By Benjamin Picton, Rabobank senior strategist

US bond yields dumped on Friday as the August US payrolls report confirmed a weakening labor market. Yields on US 10s finished the session 8.5bps lower at 4.08%, and 10-year sovereign yields in Australia and New Zealand are taking the lead this morning, currently down 5 and 4.5bps respectively.

OIS futures are now pricing a Fed rate cut in September as a virtual fait accompli, with at least one subsequent cut (almost two) priced in for the remainder of 2025 (and 10% odds of a 50bps rate cut). Nevertheless, US stocks closed Friday lower with the duration exposed NASDAQ performing best and the ‘earnings-today’ Dow Jones faring worst to end the session 0.48% lower.

Gold prices are rising again in early trade this morning after pumping more than 4% last week to reset all-time-highs. The prospect of lower real rates is doubtless a driver, as the US front-end comes under pressure following the soft payrolls report and the market looks ahead to CPI figures later this week that could confirm the stagflation scenario that Jerome Powell said he couldn’t see as recently as last year.

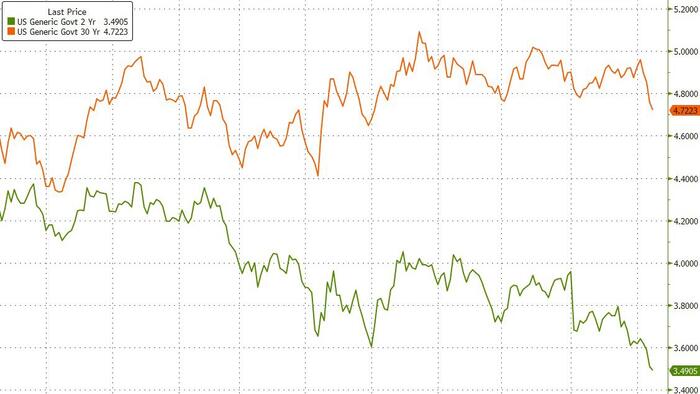

5y5y inflation swaps in the US have been rising since Liberation Day back in April, while 2-year treasury yields have been falling since the middle of May. Politicization of the Fed is undoubtedly a factor in the unusual price action. Short-end nominal yields dropped substantially after Adriana Kugler announced on August 1st that she was stepping down as a Fed Governor, and dropped again after Trump’s August 21st announcement that he was firing Lisa Cook. In both instances, long-end real yields remained comparatively well supported, creating an alligator-jaw effect on the graph.

Trump further upped the ante in his campaign to assert control over monetary policy late last week. Following the release of the poor payrolls data (which followed poor reads on the ADP report, the JOLTS report and the weekly jobless claims report) he ‘Truthed’ that Jerome ‘Too Late’ Powell should have cut rates a long ago and also nominated a shortlist of Kevin Warsh, Kevin Hassett and Christopher Waller as potential successors to Jerome Powell as Fed Chair. Naturally, all three have shown an inclination to cut the Fed Funds rate.

Events in other markets are also perhaps conducive to ideas of structurally higher borrowing costs at the long end of the curve. Firstly, Japan’s PM Ishiba has just announced that he will be stepping down. Ishiba is a fiscal hawk and while there is no clarity yet over a successor, it is likely that whoever takes over would be less inclined toward budget restraint and less supportive of tighter monetary policy from the BOJ. Sanae Takaichi, who finished second to Ishiba in a previous LDP leadership runoff, favours a more stimulatory fiscal stance and could be in the mix to become the new Premier.

In a similar fashion, France’s PM Bayrou faces a confidence vote later today where he is likely to lose his job. Bayrou has proposed EUR 44bn of austerity measures over the next 12 months in a bid to repair France’s parlous public finances, but faces staunch opposition on both the left and right to his plans. If Bayrou loses the vote (which seems likely), President Macron could either appoint a new Prime Minister, dissolve the national assembly and call fresh elections, or step down himself. The latter is highly unlikely, and the second course risks an even less palatable composition of parliament. We believe that the most likely course is that Macron will appoint a new Prime Minister and plans for fiscal retrenchment will be necessarily curtailed by the unfriendly operating environment. Our full analysis is available here.

And finally, the UK lost its deputy PM (who also happened to be the housing minister) late last week when news emerged that Angela Rayner had underpaid taxes on the purchase of a seaside flat, contravening the ministerial code of conduct in the process. PM Starmer has announced a comprehensive cabinet reshuffle but was at pains to stress that beleaguered Chancellor Rachel Reeves would be remaining in her current position in a bid to calm the already jittery gilts market.

30-year gilt yields reached their highest levels since 1998 last week as markets lost confidence in the trajectory of the UK fiscal position. Rising yields and projected productivity downgrades have more than wiped out the ‘fiscal headroom’ that Reeves left for herself at her last budget and now puts her in the position of having to find tens of billions of pounds worth of savings measures that are almost certain to be opposed by her own backbench.

Failure to pass savings measures will likely push gilt yields even higher, highlighting the economic doom loop that the UK now finds itself in as the Guardian reports senior Labour Party figures helpfully advising Keir Starmer to “stop making mistakes.” Keep in mind that the UK (and France!) also needs to find some money to re-arm on the off chance that they might have to fight the Russians.

So, while front end yields are sinking today on hopes of easier money from central banks, the story at the long end is a little more complicated. Fixing bloated fiscal positions without clobbering the economy and simultaneously finding ways to finance spending priorities has become a policy paradox. Is it simply ‘too late’ to fix? Or can out of the box economic thinking still find a solution?