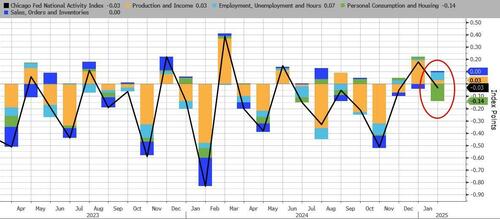

Admittedly second-tier data, but this morning has seen two disappointing signals for US growth as The Chicago Fed's National Activity Index dropped to 0.03 (thanks to a plunge in Personal Consumption & Housing...

Source: Bloomberg

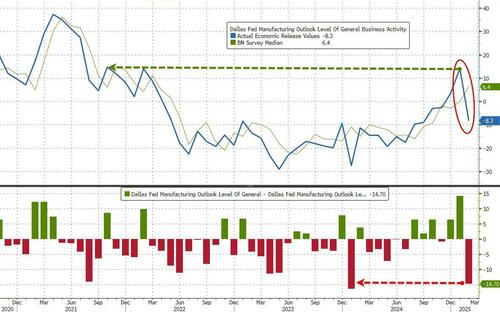

...and The Dallas Fed Manufacturing survey clumped into contraction (from its highest level since Oct 2021), dramatically worse than expected, as tariff fears loom large for many. The general business activity index tumbled 22 points to -8.3 (biggest miss since Jan 2024 and biggest MoM drop since COVID lockdowns), and the company outlook index fell 24 points to -5.2.

Source: Bloomberg

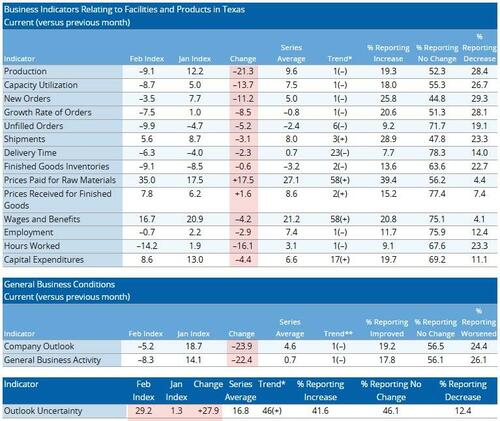

Texas factory activity fell in February after rising notably in January, according to business executives responding to the Texas Manufacturing Outlook Survey.

The production index, a key measure of state manufacturing conditions, fell 21 points to -9.1. Other measures of manufacturing activity also declined this month.

The new orders index fell 11 points to -3.5, and the capacity utilization index slid 14 points to -8.7.

The shipments index remained positive but edged down to 5.6. Perceptions of broader business conditions worsened in February.

In fact across the entire spectrum, every indicator is a disastrous stagflationary signal:

Input cost pressures intensified in February, while wage pressures retreated slightly. The raw materials prices index pushed up 18 points to 35.0, a multiyear high.

The outlook uncertainty index shot up to 29.2 from a near-zero reading last month, reaching a seven-month high.

Fear-mongering over the impact of Trump's tariff plans appear to be the main driver of the sudden slump in sentiment:

And then there's those who live off the government teat:

President Trump’s freeze on government contracts has had a dramatic impact on us. USAID [United States Agency for International Development] is our major customer.

But, it's not all doom and gloom:

And then there is this comment, that sums up many businesses' hopes: