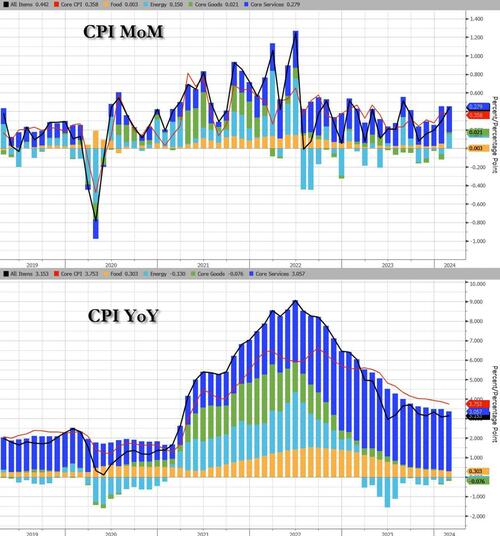

After January's surprised upside shift, expectations have been adjusted up over the last month for another sizable MoM move in headline CPI. But that was not enough as the 0.4% MoM rise in the headline (as expected - highest since August) lifted CPI YoY up to +3.2% (hotter than the 3.1% exp)...

Source: Bloomberg

The 3-month annualized CPI rate was rose to 2.8% from 1.9%. The 6-month annualized core rate dropped to 3.2% from 3.3%.

Energy costs surged MoM as Core Services inflation slowed MoM...

Source: Bloomberg

Full CPI MoM breakdown:

The index for all items less food and energy rose 0.4 percent in February, as it did the previous month.

Full CPI YoY breakdown:

The index for all items less food and energy rose 3.8 percent over the past 12 months.

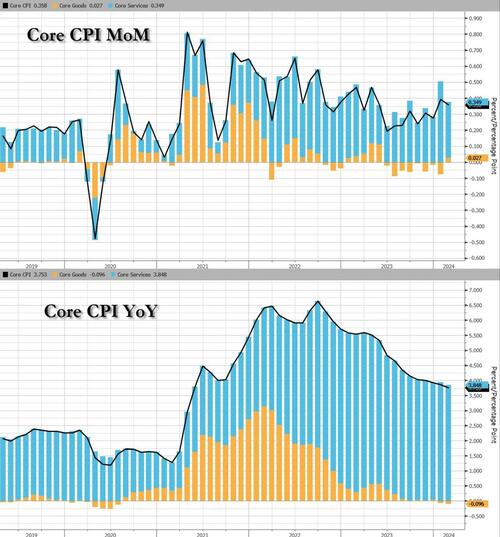

Core CPI rose 0.4% MoM (hotter than the +0.3% exp) and up 3.8% YoY (hotter than the +3.7% exp), but still the lowest since April 2021...

Source: Bloomberg

The 3-month annualized Core CPI rate was rose to 4.1% from 3.9%. The 6-month annualized core rate rose to 3.8% from 3.5%.

Core Goods actually rose MoM for the first time since June 2023...

Goods deflation continues (-0.3% YoY) but has flattened out, while services inflation remains stubbornly high at +5.2% YoY...

Source: Bloomberg

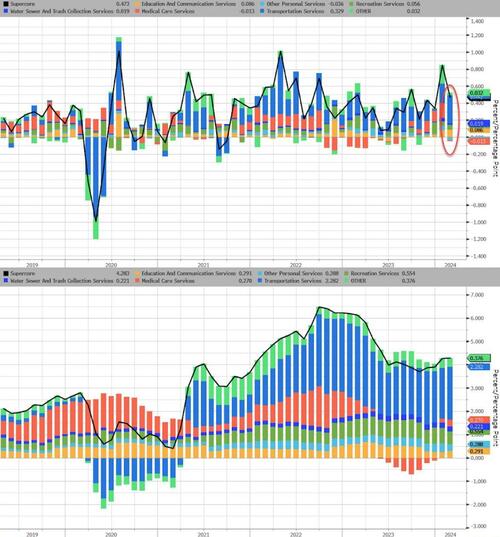

And one step deeper - the so-called SuperCore: Core CPI Services Ex-Shelter index - soared 0.5% MoM up to 4.5% YoY - the hottest since May 2023...

Source: Bloomberg

While SuperCore CPI slowed MoM, there was a large jump in Transportation Services MoM...

Source: Bloomberg

Finally, we note that consumer prices have not fallen in a single month since President Biden's term began (July 2022 was the closest with 'unchanged'), which leaves overall prices up 19% since Bidenomics was unleashed. And prices have never been more expensive...

Source: Bloomberg

That is an average of 5.6% per annum (more than triple the 1.9% average per annum rise in price during President Trump's term).

So, about that shrinkflation - did companies only 'get greedy' when Biden took office?

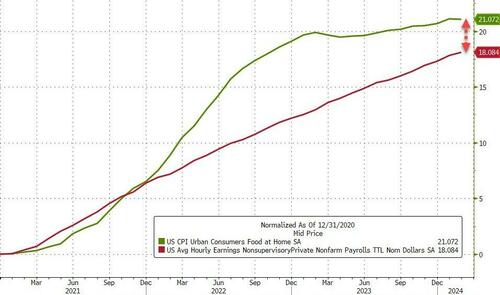

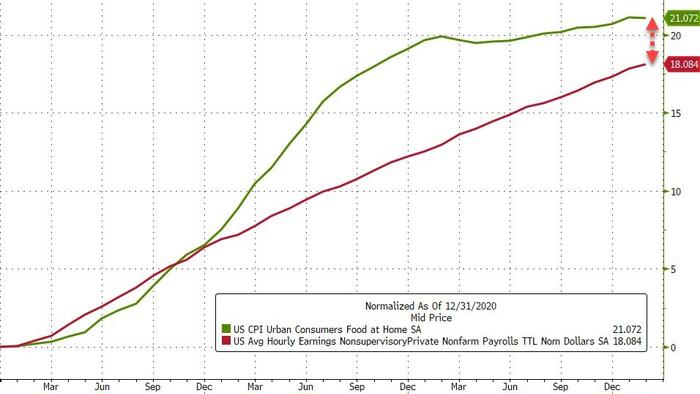

But it gets worse, real wage growth has lagged significantly for the average joe in America...

Source: Bloomberg

Despite a very modest decline in Feb, Food costs are up over 21% since Biden's term began, but non-supervisory wages are up only 18%.

Bidenomics for the win!

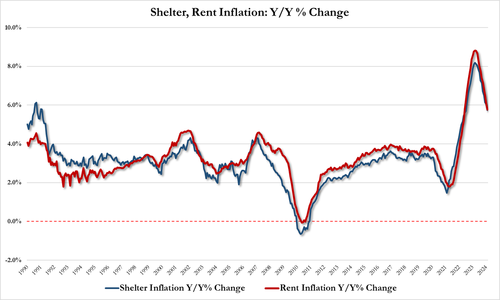

Are we going to see a replay on the '70s?

Source: Bloomberg

The market narrative of slow and steady disinflation just broke harder.

...or are we still set for a massive wave of depressionary deflation?