Today marks 45 days after the end of the first quarter, also known as the day when Q1 13-F season begins (and ends) and while we will have a comprehensive summary of what hedge funds did in the first quarter (which, again, ended 45 days ago and in a world where the average holding period is a few minutes, is largely meaningless by now) we start our reporting with the grand daddy of all modern day taxpayer-backed hedge funds, Warren Buffett's Berkshire Hathaway.

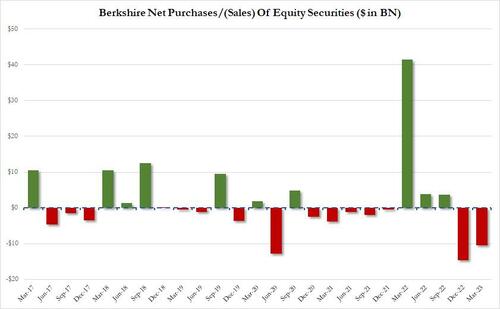

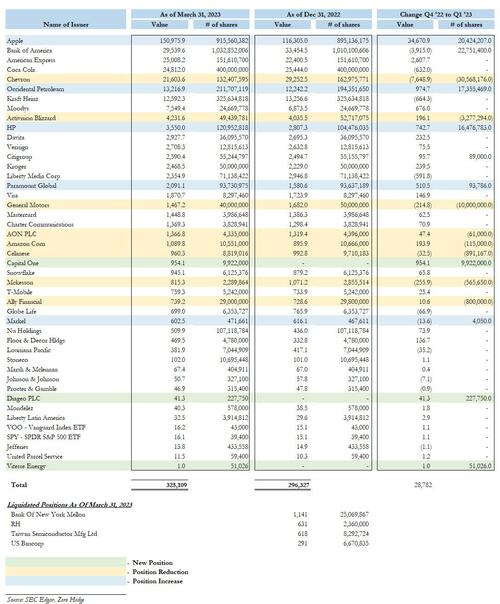

Which actually was not that much: the reported value of Berkshire's long-only equity portfolio rose by 8.7% from $299BN to $325BN, largely thanks to stock price appreciation because as we previously noted, in Q1 Buffett "harvested" (read sold) his positions for the second quarter running, dumping a net $10.4BN in stocks (against $2.9 billion in purchases), a modest slowdown from the $15BN net he sold in Q4 (both of which are a small fraction of his portfolio of ~$300BN).

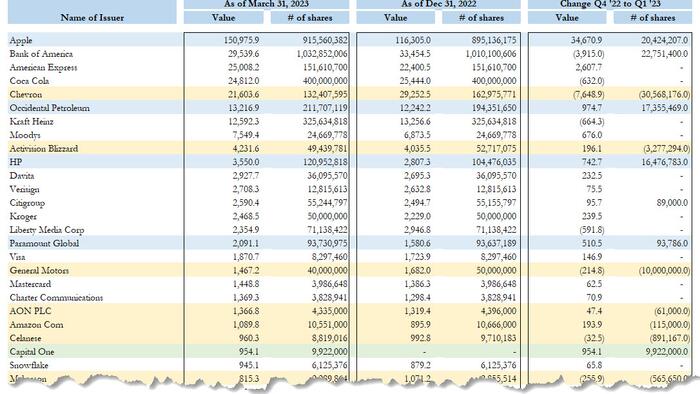

With that in mind, here are the most notable changes in Q1: one quarter after Berkshire neither added new position nor fully liquidated holdings in the fourth quarter of 2022 for the first time in years, in Q1 Berkshire both added several new positions and fully liquidated several others.

Three new buys:

Four exits:

The market promptly responded to the changes in the portfolio, sending two banks' shares in opposite directions Monday afternoon: Capital One Financial shares rallied more than 5% in after-hours trading while Bank of New York Mellon sold off in the extended session Monday after Berkshire bought the former and liquidated the latter.

At Berkshire's annual meeting, Buffett weighed in on recent scares for regional banks: "In terms of owning banks, events will determine their future and you've got politicians involved, you've got a whole lot of people who don't really understand how the system works." Apparently, when it comes to recently hobbled bank names such as USB and BNY, neither did Buffett.

Elsewhere, RH shares fell 3% after Berkshire disclosed liquidating his entire 2.4 million share stake. Berkshire also officially reported selling of its 8.3 million stake in Taiwan Semiconductor.

Added to five positions:

While the 13F indicated additions to Berkshire's positions in Bank of America and Citi, the conglomerate clarified that those positions are not actual additions but are inherited from Gen Re: "beginning with the Form 13F to be filed later today, the holdings of Gen Re will be included in Berkshire's 13F filing," Berkshire said in a news release earlier Monday. "The NEAM Form 13F filings will no longer include Gen Re's holdings but they will continue to include NEAM client holdings where NEAM is acting as an investment manager." Other holdings affected by that change included Apple and Chevron Berkshire said in its news release.

Trimmed holdings in eight positions, including:

Top holdings:

Of course, by now readers know but we will remind them anyway, the holdings reported here exclude derivatives and total values may include debt securities. The equities listed may not reflect current holdings. New holdings and exits may be caused by updated disclosure requirements rather than investment changes.

Full details of all Berkshire Q4 moves can be found in the table below.

Soruce: SEC Edgar