Edward Harrison of Bloomberg recently made the following important market observation: “buying stuff you don’t believe in creates downside risk.”

Conviction is a measure of how much investors believe in their holdings.

When conviction runs high, investors are often more willing to tolerate lower prices.

In fact, some may add to their positions at lower prices. Conversely, when conviction is low, investors are likely to sell at the first sign of trouble.

This is the risk Harrison is referring to.

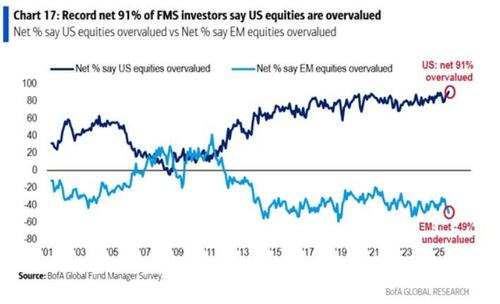

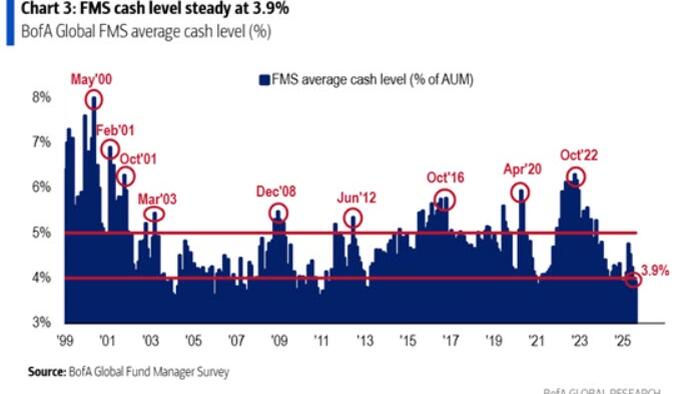

The graphs below help quantify the current state of conviction and risk-taking among fund managers.

The first graph shows that a record 91% of fund managers believe the US equity markets are overvalued.

Yet, despite their valuation stance, they are nearly fully invested as judged by the near record-low cash balances in the second graph.

More simply, institutional fund managers are fully invested but lacking conviction.

Harrison claims the potential market tumult from a lack of conviction was on full display during the sudden market downdraft in early April after the tariff announcement.

This episode shows the vulnerability. Any unexpected policy action or event that could precipitate a US recession will shock investors.

While fund managers may lack conviction and have their fingers on the sell trigger, retail buyers seem to have plenty of conviction.

Their buying led the sharp V-shaped recovery from the April lows.

Traditionally, Wall Street is considered the “smart money” and Main Street the “dumb money.”

Is that still true, or are we in a new market paradigm?