By Peter Tchir of Academy Securities

There is one chart I keep turning to, the Citi Economic Surprise Index.

The surprise index started rolling over in the middle of December. For a month, no matter what expectations were, the actual data was worse. Then, since the middle of January, the data has started outperforming expectations. Part of that is because expectations were lowered, making it easier to beat. That also happens with earnings estimates, which are dropped to the point that typically 70% or more of companies beat their expectations (Q1 has been at the low end of the range last time I checked). But a lot of the data was simply good, especially on the job front.

What did I miss in the turning of the economy? That is the question we explore today and how markets will respond to this ongoing “surprise” as many missed this turn in the economy.

As Academy prepares to host our 2nd annual San Diego Geopolitical Summit there are a lot of very interesting things to discuss.

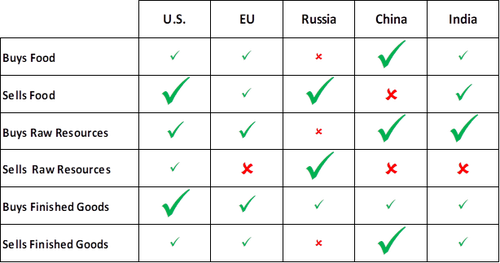

Yes, it is crude and simplistic, but wherever Russia has an “x”, China has a “check” and vice versa.

It seems that either we get the “surprise” of peace talks being announced in the very near term (which would be a surprise because Zelensky seems so against it, and Putin can’t really afford to “lose”) or after some “appropriate waiting period” we get the “surprise” of China selling arms to Russia.

With the economic data taking a turn for the better (both on an absolute basis and relative basis), what is next?

I guess, as a curmudgeon, we can start by questioning some of the data.

It is difficult to extricate markets from the Fed at this point. But as we wrote on Friday, we may have entered the 5th Stage of Rate Hike Grief – Acceptance.

Have we entered the “acceptance” stage?

I like owning stocks and bonds here. I’m looking for a bounce in both (3.7% on 10s and 4,200 on the S&P 500).

In the meantime, I might be going to San Diego in the only week March, ever, that San Diego has worse weather than Connecticut! Now that is surprising!