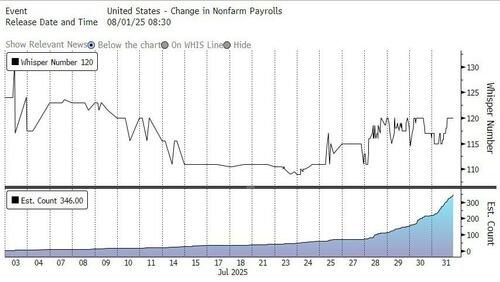

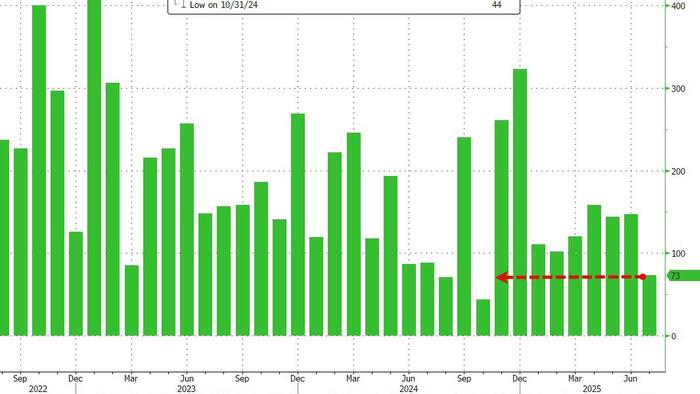

Heading into today's jobs report, sentiment had seen a surprising boost in recent days, with the whisper number rising from just about 110K back to 125K, or where it started the month of July.

Well, the optimism proved to be very, very wrong, because moments ago the BLS reported job numbers that were very ugly with July printing just 73K, far below the 104K estimate.

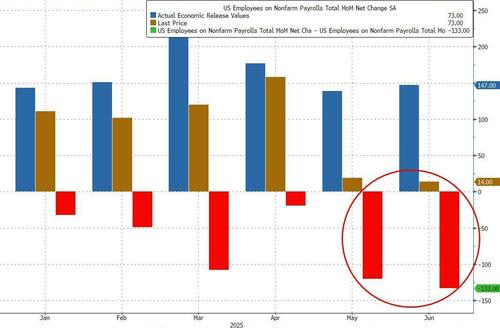

But that's not the real punchline: what is, is that Trump not only took a page out of the Biden playbook, but ripped pretty much all of it out with May and June revised massively lower, to wit:

With these revisions, employment in May and June combined is 258,000 lower than previously reported, which puts to shame any/all of the far smaller revisions that defined much of the Biden regime.

Blackrock PM Jeff Rosenberg told Bloomberg TV that the big news today is the revisions, and the main takeaway is that it raises the odds of a rate cut in September.

The number of jobs came in below the 80-100k breakeven level estimated by Fedʼs Barkin, suggesting Trump may have literally instructed the BLS to print a number that basically forces Powell's hand to cut.

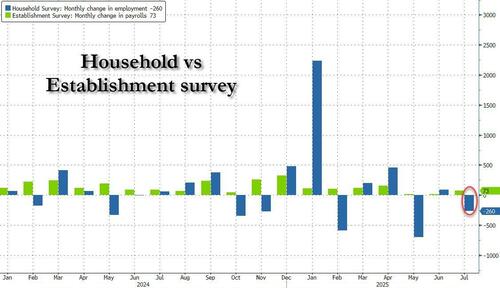

The number was even uglier in the Household survey, which showed a drop of 260K workers in July, the 3rd biggest monthly drop of 2025.

And with that the gaping disconnect between the two series is back with a vengeance.

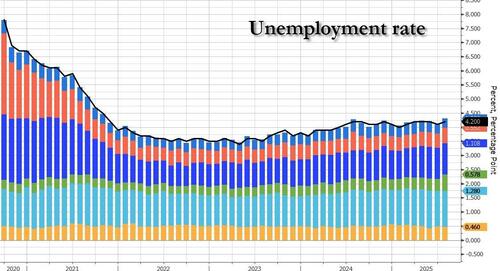

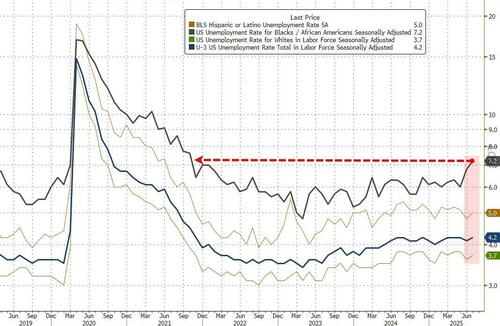

Going down the report, the unemployment rate rose from 4.1% to 4.2%, as expected, which may be the only silver lining in today's report as the Fed is now more focused on the unemp rate (according to Powell) than the number of jobs actually added.

Of note here is that the unemployment rate for Black workers was highest since October 2021.

The labor force participation rate, at 62.2%, dropped slightly in July from 62.3%, and has declined by 0.5% point over the year. It was the lowest since November 2022. The employment-population ratio, at 59.6%, also changed little over the month but was down by 0.4% over the year.

Turning to wages, we find that hourly earnings actually rose from an upward revised 3.8% (was 3.7%) to 3.9%, above the 3.8% expected.

Average hourly earnings for all employees on private nonfarm payrolls rose by 12 cents, or 0.3 percent, to $36.44 in July. Over the past 12 months, average hourly earnings have increased by 3.9 percent. In July, average hourly earnings of private-sector production and nonsupervisory employees rose by 8 cents, or 0.3 percent, to $31.34.

The average workweek for all employees on private nonfarm payrolls edged up by 0.1 hour to 34.3 hours in July. In manufacturing, the average workweek held at 40.1 hours, and overtime edged down to 2.8 hours. The average workweek for production and nonsupervisory employees on private nonfarm payrolls edged up by 0.1 hour to 33.7 hours in July.

Some more details from the report:

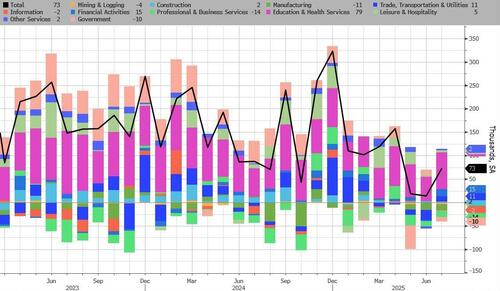

Turning to the composition of the report, the BLS reports that employment continued to trend up in health care and in social assistance. Federal government continued to lose jobs.

The numbers were so ugly, they effectively put a 25bps rate cut in Sept front and center... maybe even 50bps. Sure enough, bond yields from the two-year through seven-years are lower by at least 10 basis points as the market sniffs out a Fed being late to cut.

“We would look for the Fed to begin lowering rates in September,” says Gregory Faranello, head of US rates trading and strategy for AmeriVet Securities. “It’s somewhat amazing how you can have a sitting Fed Chair intimate the strength in labor one day and receive these numbers a few days later.”

Commenting on the numbers, Bloomberg's chief Economist Anna Wong wrote:

“July’s nonfarm payrolls were surprisingly weak, but the biggest shock was the massive revision to past data, which reduced gains for the past two months from solid to nearly zero. Adjusted for potential overstatement from the BLS’ ‘birth-death’ model, underlying job gains in July were also about flat.

“The unemployment rate, which Fed Chair Powell said earlier this week is the ‘main number’ to watch, also edged up, even as the labor force shrank for a third straight month. The main takeaway from the jobs report is that labor demand appears to be falling faster than labor supply – the labor market is not ‘solid,’ as Powell characterized it earlier this year, and we expect him to revise his opinion accordingly. We see growing chances of an earlier rate cut than our December base case.”

And here is B. Riley Wealth chief market strategist, Art Hogan,

“Today’s jobs report is unambiguously soft and a reflection of the trade and tariff impact on economic growth. Both the actual report and the big negative revisions are more evidence that the trade policy will slow growth. What we know about our workforce population growth is that we need to create between 100 and 150,000 jobs a month to keep the unemployment rate unchanged. That is down from a range of 150 to 200,000 last year due to less immigration. The three-month average coming to today’s report was 150,000. The new three-month average of job creation is now 80,000. Not great news.”

All good points, but what really happened is that Trump finally figured out what we said last December, namely that if he wants the Fed to cut quick, he needs a labor market emergency.

Well, he finally got it.