After the close, Oracle reported Q2 earning that were a big disappointment, missing from top to bottom: revenue was $14.93BN, below the est of $15.02BN, all-important cloud revenue of $3.3BN also missed expectations of $3.38BN. And yes, EPS also missed coming in at $1.47, just below the $1.48 median estimate.

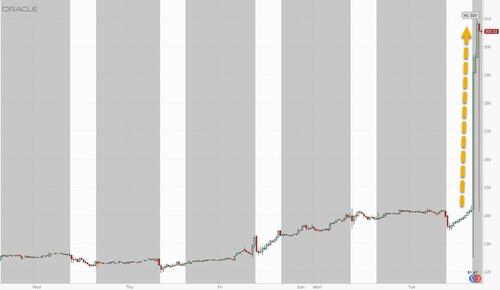

And yet the stock, which is not some retail favorite penny stock prone to short squeezes but a massive $680 billion market cap giant (with very little short interest) is soaring 25% after hours, an unheard of move for a company this size.

Why and how is this possible? Well, instead of looking for the answer in the company's historicals one has to look at the extremely squish concept known as backlog (in the case of Oracle called Remaining Performance Obligations) and specifically read the company's projections.Here's the first part: "We signed four multi-billion-dollar contracts with three different customers in Q1," said Oracle CEO, Safra Catz. "This resulted in RPO contract backlog increasing 359% to $455 billion. It was an astonishing quarter—and demand for Oracle Cloud Infrastructure continues to build."

Yes, 3 (three) clients increased Oracle's backlog by almost 4x, or more than $300 billion, to just shy of half a trillion dollars (this of course assumes no recession any time in the next decade as an economic slowdown immediately means all soft purchase orders will be immediately wiped out... and as we already know the US is already in a recession thanks to today's massive payrolls revision).

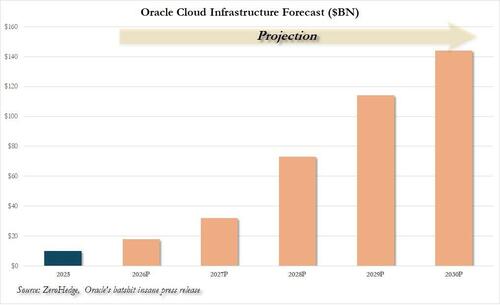

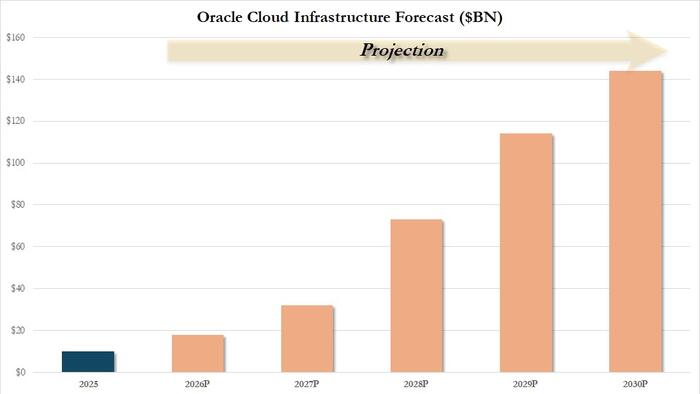

But while the backlog was bad, it was the company's forecast that was... idiotic? ridiculous? laughable? batshit insane? we can't quite pick the right word, although exponential is closest. You see, Oracle decided to take a random number and simply double it every year for the next 4 to get its oracle cloud infrastructure forecast. To wit:

"we expect Oracle Cloud Infrastructure revenue [of ~$10BN] to grow 77% to $18 billion this fiscal year—and then increase to $32 billion [double], $73 billion [double], $114 billion [almost double], and $144 billion over the subsequent four years. Most of the revenue in this 5-year forecast is already booked in our reported RPO. Oracle is off to a brilliant start to FY26."

But instead of discussing it, let's just show it: here is the most batshit insane chart in the world right now - Oracle's cloud revenue growth forecast.

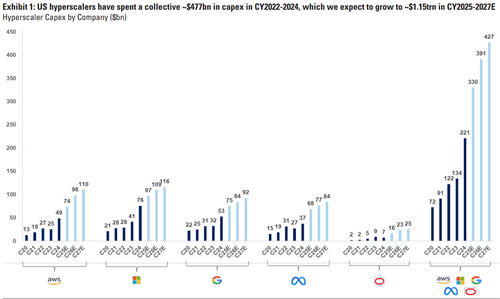

Now in a world that is as batshit insane as this one, where AI is somehow expected to generated ungodly amounts of value even though it still can barely generate any revenue, this forecast might, just potentially might make some sense if hyperscaler capex (after all ORCL's revenue is someone else's capital spending) were to similarly double every year. Which, of course, is nowhere even remotely the case. In fact, after surging by 50% in 2025, Capex growth is expected to slow down dramatically and barely grow in 2026 and 2027.

But that doesn't matter to ORCL which has decided that since revenue (i.e. capex) almost doubled this year, it will almost double again next year, and the next, and the next again, and so on. All of this also assumes there are zero bottlenecks like power supply, electricity, water, not to mention actual revenue to be generated by the hyperscalers (just how many chatbots do college students really need to write that essay) and of course, a sudden collapse in pricing as every tech revolution does sooner or later (whatever you do, don't look at Chinese LLMs which can do everything that their US peers can do at 95% off).

But to the ultimate showboat (no pun intended), Larry Ellsion none of this matters, and in fact, the billionaire clearly has one last wish before he passes away: see how much he can get away with in terms of insane bullshit shoved down shareholders' throats before they finally push back.

Judging by the ridiculous move in the stock after hours, the answer is lots more, which is to be expected: after all, at this point nobody doubts that AI is the world's biggest bubble. And the consummate corporate executive, Ellison, knows just how to call the world's bluff - if someone dares to point out that the exponential hockey stick forecast chart emperor is batshit insane - and naked - then every other AI assumption would have to be meticulously questioned, and very soon the whole house of cards will collapse. Which it will... eventually. Just not today.

* * *