s trade calendar. So expect the White House stationery cupboard to take a hit this week, with a flurry of letters flying out— but in the context of most of the big trade understandings having already been agreed.

Adding a curveball to the week though, Thursday (July 31st) will see the Federal Appeals Court hear the International Trade Court’s ruling that President Trump’s use of an emergency declaration to impose tariffs was unlawful. It’s hard to gauge the outcome or the potential impact if the policy is indeed struck down—so this is one to watch. It feels like the agreements made with other countries would likely stand even if the court ruling continues to go against Mr Trump. For others he will pivot to different methods of imposing tariffs. So perhaps no major impact now, but we will see.

Turning to central banks, the Fed meets on Wednesday. The key question is whether enough uncertainty has lifted for the Fed to signal a clearer policy direction for September.

The Federal Reserve is likely to leave interest rates unchanged on Wednesday (4.25-4.50%) for a fifth consecutive meeting, leaving all the emphasis on Chair Powell’s press conference and any indication of a cut at the next meeting in September. Notably, Deutsche Bank economists anticipate two governors will dissent - something that hasn’t happened since 1993 - at a time when political pressure on Chair Powell is intensifying. On current evidence, strong inflation rather than weak growth remains the bigger problem. Just a few hours prior to the decision is the next ADP jobs report. A month ago, it reported 33k of private sector job losses and noted respondents were all suspending hiring plans on tariff uncertainty.

Also meeting this week are the Bank of Canada (Wednesday) and the Bank of Japan (Thursday), both expected to keep rates unchanged. For the BoJ, the markets will only be interested in anything Governor Ueda has to say about the persistent gains in long-end JGB yields, with the 10-year at its highest of 1.58% since 2008.

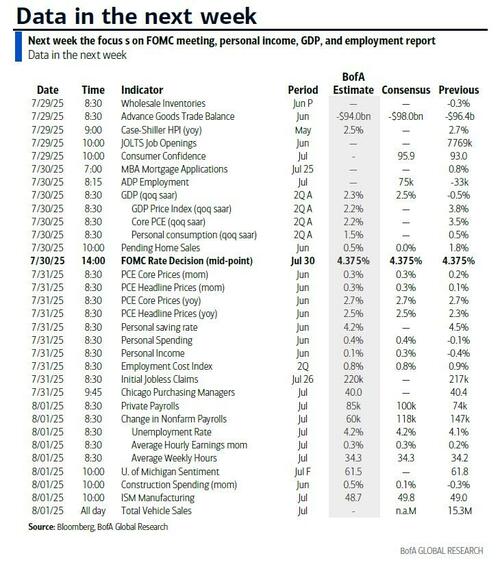

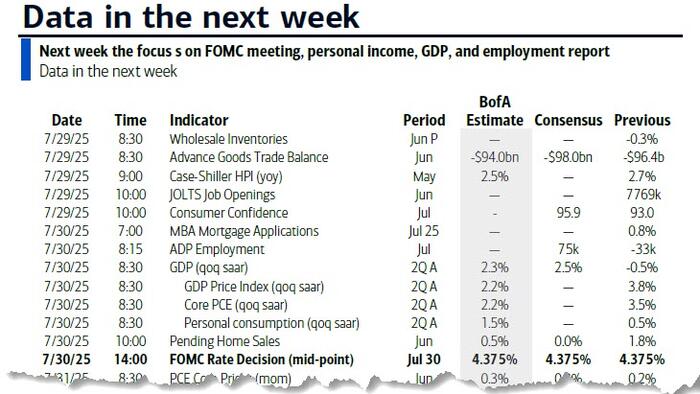

The Fed isn’t the only focus in the US this week. It’s a packed schedule for data and earnings, culminating in Friday’s payrolls report. Deutsche Bank forecasts a headline gain of just +75k (vs consensus +109k and last month’s +147k), and +100k for private payrolls (matching consensus and up from +74k last month). The difference reflects a reversal in strong state and local hiring seen in the previous month. Both DB and consensus expect the unemployment rate to tick up to 4.2%. Importantly, a growing number of economists believe that with lower immigration, even payrolls in the 50–100k range could still tighten the labor market. Also of note: whatever interpretation Powell puts on things on Wednesday could be very different by close Friday if payrolls weaken and the apparent margin squeeze on earnings has continued. Other labor indicators this week include the JOLTS report tomorrow and ADP data on Wednesday.

Also on Wednesday, Q2 US GDP is expected to show a +2.1% print, rebounding from -0.5% in Q1. Thursday brings the crucial June core PCE data, alongside personal income and consumption figures. Rounding out the US data highlights, we’ll see the Conference Board’s consumer confidence index for July tomorrow (DB forecast 96.1 vs 93.0 in June), the Q2 employment cost index, and the ISM manufacturing gauge for July on Friday (DB forecast 49.5 vs 49.0 in June).

Here is another visualization of the coming macro deluge:

In other US news, the Treasury refunding announcement is due Wednesday, following today’s borrowing estimate. Remember that a couple of summers ago this announcement shocked markets with unexpectedly large long-term debt auctions. However, since then, the Treasury has managed the process to avoid such surprises.

In Europe, July CPI and preliminary Q2 GDP figures will be released across major economies. Spain’s inflation report comes Wednesday, followed by France, Italy and Germany on Thursday, and the Eurozone on Friday. GDP prints begin with Spain on Tuesday, then Germany, France, Italy and the Eurozone on Wednesday. Labour market data will also be released throughout the week. Tomorrow, the ECB will publish its consumer expectations survey for June. Other macro data include Q2 GDP from Sweden, Australia, Germany and France.

In Asia, key releases include July PMIs in China on Thursday and Friday, and Japan’s June industrial production, retail sales and July consumer confidence on Thursday. Bloomberg’s median estimates suggest China’s manufacturing PMI will remain unchanged at 49.7, while the non-manufacturing index is expected to dip slightly to 50.3 from 50.5 in June.

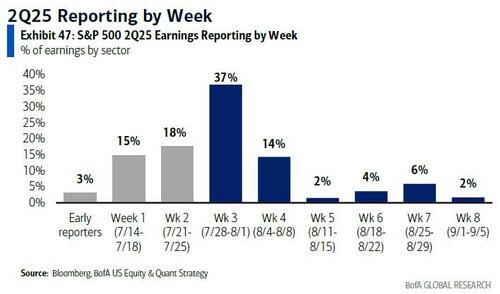

Turning to earnings, UBS' Simon Penn writes that almost half of S&P 500 companies will report their Q2 earnings over the coming week, including Microsoft, Meta, Amazon and Apple.

For most earnings, the focus will be just as much on tariff impact as topline numbers. Thus far, aggregate earnings and revenue might be beating (thanks to financials), but margins are being squeezed. In cyclicals, margins are down almost 8% y/y and within that, materials are 5.8% lower. So at the very moment that investors are rotating into the cyclical catch-up trades, those same companies are reporting declining margins and weakening earnings. The materials sector in the S&P has been up 4% in the last two weeks.

Courtesy of DB, Here is a day-by-day calendar of events:

Monday July 28

Tuesday July 29

Wednesday July 30

Thursday July 31

Friday August 1

Finally, looking at just US macro, Goldman writes that the key economic data releases this week are the Q2 advance GDP report on Wednesday, the Employment Cost Index on Thursday, and the employment report and ISM manufacturing report on Friday. The July FOMC meeting is on Wednesday. The post-meeting statement will be released at 2:00 PM ET, followed by Chair Powell’s press conference at 2:30 PM. The pause on many country-specific tariffs is set to end on Friday, August 1st.

Monday, July 28

Tuesday, July 29

Wednesday, July 30

Thursday, July 31

Friday, August 1

Source: DB, Goldman