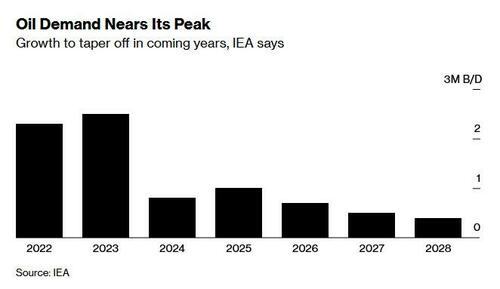

In the latest downbeat outlook on the oil market, which lately has gotten nothing but bad news despite the ongoing collapse in energy capex spending which will come back to buy oil prices... but not yet... overnight the IAEA predicted that global oil demand is nearing its peak and will taper off over the next few years as high prices and Russia’s invasion of Ukraine speed up the transition from fossil fuels (spoiler alert: that won't happen, since the resulting flood of Russian oil which recently hit a record high has removed all incentives, especially by India and China, to spend on expensive transition technology). Meanwhile, in the shorter term, the IAEA was more constructive, expecting higher 2023 demand to offset higher non-OPEC supply, resulting in crude markets that may tighten “significantly” as China’s consumption rebounds.

“Growth in the world’s demand for oil is set to slow almost to a halt in the coming years,” said the agency, which advises major economies, and which in the past has been accused of pushing Biden's low oil price agenda.

“The shift to a clean energy economy is picking up pace, with a peak in global oil demand in sight before the end of this decade.”

Below is a summary of the latest IAEA report (courtesy of Goldman):

Bottom line:

Demand:

Supply:

Stocks:

IEA Outlook Through 2028