Today marks 45 days after the end of the first quarter, also known as the day when Q1 13-F season begins (and ends) and while we will have a comprehensive summary of what hedge funds did in the first quarter (which, again, ended 45 days ago and in a world where the average holding period is a few minutes, is largely meaningless by now) we start our reporting with the grand daddy of all modern day taxpayer-backed hedge funds, Warren Buffett's Berkshire Hathaway.

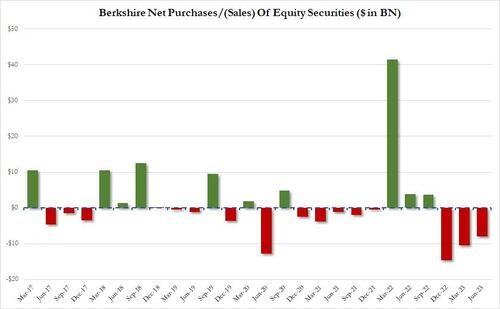

Which actually was not that much: the reported value of Berkshire's long-only equity portfolio rose by just 7% to $348BN as of June 30 from $325BN in Q1 (which in turn was an 8.7% increase from $299BN in Q4) to $325BN, largely thanks to stock price appreciation because as previously noted, in Q2 Buffett "harvested" (read sold) his positions for the third quarter running, dumping a net $8.0BN (down from $10.4BN in the previous quarter, and from the $15BN net he sold in Q4, both of which are a small fraction of his portfolio of ~$350BN).

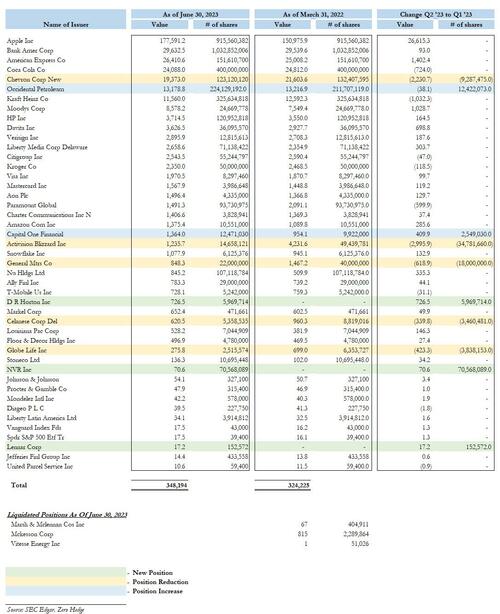

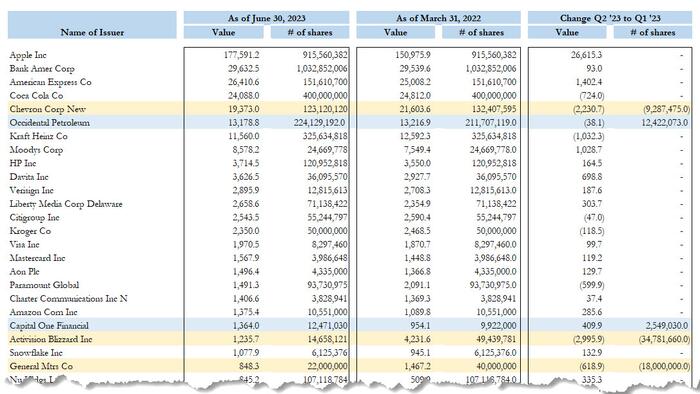

With that in mind, here are the most notable changes in Q2:

Three new buys, all homebuilders:

As Bloomberg notes, the largest US homebuilders have been outperforming smaller rivals despite soaring mortgage rates, with stocks rallying and the companies welcoming an onrush of buyers frustrated by a severe shortage of existing-home listings. Lennar, D.R. Horton and NVR are all up more than 30% this year.

Four exits:

Added holdings in just two positions:

Trimmed holdings in five positions, including:

Recent disclosures from Berkshire related to its stock portfolio revealed a departure from the company’s long-held strategy of buying shares and holding them for the long term. The conglomerate revealed a stake in Taiwan Semiconductor Manufacturing Co. last year, only to largely rotate out of that position in subsequent months. Buffett said the decision to cut the stake in TSMC was his, citing geopolitical tensions as the motivation behind the move even as he continued to praise the chipmaker.

“I feel better about the capital that we’ve got deployed in Japan than in Taiwan,” Buffett said earlier this year. “I wish it weren’t so, but I think that’s the reality, and I re-evaluated that in the light of certain things that were going on.”

Of course, by now readers know but we will remind them anyway, the holdings reported here exclude derivatives and total values may include debt securities. The equities listed may not reflect current holdings. New holdings and exits may be caused by updated disclosure requirements rather than investment changes.

Full details of all Berkshire Q2 moves can be found in the table below.