Cash-strapped consumers had no joy and happiness in the third quarter as they dialed back spending on chocolate and salty snacks produced by Hershey Co. The company slashed its net sales growth and earnings outlook after consumers balked at rising retail snack prices due to soaring cocoa costs.

Hershey reported third-quarter adjusted earnings per share of $2.34, missing the $2.56 forecast held by analysts tracked by Bloomberg. Salty snack sales in the quarter plummeted in the US, while candy sales were marginally higher.

Here's a snapshot of the third quarter results:

Adjusted EPS $2.34 vs. $2.60 y/y, estimate $2.56

Net sales $2.99 billion, -1.4% y/y, estimate $3.07 billion

- North America confectionery net sales $2.48 billion, +0.8% y/y, estimate $2.53 billion

- North America salty snacks net sales $291.8 million, -15% y/y, estimate $313.9 million

- International net sales $218.4 million, -3.9% y/y, estimate $243 million

Net sales at organic constant FX -1% vs. +10.7% y/y, estimate +1.91%

- North America confectionery sales at constant FX +0.9% vs. +10.1% y/y, estimate +2.86%

- North America salty snacks sales at constant FX -15.5% vs. +25.5% y/y, estimate -9.59%

- International net sales at organic constant FX +0.2% vs. -1.2% y/y, estimate +8.65%

Adjusted gross profit $1.20 billion, -12% y/y, estimate $1.29 billion

Adjusted gross margin 40.3% vs. 44.9% y/y, estimate 41.7%

On an earnings call on Thursday, CEO Michele Buck told investors that "pressure in the snacking categories are really driven by the consumers feeling pressured financially."

Hershey has warned several times that record-high cocoa prices would pressure consumers and thus "limit earnings" this year.

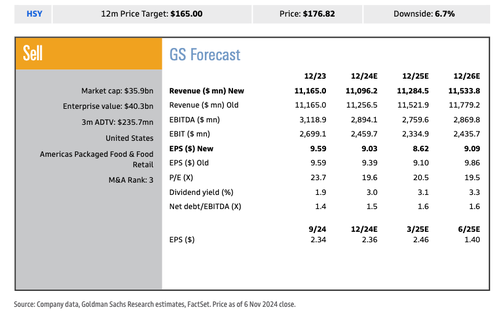

On Thursday, Goldman's Leah Jordan penned a note for clients about the dismal demand story around Herhsey, reiterating a "Sell" rating...

HSY closed down -2.3% (vs S&P 500 +0.8% and XLP +0.4%) after its 3Q miss and lowered FY24 guidance, which revealed incremental demand headwinds given shifting consumption trends (resulting in inventory reductions at retailers) coupled with increasing competitive pressures across the portfolio as smaller brands and private label gain ground. While HSY sounded more constructive on the longer term outlook for cocoa prices and the impact on its business, there is still uncertainty surrounding the margin pressure from higher cocoa costs for FY25. Furthermore, we believe it will be difficult for the stock to work until we see better demand for the category and market share trends for HSY. We reiterate our Sell rating for HSY with an updated 12-month price target of $165.

Jordan offered clients her top three takeaways from earnings:

Jordan reiterated Hershey's "Sell" rating and lowered her 12-month price target to $165 from $185.

Here's what other Wall Street analysts told clients:

DA DAVIDSON (neutral), Brian Holland

- 3Q "once again lagged tempered expectations," and in addition to "moving parts around inventory and shipment timing, underlying demand" remains weaker than expected, Holland writes

- The reduced 2024 guidance reflects the 3Q shortfall, but also implies that both his and the Street's 4Q estimates are too high

- "Beyond cocoa, the combination of weaker snacking trends and reinvestment needs figures to pressure both the top & bottom line in the near to intermediate term,' he says

- "Without a clearer picture of when/where the bottom is in the cycle, valuation nearer trough levels alone is not compelling enough to make us more constructive here"

BERNSTEIN (market perform), Alexia Howard

- "It seems that over and above the obvious cocoa pressures on margins, category growth remains lackluster even against particularly easy" y/y comparables, Howard writes

- "Begs the question" of what the GLP-1 drug impact might be having on "indulgent snacking categories and how Hershey's core chocolate volumes might fare as the company attempts to take pricing, even as it acknowledges that incremental promotion and revenue growth management efforts are needed"

- These challenges may intensify as "cocoa input cost pressures step up and the volume outlook for the US chocolate category remains highly uncertain"

MIZUHO (neutral), John Baumgartner

- "Halloween shipments/sell-through met expectations (+LSD%), but total US snacking industry consumption decelerated (+0.1% vs. 2Q's +0.9%)," Baumgartner writes

- Market share losses are increasing amid competition from smaller companies, private label and multinationals, while consumer shopping is shifting more toward club stores/dollar stores/online and less at convenience and drug stores

- "Our concerns are rising for FY25 (consensus EPS not low enough) as HSY's main response appears to be pursuing retail productivity/merchandising & promo optimization," he says

BARCLAYS (equal-weight), Andrew Lazar

- 3Q results were "well below even our well-below-consensus" hurt by "both industry-wide and Hershey-specific challenges," Lazar writes

- "Total snacking consumption has softened and consumers are channel shifting from c-store and drug [store] where the category overindexes to club and mass merchandisers where the category is less developed" and retailers "continued to take down" inventory levels across both North America Confectionery and North America Salty Snacks

- From a company-specific perspective, Hershey continues to lose market share in core confection business amid increased competition, and hit by execution issues in both Confectionery and Salty Snacks

- While a 2024 EPS guidance reduction was likely anticipated, the cut is "greater than most had expected" and 2025 EPS will probably decline "well below current Street estimates"

- "While sentiment on HSY shares is already quite negative, in our opinion, we think the magnitude of the 2024 EPS cut combined with underlying fundamental trends that remain challenged will still likely result in some additional share weakness on the open," he says

The big takeaway is that food inflation remains sticky, and cash-strapped consumers have balked at expensive, leading brands and traded down to generic ones - or, in some cases, entirely pulled back on spending.