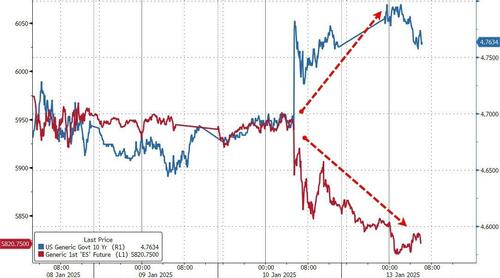

The initial reaction to Friday’s BLS jobs report was a yield surge and a sharp stock decline.

Stock investors are finally noticing higher yields.

While sentiment can certainly cause stocks and bonds to deviate from fundamentals, at the end of the day, they both have fundamental roots in economic activity. Over the past couple of Commentaries, we have shared data showing that the recent increase in bond yields is due to poor sentiment. Before this past week, the stock market didn’t seem concerned about higher interest rates resulting from the negative bond sentiment, aka higher term premiums.

The stock market’s negative reaction to the jobs data and higher yields is not necessarily a reaction to how the Fed might react.

Sure, if the Fed were to raise rates, that, on the margin, might portend stock weakness.

Instead, however, we think the adverse reaction directly relates to the expected economic impact of higher rates.

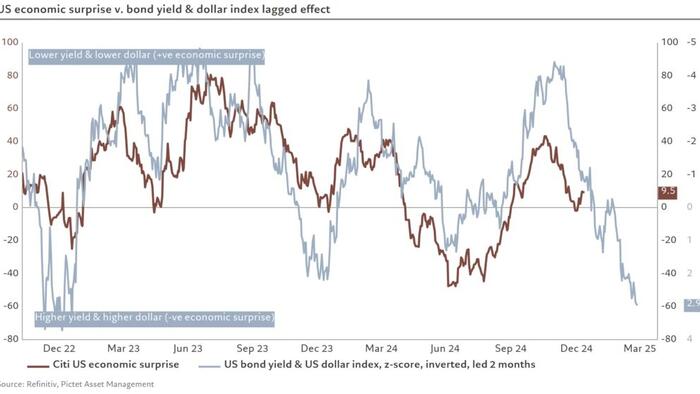

The graph below, courtesy of Pictet Asset Management, shows the lagged correlation between the Citi Economic Surprise index and yields and the dollar.

It portends that economic data will likely fall below forecasts for the next few months.

In other words, it takes a few months for higher rates and a stronger dollar to impact economic data negatively. And stocks seem to acknowledge that.