By Michael Every of Rabobank

Miss the Basis And The Points

I concluded yesterday that it looked to be a quiet day, but we don’t live in quiet times. Indeed, here are just some of the key developments over the past 24 hours:

If you too are only focusing on the basis-points trees so cannot see the underlying basis for these headlines and the key points being made, consider two recent tweets from national security/IT expert @matthew_pines, which condense many of the arguments made here repeatedly.

“The “world system” is so tightly coupled that it’s not clear any particular “bloc” is well poised for its violent disintegration. That said, the dominance of capital (G7) is advantaged in peacetime, while raw commodities (OPEC+) & material production (China) are key in wartime.” In other words, there is huge pain ahead if things continue to trend as they are, for both sides, but Western capital markets don’t matter much if you don’t produce things when bullets start flying. The Pentagon agrees: and would Fed zero rates and QE help if BRICS+++ say “We don’t Truss the West now”?

“US geopolitical dominance used to be a function of deterrence. Now, it’s a matter of compellance. USD’s GRC [Global Reserve Currency] status was useful to the former but has eroded the hard power necessary to credibly wield the latter. The strategic game has changed & USD now hurts more than it helps.”

Pines is saying the US would arguably be better off with mercantilism from a grand strategy perspective rather than allowing geopolitical rivals to use free trade, free capital flows, and the liberal world order to weaken it, deliberately or inadvertently, to the point where its military hegemony is hollowed out – as today. We argued that in ‘Thin Ice’ (2016), ‘The Great Game of Global Trade’ (2017), ‘On Your Marx’ (2017), and ‘The World in 2030’ (2020), among other reports.

Economics professor Michael Pettis agrees, adding:

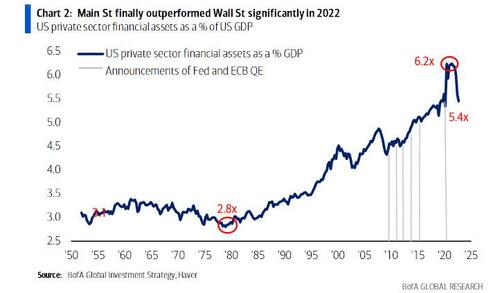

“Financial markets have grown so large relative to the underlying economies that regulators have no choice but to intervene to protect failing banks, even though this only reinforces further growth in the financial system. Perhaps the solution is not to keep saving the banks, nor even to let them fail, but to take longer-term measures to cut down the size and important of the financial system in the US and global economies. Banks should be cut down, different sectors of the financial system segregated, financial transactions taxed, and capital controls implemented that limit massive hot money flows. Critics will say that these measures will reduce the efficiency of the financial system, and they are right, but increased efficiency in the financial system has long ago stopped meaning increased efficiency in allocating capital productively, and has meant instead increased efficiency in financial flows.”

Of course, one doesn’t need to worry about an imminent collapse in Wall Street, but geopolitical winds are not blowing in their direction. Neither does one need to fear an imminent collapse in the US dollar as GRC, even if stronger headwinds are coming its way according to the headlines.

However, the geopolitical fat tail risks of a tipping point moving us towards a deeper bifurcation, led by either Chinese or US actions, are a real basis for points of concern, if you pay attention.

If you really want to worry, The South China Morning Post reports: ‘Chinese team behind extreme animal gene experiment says it may lead to super soldiers who survive nuclear fallout’. They add: “Modified human embryonic stem cells showed supernatural resistance against radiation, according to paper by Academy of Military Sciences team in Beijing - Shanghai-based scientist says study may open a can of worms, particularly when funding is involved.”

You think that story just appeared out of nowhere in the Chinese press, or that this is a Watergate moment?

Or pay attention to Elon Musk and 1,000 tech experts making a public call for a temporary pause of at least six months on training AI systems exceeding GPT-4, which is already terrifying some in terms of how far it exceeds what Chat-GPT could do just months ago. They argue:

“AI systems with human-competitive intelligence can pose profound risks to society and humanity, as shown by extensive research and acknowledged by top AI labs. As stated in the widely endorsed Asilomar AI Principles, Advanced AI could represent a profound change in the history of life on Earth, and should be planned for and managed with commensurate care and resources. Unfortunately, this level of planning and management is not happening, even though recent months have seen AI labs locked in an out-of-control race to develop and deploy ever more powerful digital minds that no one --not even their creators-- can understand, predict, or reliably control.

Contemporary AI systems are now becoming human-competitive at general tasks, and we must ask ourselves: Should we let machines flood our information channels with propaganda and untruth? Should we automate away all the jobs, including the fulfilling ones? Should we develop nonhuman minds that might eventually outnumber, outsmart, obsolete and replace us? Should we risk loss of control of our civilization? Such decisions must not be delegated to unelected tech leaders. Powerful AI systems should be developed only once we are confident that their effects will be positive, and their risks will be manageable.”

It suddenly seems very small beer that Canada is sending billions in checks to households to help with grocery price inflation, as if we learned nothing from 2020 and 2021.

Or that asset x went up or down y or z bps yesterday.