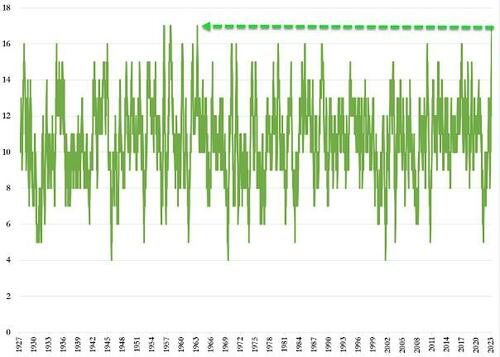

As DB's Jim Reid writes this morning, we're currently on a run that you may not see again in your lifetimes. He is referring to the fact that the S&P 500 just completed a historic run of 16 positive weeks out of the last 18 for first time since 1971. If this carries on for another week it'll be 17 out of 19 for the first time since 1964, a "a remarkable and relentless period of performance"... and not even that can help Biden get elected. Oh well.

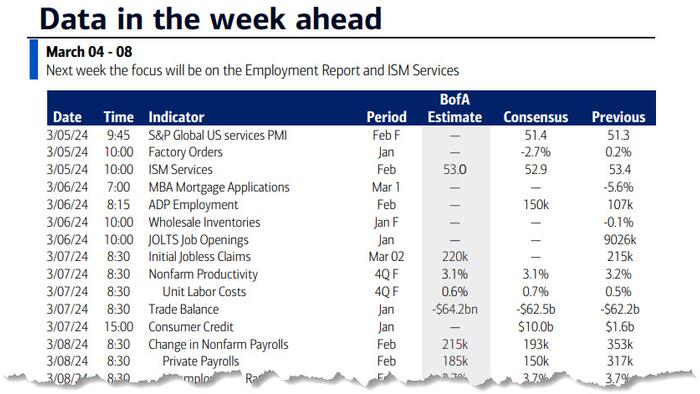

In any case, if the market run survives another week it will have navigated a number of big events ending with US payrolls on Friday. Before that we have the US services ISM, China's Caixin services PMI, the start of China's National People's Congress, alongside Super Tuesday in the US presidential race tomorrow. Wednesday sees the latest JOLTS data, the BoC meeting, the UK budget and Powell's first congressional testimony of the week. Thursday has the latest ECB meeting. Biden's state of the union address, and Powell's second testimony. Friday has a fair bit of European data alongside payrolls, including German PPI and Industrial Production.

Let's briefly review a few of these highlights now starting with payrolls.

Moving on to Asia, in Japan, there will be several appearances by BoJ speakers including Governor Ueda tomorrow. In China, the main event will be the National People's Congress starting tomorrow.

Here is a day-by-day calendar of events

Monday March 4

Tuesday March 5

Wednesday March 6

Thursday March 7

Friday March 8

Focusing only on the US, Goldman writes that the key economic data releases this week are the ISM services report on Tuesday, the JOLTS job openings report on Wednesday, and the employment situation report on Friday. There are many speaking engagements from Fed officials this week, including Chair Powell’s testimony before Congress on Wednesday and Thursday.

Monday, March 4

Tuesday, March 5

Wednesday, March 6

Thursday, March 7

Friday, March 8

Source DB, Goldman, BofA