After a turbulent week for stocks and especailly for bonds, where 10yr yields closed the week above pre-SVB levels for the first time since that major accident and 2yr yields traded briefly above 5% for the first time too, the direction of travel in markets over the next several weeks will be set by US CPI on Wednesday and as DB's Jim Reid writes this morning, "will take something remarkable elsewhere for it not be the most important event this week."

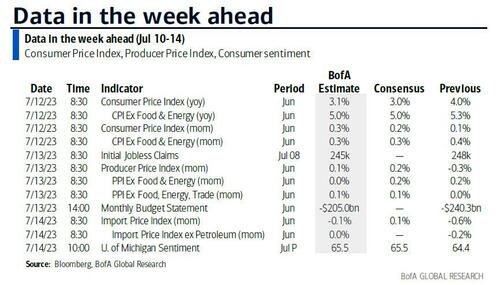

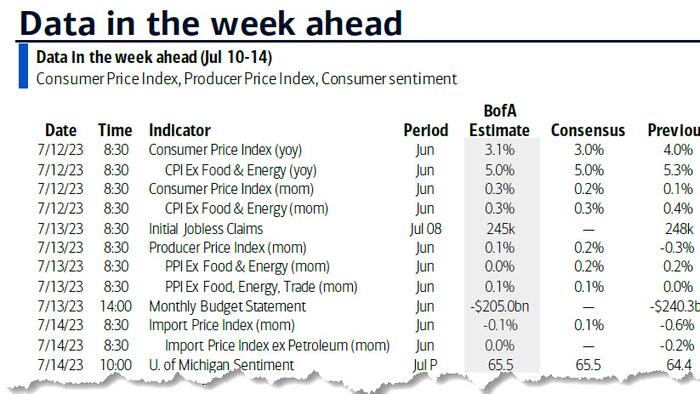

Additionally, there is also plenty of Fed speak before and after the release (at least 9 Fed speakers on deck) so their response to it and to payrolls last Friday will be very closely watched too. The other highlights in the US include the Beige Book (Wednesday), PPI, jobless claims (both Thursday), and the University of Michigan survey (Friday) which includes the important inflation expectations series. In addition, Friday sees JPMorgan, Citigroup and BlackRock report as Q2 earnings season slowly starts this week.

Over in Europe, notable economic indicators include the Euro and German ZEW survey (tomorrow), UK's labour stats (tomorrow), and the UK monthly GDP report (Thursday). The ECB account of their June meeting (Thursday) will be another interesting release given the increased pricing of a September hike in markets of late.

Staying with central banks, the Bank of Canada decision on Wednesday will also be of note. Markets are expecting a 25bps hike now after strong Canadian payrolls on Friday.

Going through a few points in more detail now.

For US CPI, DB economists (full preview available in full here to pro subs) expect a +0.20% mom gain for headline CPI (vs. +0.12% previously, consensus +0.3%) and a +0.28% increase for core (vs. +0.44%, consensus +0.3%) which would have the YoY rate for the former dropping by a full percentage point to 3.1%, while that for the latter would drop by 30bps to 5.0%, both in line with consensus. This would leave the three- (4.6% vs. 5.0%) and six-month annualized (4.8% vs. 5.1%) core rates still well above the Fed’s target.

Another piece of the inflation puzzle will come from the University of Michigan's consumer sentiment survey on Friday. The focus will likely be on whether the drop in 12-month inflation expectations will prove sustainable, after the latest reading of 3.3% was the lowest since March 2021 (consensus 3.1% this month) and now converging back to the long-term series which is at 3% at the moment.

In the UK, the labor market stats tomorrow (including the crucial wages number) will be important given recent big Gilt moves.

There will be a few events to watch in geopolitics as well this week, starting with US President Biden's current trip to Europe from yesterday to Thursday. It will also include NATO's annual summit in Vilnius held tomorrow and Wednesday, where Ukraine's potential membership path will be a key point to watch. The G20 finance ministers and central bankers meeting will take place in Gandhinagar on July 14-18.

Finally, as noted above, earnings season begins this Friday when we get JPMorgan, Citigroup and BlackRock report Q2 earnings.

Here is a day-by-day calendar of events courtesy of DB

Monday July 10

Tuesday July 11

Wednesday July 12

Thursday July 13

Friday July 14

Finally, focusing on just the US, Goldman writes that the key economic data releases this week are the CPI report on Wednesday and the University of Michigan preliminary report on Friday. There are several speaking engagements from Fed officials, including governors Barr and Waller, and presidents Daly, Mester, Bostic, Barkin, and Kashkari.

Monday, July 10

Tuesday, July 11

Wednesday, July 12

Thursday, July 13

Friday, July 14

Source: DB, Goldman, BofA