And we're off: Q4 earnings season officially launched moments ago when the largest US commercial bank, JPMorgan, reported Q4 earnings which beat on the top and bottom line, and provided strong guidance.

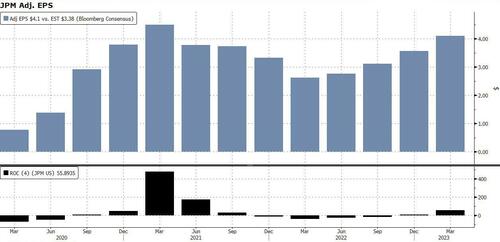

Here are the details for Q1:

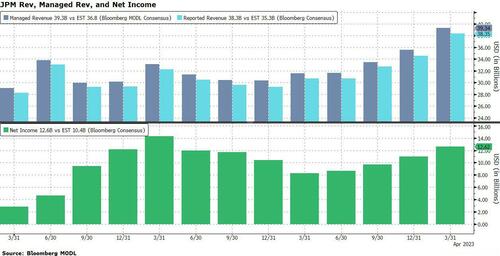

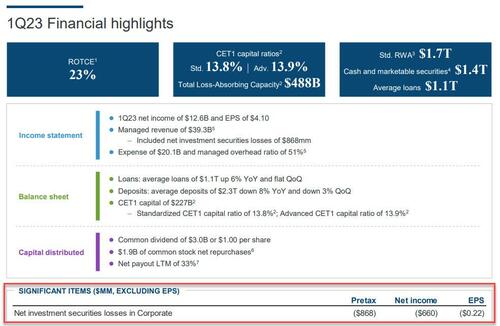

Managed revenue of $39.34BN, beating estimates of $36.83BN, and 25% or $7.7BN higher than a year ago.

Taking a closer look at the breakdown in revenue, managed net interest income was $20.83 billion, beating the estimate of $19.12 billion and up $6.9BN from a year earlier, while non-interest income was $18.5BN, rising a more modest $0.9BN Y/Y. On the expense side, Q1 non-interest expenses came at $20.11 billion, below the estimate $20.51 billion, while compensation expenses of $11.68 billion were just above the estimate $11.44 billion.

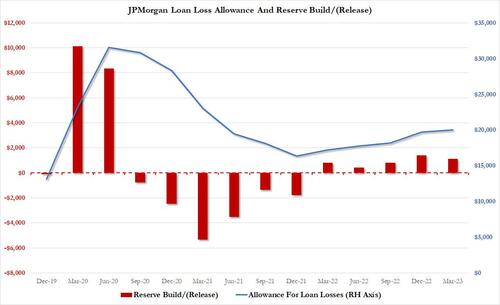

Also, for Q1, JPM's credit loss provisions were $2.28BN, up 56% Y/Y, but slightly below the $2.31BN expected; the number consisted of a $1.1BN reserve build (down sequentially from $1.4BN), and $1.14BN in net charge offs, also just below the $1.15BN expected.

The bank also reported that net yield on interest-earning assets rose to 2.63%, handily beating the estimate of 2.39%.

Visually, this is how the summary data looked:

And while few will focus on this, JPM announced a curious $868MM securities loss in Corporate. It wasn't immediately clear what was behind this loss.

And another question: the reserve build also includes wholesale which resulted from “a build for single name exposures in corporate,” Hopefully JPM will disclose which names? Also worth noting that the $1.1 billion in net charge-offs were up $555 million, “largely driven by card services.”

Moving on: since everyone is focused on bank loan and deposit shifts, here is the punchline: JPM's deposits dropped 8% Y/Y but rose 1.6% from the $2.34BN in the previous quarter to $2.38BN, above the estimate of $2.33BN; on the other side, average loans were $1.13BN, up 6.6% Y/Y and flat Q/Q.

Commenting on the quarter, JPM said that results are “strong,” that $38.3 billion revenue was a “record,” the bank “continued to generate considerable amounts of capital,” the bank’s CET1 ratio increased above a target that “we had already exceeded.”

As BBG notes, Dimon’s tone could even be read as sort of chest-thumping. He doesn’t only say that the bank’s “years of investment and innovation, vigilant risk and controls framework, and fortress balance sheet allowed us to produce these returns,” but that JPMorgan was “a pillar of strength in the banking system” during “a period of heightened volatility and uncertainty.” It’s very Dimon.

Dimon also said consumer spending “remained healthy,” and emphasizes that the markets revenue inside the corporate and investment bank fell “versus a very strong prior year.” Even in investment banking, where “fees remained challenged for the industry,” he says the bank “significantly outperformed.” He cites commercial banking’s “record revenue,” touting “exceptionally strong payments revenue,” and the “strong long-term inflows” inside asset and wealth management.”

Looking ahead, Dimon says the bank continues to look “for potentially higher inflation for longer,” which would mean “higher interest rates.” What else does the bank worry about? Well, there’s “the inflationary impact of continued fiscal stimulus,” the old theme of “quantitative tightening,” and “geopolitical tensions including relations with China and the unpredictable war in Ukraine.” Dimon also uses yet another weather metaphor, saying he hopes “these clouds will dissipate,” but that the firm will be “prepared for a broad range of outcomes.”

Taking a CEO more cautious tone, the CEO said that "the banking industry turmoil adds to these risks. The banking situation is distinct from 2008 as it has involved far fewer financial players and fewer issues that need to be resolved, but financial conditions will likely tighten as lenders become more conservative, and we do not know if this will slow consumer spending."

Actually we know, and retail sales data in a few minutes will confirm what we know. Here are his full remarks.

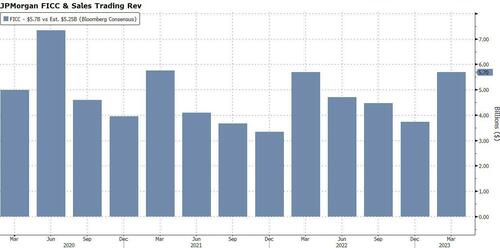

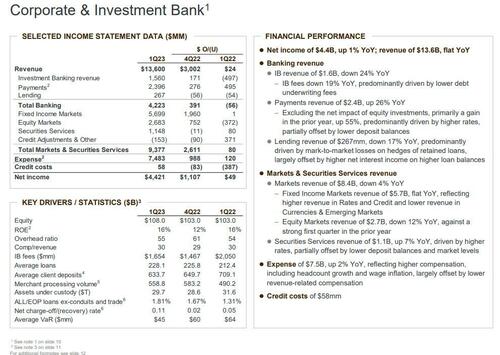

Turning to the bank's Corporate and Investment Bank, we find that the spike in market volatility in certainly helped the bank's fixed-income traders, with the unit comfortably beating estimates of $5.25 billion to post $5.7 billion in revenue. At the same time, equities revenue came in a little light at $2.68 billion relative to a $2.75 billion estimate. This is how the bank described the numbers:

Elsewhere in the group, investment-banking fees were roughly in line with estimates at $1.6 billion. Here’s the breakdown:

Some more color:

JPM also reported:

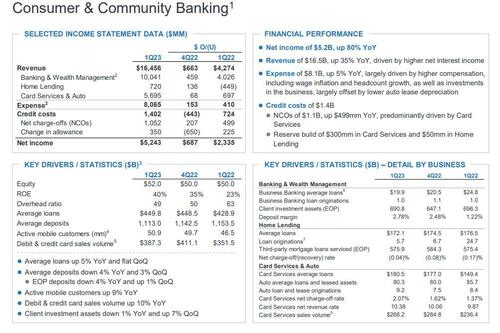

Turning to the consumer and community banking unit, net income was $5.2 billion up 80%, a remarkable stat considering that $16.5 billion of net revenue was up only 35%. How did that happen? As BBG explains, banking and wealth management’s $10 billion of net revenue was up 67%, “driven by higher deposit margins,” which helped make up for home lending net revenue down 38% to $720 million, “largely driven by lower net interest income from tighter loan spreads and lower production revenue” on account of volume.

Card services and auto’s $5.7 billion of net revenue was up 14%, “largely driven by higher net interest income” thanks to “higher revolving balances.” But that was “partially offset by lower auto operating lease income,” which I’d love to know more about.

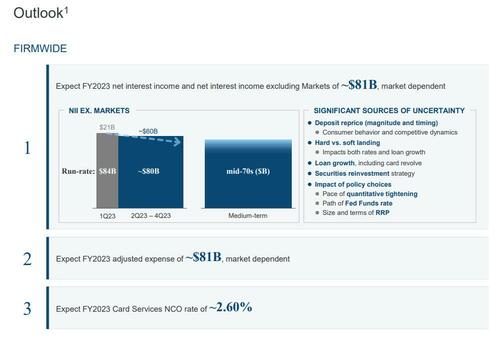

But perhaps the most notable highlight of the quarter was the outlook slide where JPM said it now expects net interest income for full-year 2023 of about $81 billion, roughly 10% increase over their previous 2023 NII forecast. So roughly the same run rate for the rest of the year (a touch lower than Q1 NII of about $21 billion).

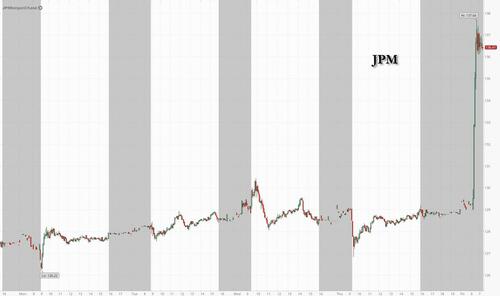

As a result of the strong earnings and solid outlook, JPM stock is soaring, lifting peer banks (Bank of America is up 2.4%; Morgan Stanley gains 1.1%l Goldman Sachs Group is higher by 1.2%) and helping offset some of the broader market weakness following Boeing's latest 737MAX fiasco.

Here is the full earnings presentation (pdf link).