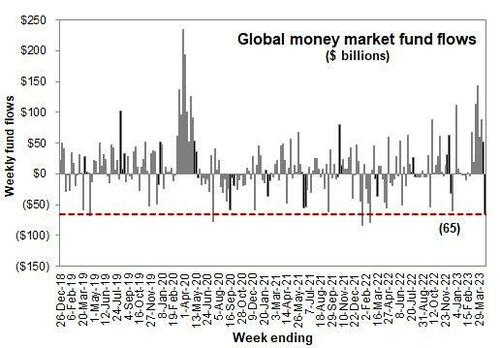

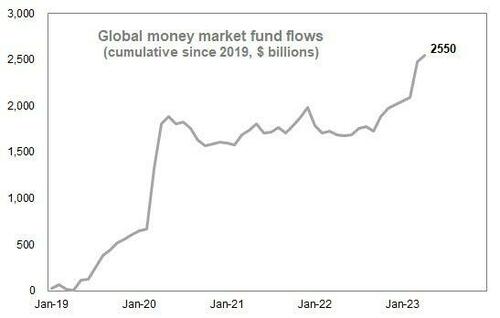

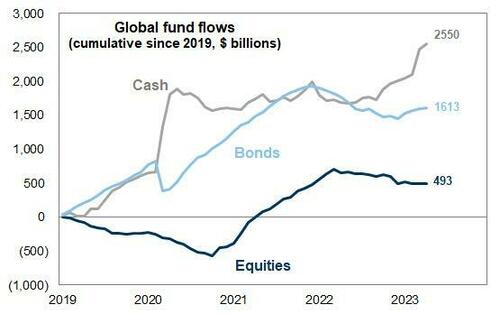

One month ago, when we first pointed out the surge in Fed reserves following the March bank crisis, and when the S&P was trading in the mid-3900, we correctly said that the risk "chase" was just beginning for one simple reason: the Fed had put both QT and tightening on hold, and had injected nearly half a trillion in reserves into the market overnight, courtesy of slow motion collapse of small and regional banks which just can't keep up with the Fed and offer depositor rates anywhere close to the 5.00% on offer by the Fed Funds, which is why nearly a trillion has since shifted to money market funds.

A few days later, none other than Goldman's closely followed flows guru, Scott Rubner, who until recently had been in the deeply bearish camp, flipped bullish as we reported in "Technicals Are Extremely Favorable Starting Today 4pm": Goldman's Rubner Turns Bullish Again.

Sure enough, since then stocks to rise, and the S&P almost hit 4,200 earlier this week before retracing some recent gains which brought them to the highest level since early February and matching the late-August highs.

But then something changed: as we again first pointed out yesterday after the latest Fed H.4.1 report, Fed reserves - after spiking in late March - had flatlined and in the latest week, they dipped to the lowest level since mid-March, and a level which basically suggests stocks are now at fair value relative to the Fed's latest generous helping of liquidity. It was this, that prompted us yesterday to declare the ending of the "chase."

So in retrospect, we were not surprised to see that Rubner also pulled a 180 this morning, and in a note published this morning, he has put a lid on his recent bullishness and writes that "flow dynamics are starting to change, we expect the market to move more freely next week and non-fundamental technical demand starts to run out of gas (this is in inning 9 for flow-of-funds). This is the last bullish email that I will send, as downside starts to open and $4200 ceiling holds. $1.9 Trillion worth of options expire today ($855 Billion PM AM) and $1 Trillion (PM) and the gamma will be unclenched starting next week. It is time for a thread."

Below we excerpt from his latest must-read note (available to professional subs at the usual place), and start with the 3 key points of his "Hike in May and go away" thread.

- The extremely net positive April equity flow-of-fund demand dynamics have started to wane, this is not a negative dynamic, but no longer a market positive tailwind. Technical supply doesn’t pick up until a major equity move lower. Systematic investors are (near max) long, but fundamental investors are not, and retail has been heavily allocated to money market funds. GS Overall Book L/S Ratio is in the 3rd percentile 1-yr, 1st percentile 3-yr, and 1st percentile 5-yr).

- Every incoming email / ping on persistent IB chat / global zoom call this week have been bearish. Being bullish on equities today is a very lonely proposition. By the end of the month, the technicals will have shifted and I will pile on to the "consensus bear" trade. I generally prefer not to go the same way.

- I continue to watch $4200 as the "magical" physiological level that changes investor behavior in the short term. This is a major long gamma "stuck in the mud" pin, and has been the top of the range (major strike of DNT range trades). Generally investors have been "ok" to miss [exposure] given we have not broken out from this level.

This is the number one incoming investor question: Why did the market not move this week? This week was aggressively unchanged in equities, I said this on our trading call, if felt like a battle of Mike Tyson vs. Evander Holyfield, Tyson as a systematic investor, and Holyfield as a fundamental investor, flow of funds were literally offsetting each other in a daily ecosystem. Instead of having a great battle of $4150, both fighters start to move in the same direction opening potential supply.

Which brings us to Rubner's Tactical Flow of Funds Preview: "Sell in May and Go-Away. 10 points."

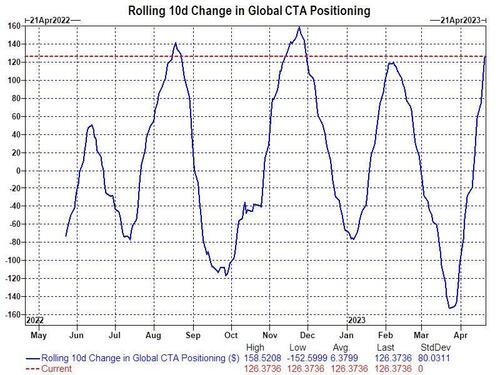

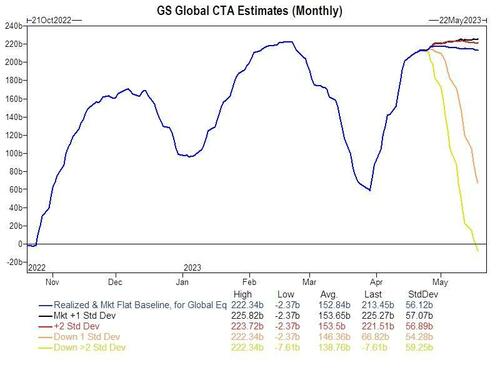

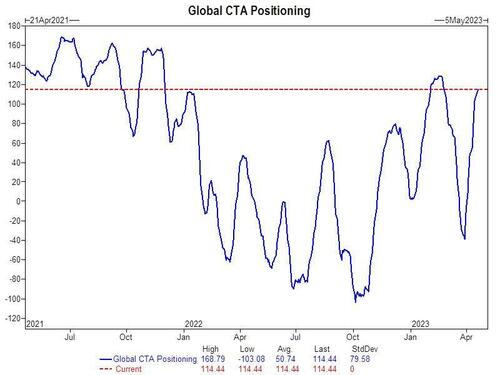

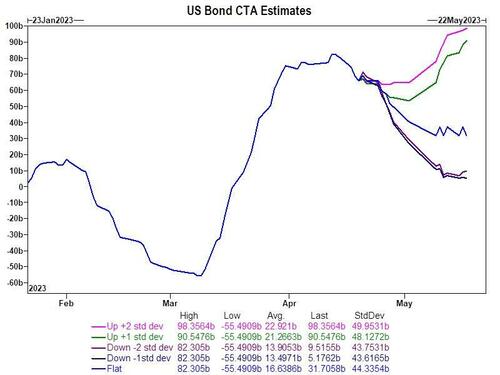

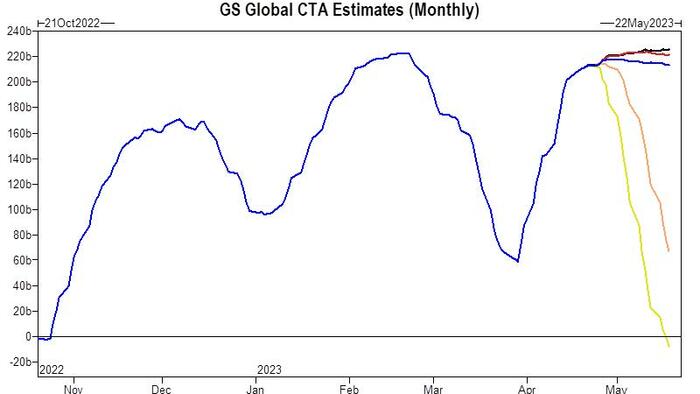

1. Global CTA Update: Buyers are officially out of ammo in an up tape and opens large asymmetric skew to the downside if the market were to sell off.

*Over 1 week:

*Over 1 month:

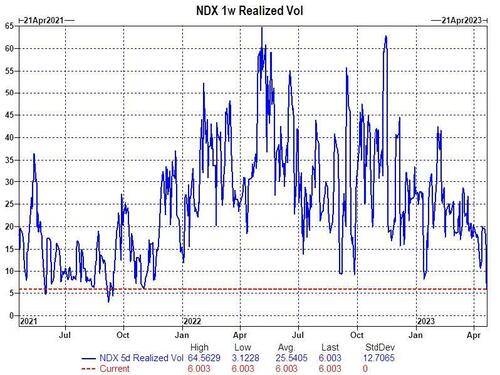

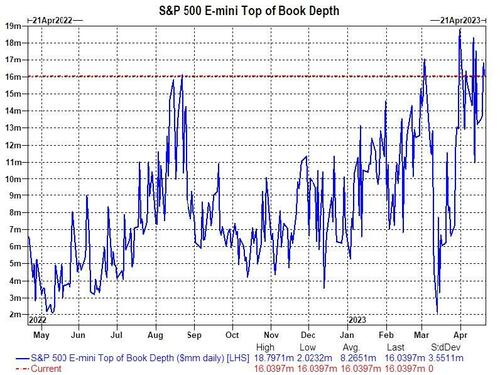

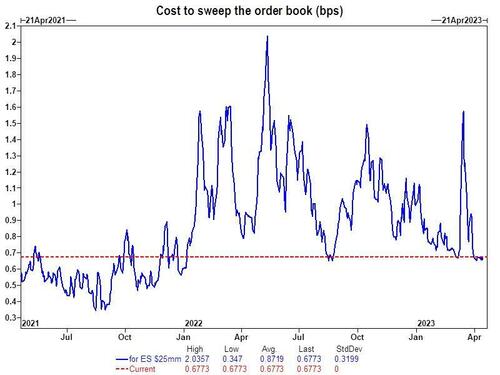

2. Equity Macro Liquidity has improved and remains healthy for now given low realized volatility

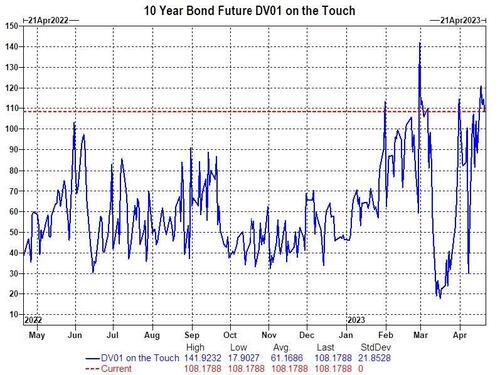

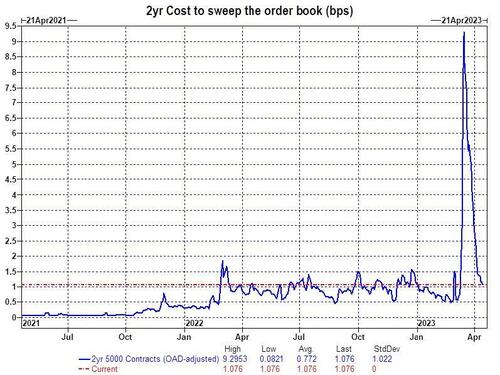

Fixed Income Macro Liquidity has also improved.

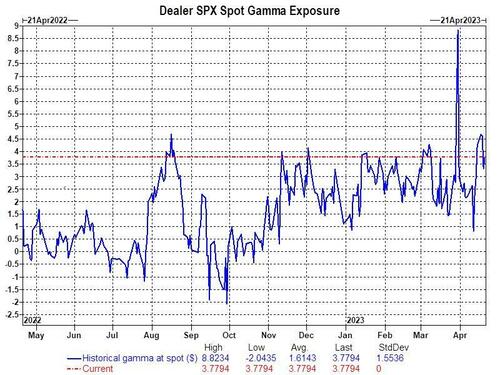

3. Index Gamma and 0DTEs: We estimate that dealers are long $4.0B worth of S&P 500 gamma. This is the second longest gamma position since the start of 2022. Following Option Expiry, gamma will be unclenched and less long.

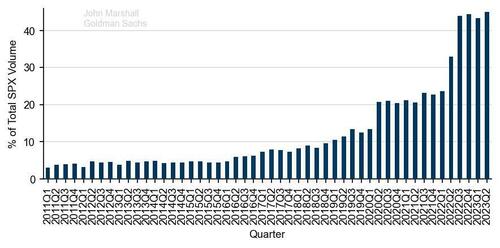

Has zero days to expiry option trading slowed down? Absolutely not. 46% of all options traded expire in 6.5 hours or less. Each day is its own ecosystem. If the room gets beared up, I am watching daily puts.

Need a debt ceiling hedge for the back book? Max Loss: Limited to premium paid.

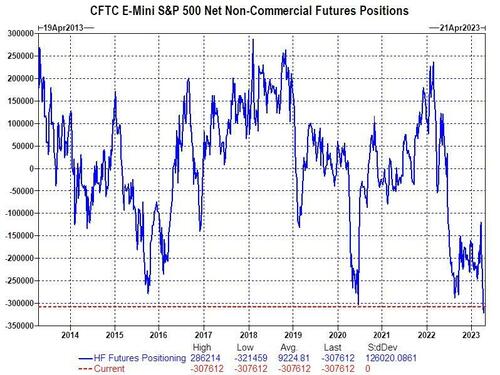

4. Discretionary Macro Short Positions still elevated (a worry for the sizing of shorts)

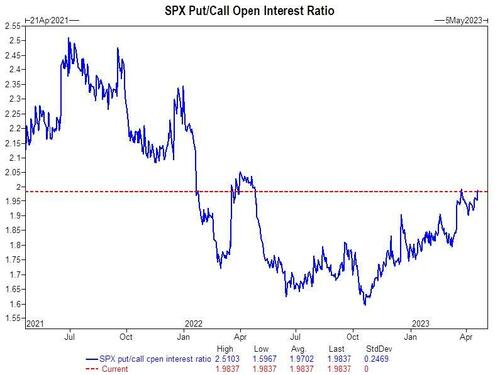

5. Put/Call Open Interest is the highest level of the year.

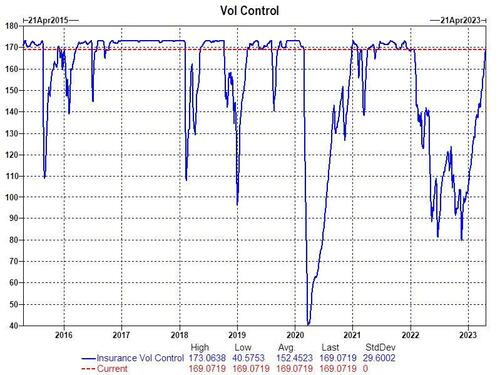

6. Systematic investors have added exposure, with Vol Control strategies near MAX LONG. What happens if vol moves higher?

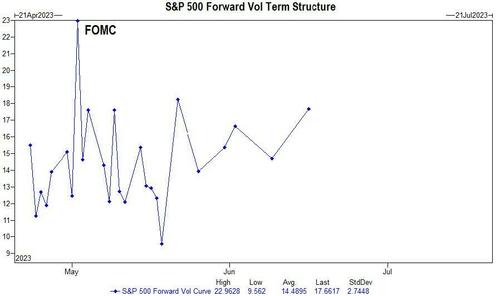

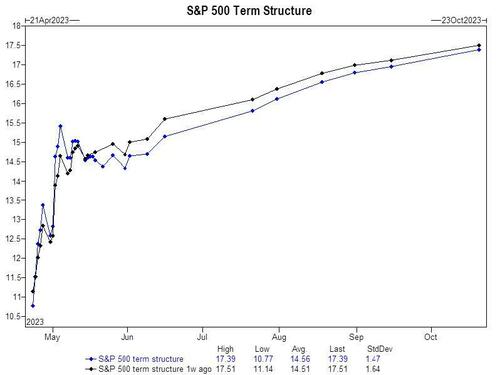

7. SPX Term structure: May FOMC vol is essentially off of my chart: big week, May 3rd FOMC, May the 4th be with you (star wars day / kids star wars Lego’s), Cinco de Mayo (end of earnings season)?

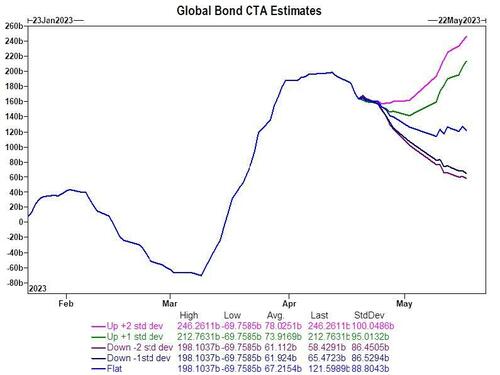

8. Fixed income CTA supply is now a major focus for equity investors. After large covering in the bond space, we have fixed income systematics as sellers given the move higher in global yields.

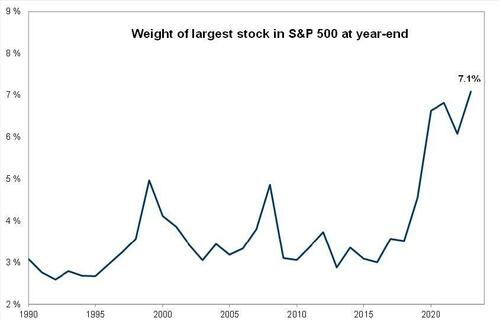

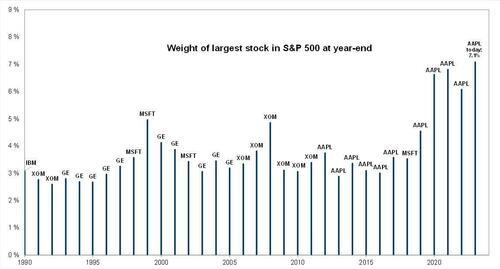

9. Know your index construction: How about them Apples? AAPL represents 7.1% weighting in SPX. No stock has represented a larger weight in the S&P for the last 40 years.

10. Money Market Flows: Time to pay taxes? Money markets logged the largest weekly outflows since Feb 2022, -$65.3 Billion worth of outflows. This barely dents the larger assets under management, which stands at a record high ($7 Trillion). 3M T-bill yield stood at 5.20% earlier in the week. Fwiw equities logged outflows on the week.

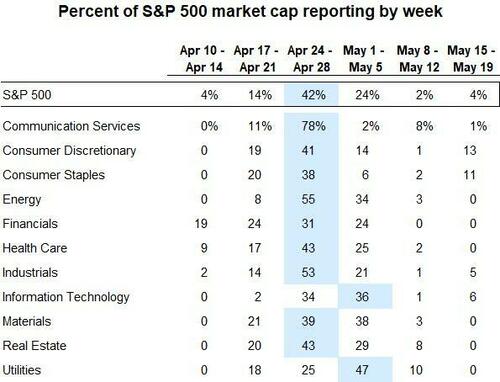

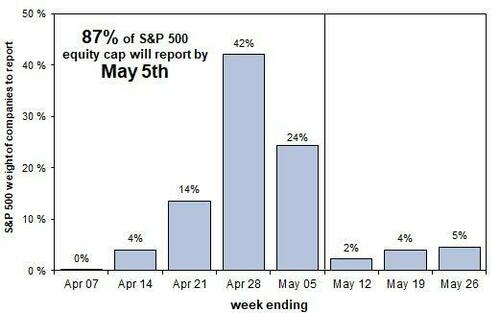

Other: Next week is the superbowl of earnings with 42% of the market cap of the S&P reporting. Spring break is over. The most loved stocks (and highest index weights) weigh in for the fight.

More in the full Rubner report available to professional subs in the usual place.