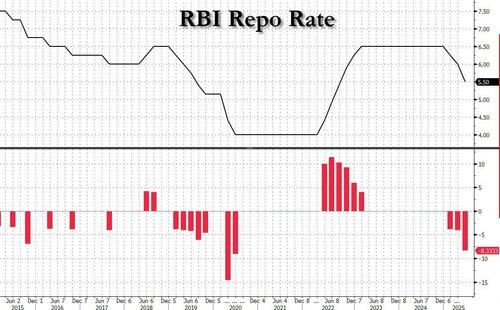

India's central bank shocked markets this morning when it slashing interest rates (in a 5:1 vote) by a deeper-than-expected half a percent - the third cut in a row - and the largest rate cut since the covid crash, amid falling inflation and lower growth in Asia's third largest economy. It also spiked the amount of liquidity available in the system to kickstart moribund lending.

The repo rate - the level at which the central bank lends money to commercial banks, influencing borrowing costs for home and car loans - now stands at 5.5%, the lowest in three years, following two previous 25bps reductions in April and February.

Explaining the rationale for the cut, RBI governor Sanjay Malhotra said growth is "lower than our aspirations" and the bank felt it was "imperative to stimulate domestic consumption and investment" amid rising global uncertainties.

Data released last week showed that India's economy grew by 6.5% in the previous financial year ending March. The world's (newly) most populous country remains the world's fastest expanding major economy, although growth has sharply dropped from the 9.2% high recorded in financial year 2023-24. Meanwhile, retail prices in India have slowed faster than expected to 3.16% in April - the lowest in six years - and below the RBI's 4% target, driven down by falling food prices.

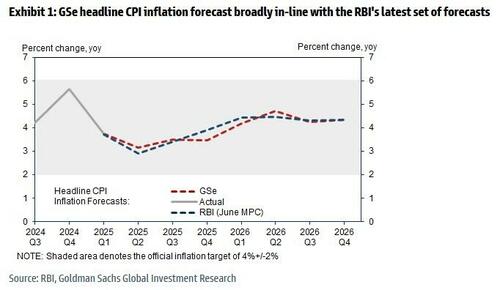

RBI has now forecast lower inflation than earlier projected for the year ahead. Inflation for Fiscal Year 2026 has been revised down to 3.7% from 4%, with Q1 (April- June) projected at just 2.9%. Growth forecast remains unchanged at 6.5%. This growth is well below the 8% growth the RBI aspires for.

There was another big surprise in today's announcement: alongside the greater than expected cut, the central bank changed its monetary policy stance from "accommodative" to "neutral", indicating that further rate cuts will depend on how India's growth-inflation dynamic evolves, a move which was viewed as hawkish, and sparking a sharp curve steepening.

The change in stance suggests the bar for further rate cuts is now higher. As the RBI noted, after 100bps of cuts since February, policy space is now limited.

However, fuller granaries due to a better-than-expected monsoon, weaker prices of commodities like oil - of which India is a net importer - as well as a strong currency are likely to help keep India's inflation in check in the months ahead, allowing the RBI to keep rates low.

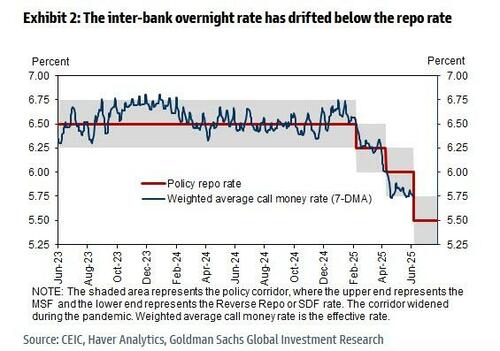

The RBI also unexpectedly cut the Cash Reserve Ratio (CRR) rate starting September 2025 , which is set to release INR2.5tn into the banking system. With liquidity already in surplus, overnight rates may now move closer to the SDF, 25bps below the repo rate.

Credit growth remains weak at 9.8% YoY (vs 19.5% a year ago). The CRR cut, to be implemented in four 25bps tranches starting September, aims to improve credit transmission. The Governor noted that announcing the schedule in advance is meant to reassure banks of the RBI’s commitment to supporting liquidity

Some more details from Goldman Sachs:

India's lower borrowing costs will have a positive growth impact due to improved purchasing power for households, lower input costs for companies and lower debt servicing costs for the government. They will also help homebuyers and a struggling real estate sector.

"This effectively lowers the cost of borrowing, making home loan EMIs [mortgage payments] easier on the pocket and thereby directly improving affordability for buyers. This can potentially boost demand in the Indian real estate sector, especially in affordable and mid-income segments. Affordable housing faced the sharpest pandemic fallout, with sales and new launches shrinking in the top 7 cities," Anuj Puri, chairman of ANAROCK Group, said.

Predictably, Indian markets rallied sharply post the rate cut announcement.

Looking ahead, Goldman expects the RBI to stay on hold for the rest of the year unless growth slows sharply. The front end of the IGB curve should remain supported by strong liquidity and favorable demand-supply dynamics. The bank favors 2Y IGB and expect the IGB curve to steepen.