After ISM Manufacturing's tumble spooked markets yesterday (along with the JOLTS data), all eyes were hopefully looking towards the Services surveys for some soft-landing narrative reinforcement.

As macro surprise data has risen all year (until this week)...

Source: Bloomberg

So while PMI rose MoM, it fell intra-month, and ISM was ugly - not good.

As the following chart shows, ISM saw declines in both Services and Manufacturing while S&P Global PMI saw both improve...

Source: Bloomberg

Under the hood, on the Services price front, input costs rose at the second-slowest pace since October 2020. Nevertheless, efforts to pass through higher costs to clients resulted in a steep and accelerated increase in selling prices.

However, ISM data shows Services Prices at their lowest since July 2020 and new orders tumbled (as export orders collapsed)...

Source: Bloomberg

ISM Chair Anthony Nieves noted,

“There has been a pullback in the rate of growth for the services sector, attributed mainly to

(1) a cooling off in the new orders growth rate,

(2) an employment environment that varies by industry and

(3) continued improvements in capacity and logistics, a positive impact on supplier performance.

The majority of respondents report a positive outlook on business conditions.”

...but there were plenty of negative comments from respondents too...

There remains a notable divergence between Manufacturing and Services employment data from ISM, but March shows the latter catching down...

Source: Bloomberg

Siân Jones, Senior Economist at S&P Global Market Intelligence, said:

"Business activity across the service sector expanded at a faster pace in March, as a return to new order growth offered a tonic to the US economy, which saw the fastest rise in private sector output since last June.

"Greater service sector demand and increased pressure on capacity spurred another round of job creation, with the rate of employment growth quickening slightly to a six-month high.

"Concerns regarding the impact of inflation and higher interest rates on customer spending remained apparent, however. Optimism at goods producers and service providers dipped since February amid elevated cost pressures. Nonetheless, selling price inflation accelerated again due to more accommodative demand conditions. A sharper rise in charges contrasted with the trend for input prices, which increased at the second slowest pace since October 2020."

Simply put, improvements in customer spending across the service economy counteracted another fall in manufacturing sales.

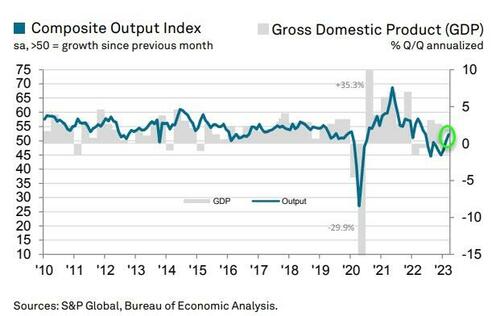

The S&P Global US Composite PMI Output Index posted 52.3 in March, up from 50.1 in February (but lower than the 53.3 flash print), to signal a moderate rise in business activity.

The uptick was led by service providers, as manufacturers recorded only a fractional increase in output.

A further marked rise in input costs was reflected in a faster increase in output charges.