This morning has seen a slew of regional Fed survey data (following yesterday's dismal Dallas Fed Manufacturing data).

Things started on a weak note with the Philly Fed Services index plummeting from -12.8 to -22.8 - the weakest since the COVID lockdowns collapse and negative for 8 of the last 9 months...

Source: Bloomberg

The indicators for firm-level general activity, new orders, and sales/revenues all declined, and firms surveyed continued to report overall increases in prices.

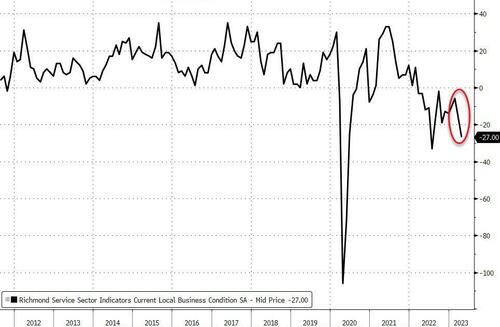

Next up was Richmond Fed's Manufacturing Index, which was also uglier than expected.

The composite manufacturing index fell from -5 in March to -10 in April (worse than the -8 exp).

Two of its three component indexes - shipments and new orders - declined.

Firms remained pessimistic about local business conditions, as the index fell to -19 in April.

Furthermore, the expectations index for future local business conditions edged down slightly again.

Source: Bloomberg

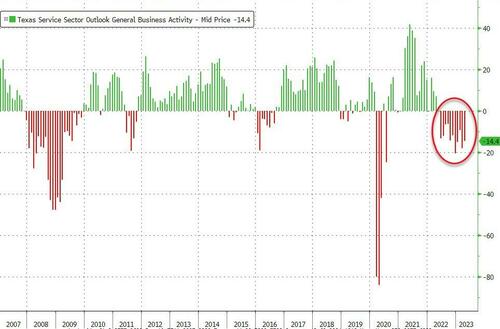

Finally, Dallas Fed Services survey printed in contraction for the 11th straight month...

Perceptions of broader business conditions continued to worsen in April, though pessimism waned slightly. Respondents’ expectations regarding future business activity were mixed in April.

The future general business activity index remained negative but largely unchanged at -13.0. The future revenue index stayed positive but fell eight points to 26.0.

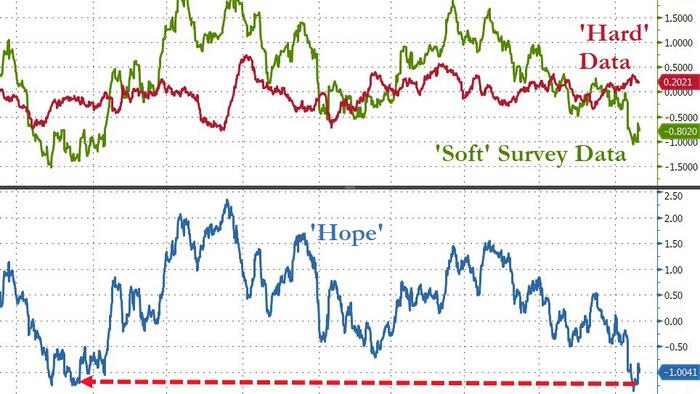

All of which leaves 'soft' survey data dismally low relative to 'hard' data expectations - which is also starting to fade...

Source: Bloomberg

Simply put - hope is at its lowest level since before Trump was elected.