The return of 'Roaring Kitty' sent GME soaring higher (up 110% at its highs)...

Source: Bloomberg

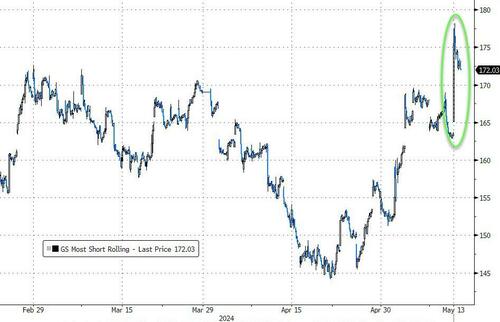

...and prompted squeezes/panic-covering across the 'most shorted' names and 'retail favorites (memes)' soared...

Source: Bloomberg

As John Flood noted from Goldman's trading desk: "GS Most Short Rolling basket in focus having a top 5 move over the past 5 Years (3.3std)."

Source: Bloomberg

Volume/activity has been abysmal recently and today was no better with overall activity levels -7% vs the trailing two weeks average.

Most notably, the weakest sleeves of the market are surging higher – Most Short Basket up +3 sigmas // YOLO basket up +3 sigmas // China Internet basket up +2 sigmas

GameStop “stonks” surged up to 119% after a cryptic post on X from Keith Gill, aka 'Roaring Kitty', his first since June 2021. Some investors interpreted it to mean that Gill is coming back into action (BBG).

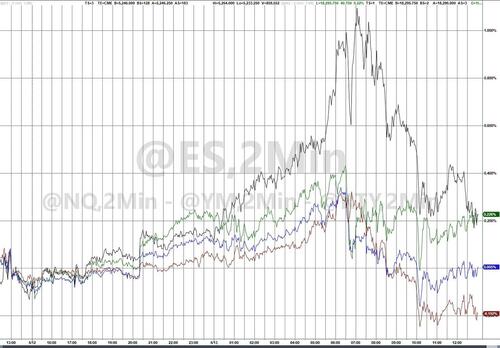

S&P is unchanged but NOT all is calm underneath the surface. HF community under pressure on this Manic Monday. We are seeing a considerable amount of covering by the fast money community in both single stocks and macro products during the first 3 hours of trading.

Keep an eye on the following thematics as it feels like this could get worse before it gets better...

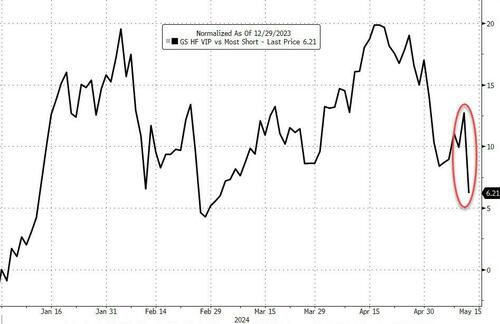

'HF VIP Longs vs Most Short' was down 7% - the biggest drop since June 2021 (today’s move is a 4SD over last 1 year of trading)

Source: Bloomberg

Mega Cap Tech vs Non Profitable Tech down 4% (today’s move is a 3SD over last year of trading)

Long Momentum down 4% (today’s move is a 4 SD over last year of trading)

In context, today saw half of all indicative hedge fund gains year-to-date have been cut in half...

Source: Bloomberg

The jump in inflation expectations (and household debt stress) from The New York Fed's survey did provide some selling pressure on the day however - as well as Chevron's decline (driven by reports that influential proxy giant ISS recommended Hess investors abstain from voting on the proposed $53 billion acquisition).

By the close, the S&P was unchanged, The Dow was the laggard (down around 0.2%), while Small Caps outperformed and Nasdaq held on to some gains (both well off the day's highs)...

Treasuries were bid today (but traded in a narrow range), ending the day down only 1bp...

Source: Bloomberg

The dollar ended the day flat, recovering overnight losses...

Source: Bloomberg

Bitcoin ripped back up to $63,000 today, erasing Friday's plunge losses...

Source: Bloomberg

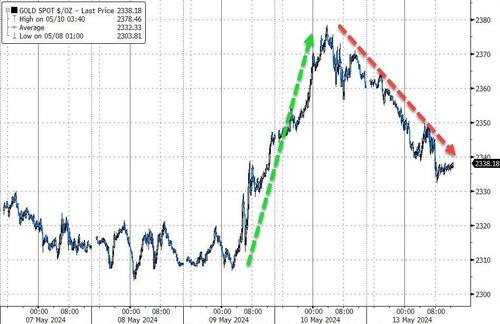

Gold gave back more than half of last week's gains today, back below $2340...

Source: Bloomberg

Oil bounced back off $78 (WTI) - around its 100DMA - recovering most of Friday's losses...

Source: Bloomberg

Finally, this trend is not Powell's (or Biden's) friend...

Source: Bloomberg

'Growth' data continues to surprise to the downside, and 'inflation' data surprise to the upside. What do we call that Jay? Clue: it rhymes with blag-station.