By Peter Tchir of Academy Securities

If the morning headlines are any indication, it is going to take a lot of coffee to make it through a long day at the end of a long week. Since I average about 1 T-Report for every 2 to 3 cups of coffee, it could be a long day for you, the readers!

The FT reported that UBS offered to buy CS for 0.25 Swiss Francs per share. There was also a line in the report stating that a Material Adverse Change Clause (MAC) was linked to UBS CDS spreads widening by 100 bps. I for one, haven’t seen a MAC clause linked to CDS spreads.

There are also headlines that CS is “said to push back” against UBS’s offer.

Bear Stearns and JPM Morgan

When that deal hit the tape it was a fait accompli. There was little to no doubt a deal was getting done. The price of $2 dollars may have seemed low (and it got changed over time), but there was clarity that a deal was done (I keep harping back to the language that JPM was guaranteeing/taking over the Bear Stearns swap books, regardless of whether the deal closed or not). That is in stark comparison to headlines crossing the tape right now where, there is significant uncertainty.

It is only one line in the FT’s report, that said the deal include at MAC clause linked to UBS CDS going 100 bps wider.

What we don’t know about the clause:

A weird “game theory” dynamic

For now we can talk generically about 100 bps wider, without knowing the details, as it helps (though I’m assuming in my own thought process 100 bps wider from something lower than Friday’s close, that lasts about a week, before falling off).

More From the Government?

No. Not by a long shot. I’m sure there will be another T-Report later today as headlines are coming fast and furious (the WSJ just reported that CS AT1’s will face a haircut). From a pure “absolute priority of payment”, many may have assumed that is equity gets money, the AT1 should not be impaired, and anyone working on that assumption might have to rethink other positions in other institutions.

One question, that I think people had hoped would be put to rest this weekend, is “if CS is solved, can European markets move on?”

For those of you who lived through the GFC and European Debt Crisis, the memories of “epic turning points” that sometimes lasted less than 24 hours is still scarred on our psyche. What is going on so far, does not inspire the greatest confidence, at least not for me, that we can rally and not look back, but the day is young!

As we sent in a Bloomberg IP on Friday, a “plane tracker” reported on twitter that a lot of private jets were showing up in Omaha. There are stories that Buffett is talking to Biden. He was very involved in the GFC, taking direct positions and indirectly supporting companies with his “seal of approval”. Will that be the case this time? Will it work?

I saw a headline that some banks were pushing for a “temporary” (in this case 2-year) extension of FDIC insurance to all deposits of any size. As written yesterday, in Gasp, Gup, Glug, I think we need much broader deposit insurance to stabilize the situation.

That will give us the breathing room to get capital infusions where necessary.

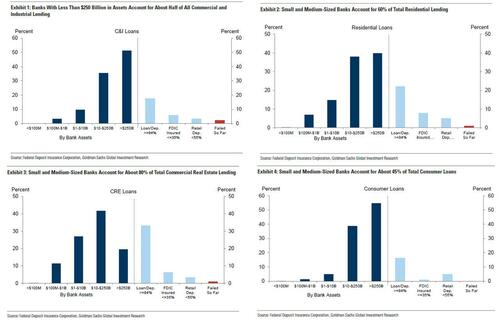

Smaller banks, well below Wall Street’s radar, are bearing the brunt of this and that can become problematic for the economy. As as reminder "small, Medium Banks Account For 50% Of C&I Lending, 45% Of Consumer Lending And 80% Of All Commercial Real Estate Lending."

The day is young, the coffee is flowing, and there is a lot more time to see some truly positive and supportive news before U.S. futures open at 6 pm EST. or the cash markets open here at 9:30 am EST.

So I am optimistic we see more done and am looking forward to being on Bloomberg TV tonight at 6:30 pm as they ramp up special coverage of the global banking industry!