A little over a month ago, we correctly predicted that the US government would purchase a stake in troubled chipmaker Intel (a few days later, the Trump admin unveiled it would acquire a 10% stake in the chipmaker, sending its price soaring).

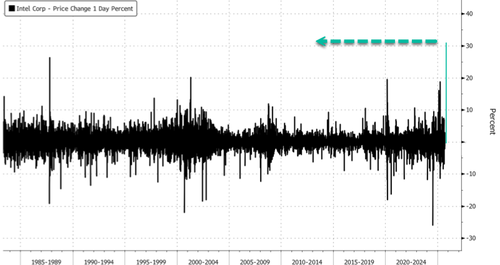

But not even we could predict what happened next: Intel shares are soaring in premarket trading - and if gains of 30% hold until the close it would mark the largest daily increase on record in Bloomberg data, dating back to the early 1980s...

... on news that Nvidia will invest $5BN in Intel at $23.28 per share, as part of a deal to jointly-develop and manufacture new chips for PCs and data centres.

The collaboration centers on integrating NVIDIA's NVLink technology with Intel's x86 CPU ecosystem, combining NVIDIA's AI and accelerated computing strengths with Intel's leadership in CPUs, process technology, and advanced packaging.

Highlights of the partnership:

The partnership also includes Nvidia investing $5 billion in Intel stock at $23.28 per share, pending regulatory approvals.

Comments from Nvidia and Intel executives on the partnership:

Nvidia and Intel have been rivals for decades. But Jensen Huang, Nvidia’s chief executive, hailed a “historic collaboration” to combine its graphics processing units, which dominate the market for artificial intelligence infrastructure, with Intel’s general-purpose chips.

Today's announcement follows less than a month after the Trump administration shocked markets when it acquired a stake in Intel at $20.47 per share. As part of that agreement, the US acquired 433.3 million newly issued Intel common shares, equivalent to approximately a 10% ownership stake.

Recall Trump recently said, "I will also help those companies that make such lucrative deals with the United States. ... I love seeing their stock price go up, making the USA RICHER, AND RICHER ... More jobs for America!!! Who would not want to make deals like that?"

Trump wasn't kidding: the U.S. Govt's Intel stake is already up 14% in under a month relative to the NVDA valuation round (translating to a 168% annualized gain) and is up more than 50% relative to the market price, which has soared by 30% this morning on the news of the historic investment.

And with this bullseye, US Capital LLC is now outperforming about 95% of all hedge funds this year.

The next question: what company is next (spoiler: LEU).