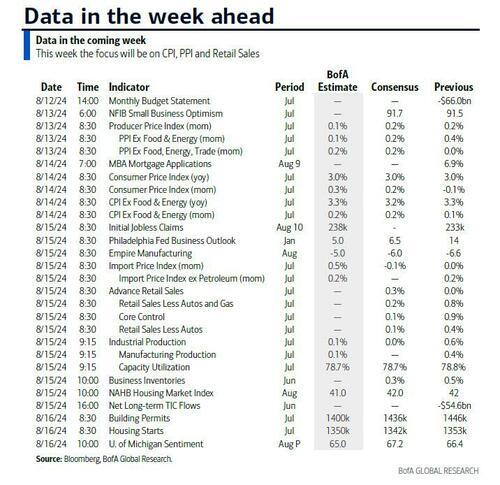

It is a macro-heavy week, and the market's key focus will be on US inflation data, with the July CPI print on Wednesday preceded by the PPI data on Tuesday, followed by Retail Sales on Thursday.

The median economist forecast is for both headline and core CPI to rise +0.20% on the month, which would leave annual headline CPI steady at 3.0%, with core ticking down a tenth to 3.2%. On a monthly basis, this would be an acceleration from the +0.1% core CPI print in June, but with both the three- and six-month annualized rates falling by 40bps to 1.7% and 2.9%, respectively.

In terms of the CPI details, there will be focus on whether the June slowing in rental inflation is sustained. For the PPI on Tuesday, economists see headline PPI gains staying at +0.2% MoM, though PPI components that feed into the Fed’s preferred core PCE measure may leave it running ahead of core CPI for the second month in a row.

The upcoming inflation data will be key for whether the Fed gains confidence to signal more clearly a cut at the September meeting. Over the weekend we heard from Fed Governor Bowman, who commented that “she “will remain cautious in my approach to considering adjustments to the current stance of policy” as "inflation is still uncomfortably above the committee’s 2% goal". So one of the most hawkish FOMC voices sounding not yet convinced on the immediacy of rate cuts.

Speaking of Fed talking heads, several regional Fed presidents are due to speak this week, including Bostic on Tuesday, Musalem and Harker on Thursday and Goolsbee on Friday, so we’ll see if there are any changes in tone in response to the inflation data. We may have to wait until next week’s Jackson Hole symposium for an in depth take on how the Fed is thinking about the expected easing cycle.

Other notable US releases this week will include July retail sales and industrial production on Thursday, which economists expect to grow by +0.4% and shrink -0.3% on the month respectively. These will present some of the first pieces of hard activity data for Q3. We will also have the University of Michigan consumer survey on Friday.

Finally, with earnings season winding down, we will get some more evidence on the health of the US consumer with earnings reports from Home Depot (Tuesday) and Walmart (Thursday) as the earnings season winds down.

A bit of a detour here courtesy of DB's Peter Sidorov who writes that as we start the week, Fed funds futures are pricing 101bps of cuts by year-end, so favoring at least one 50bps cut across the remaining three FOMC meetings. This is down from 138bps at the peak of the market stress last Monday but still well above the 87bps seen prior to the July payrolls print and it is hard to see how such easing would transpire without a material slowing of the economy. While fears of a US recession ticked up in recent weeks amid softer labor market data, activity surveys have largely held up and the Atlanta Fed’s GDPNow currently signals solid 2.9% growth for Q3. Compared to Europe, the US continues to benefit from stronger productivity growth, higher wealth effects and deeper capital markets.

Courtesy of Rabobank and DB, here is a day by day snapshot of what to expect.

Monday: A light day for data. RBA Deputy Governor Andrew Hauser is speaking, China money supply figures will be released, and we will also see building permits for Canada and the New York Fed’s 1-year inflation expectations index.

Tuesday: Japan PPI and New Zealand net migration are first up, followed by Australia’s wage price index (an important one for RBA watchers) and both business and consumer confidence figures. At the start of the European session we have UK labour market data, followed by the ZEW survey in Germany and then it’s over to the USA for PPI and comments from the Fed’s Raphael Bostic.

Wednesday: The RBNZ policy rate decision is main point of interest early in the day. We think the bank will err on the side of unchanged, but it really is a knife’s edge decision, and the futures see strong odds of a cut. Following that its over to the UK for July CPI (-0.1% m-o-m expected) and then we will get the second read of Q2 GDP for the Eurozone. The key release of the day (and the week) is the US CPI report, where prices are expected to have risen by 0.2% m-o-m on both headline and core readings.

Thursday: RBNZ Governor Orr will appear before the Kiwi parliament, and we will also see July card spending and food price data for New Zealand in the early morning. Following that is Japan Q2 GDP, the PBOC’s 1-year MLF decision, Aussie labour market figures for July (+20k employment and an unchanged unemployment rate of 4% being the consensus) and July industrial production and retail sales data for China. Later in the day we get UK Q2 GDP, the results of the Empire manufacturing survey and the US retail sales report, where growth of 0.1% m-o-m is expected for the control group. We will also see the US weekly jobless claims data, which might be important this time around. The Fed’s Patrick Harker and Alberto Musalem will be speaking.

Friday: New Zealand’s manufacturing PMI and Q2 PPI is out. We will also see more remarks from RBNZ Governor Orr and then it’s over to the UK for July retail sales (+0.6% m-o-m incl fuel expected). Following that we have Canadian housing starts and manufacturing sales for June, and then US housing starts for July, the New York Fed’s Service Business Activity Survey and the University of Michigan’s Consumer Sentiment report where a modest improvement is expected. The Fed’s Austan Goolsbee will also be speaking in a ‘fireside chat’.

Finally, focusing on just the US, Goldman notes that the key economic data releases this week are the CPI report on Wednesday and the retail sales report on Thursday. There are several speaking engagements from Fed officials this week.

Monday, August 12

Tuesday, August 13

Wednesday, August 14

Thursday, August 15

Friday, August 16