HSBC Holdings Plc has achieved a "Sputnik moment" with the first real-world trial of quantum computing in bond markets, delivering up to a 34% improvement in predicting the probability of winning customer inquiries in the European corporate bond market. This marks the first empirical evidence of quantum computing solving real-world problems in algorithmic bond trading and could intensify the race among major banks to develop and deploy quantum computing in financial markets.

"Working with a team from IBM, HSBC leveraged an approach that utilised quantum and classical computing resources to deliver up to a 34 percent improvement in predicting how likely a trade would be filled at a quoted price, compared to common classical techniques used in the industry," the London-headquartered bank wrote in a press release.

HSBC made it known that it "demonstrated the world's first-known quantum-enabled algorithmic trading with IBM."

Philip Intallura, group head of quantum technologies at HSBC, described the breakthrough in deploying quantum computing in financial markets as a "Sputnik moment" for quantum, adding, "It will create a flurry of activity" as others step up efforts to harness the technology.

Here's the significance:

HSBC's trial signals the early commercial chapters of quantum computing in financial markets. However, Nvidia CEO Jensen Huang stated earlier this year that "very useful" quantum computers are years out.

Further color on HSBC's quantum trial, plus what other banks are saying (courtesy of Bloomberg):

Josh Freeland, global head of algo credit trading at HSBC, said that at one point in the trial, a team of 16 physicists, machine learning and artificial intelligence experts were "working around the clock," trying to replicate what the quantum computer had been able to do. "If you could get something like this result everyday, that would be quite something," said Freeland.

"We spend all day looking for single-digit improvements, because when you repeat that thousands of times a day, it can really make a difference." Other banks have also been reporting their own breakthroughs in quantum computing.

Take JPMorgan. In March, it said it generated and certified so-called truly random numbers using a quantum computer in a world-first the bank hopes will have applications in encryption, security and trading. Researchers created the sequence with a machine built by Quantinuum, according to a paper published in the scientific journal Nature.

Last year, KPMG said in a report that the technology still remained in an early prototype phase, but it may be nearing its inflection point.

"We have great confidence we are on the cusp of a new frontier of computing in financial services, rather than something that is far away in the future," HSBC's Intallura said.

In the market, quantum stocks such as IonQ, D-Wave, and Rigetti have surged this year, despite Nvidia's CEO warning in January that "very useful" quantum computers are still years away. In recent weeks, these stocks have soared on several headlines, including IonQ's progress in interconnecting quantum computers over long distances using existing fiber-optic infrastructure, and Rigetti's new deal with the U.S. military.

Related:

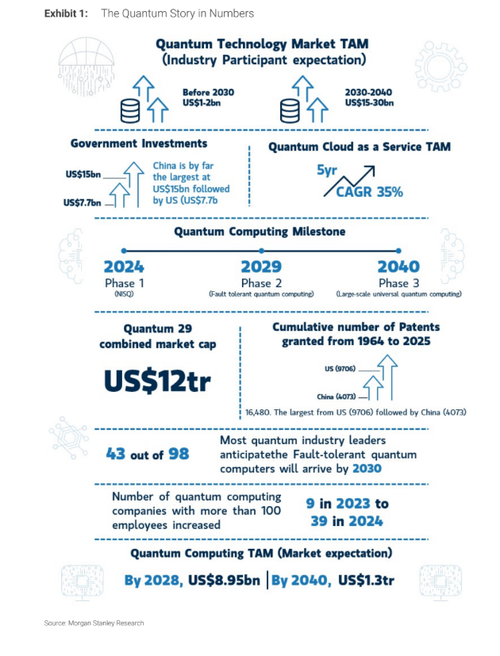

via Morgan Stanley's June report, "Quantum Computing – How Will It Impact AI?"...

. . .