Shares of the LGBTQ+ dating app Grindr surged around midday in New York after a Semafor report, citing company insiders, said they are "discussing taking the company private after a stock slide forced its owners into a precarious personal financial position."

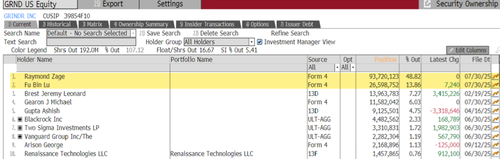

The report says the two controlling shareholders, Raymond Zage and James Lu, are in talks to secure debt financing from Fortress Investment Group to buy out Grindr.

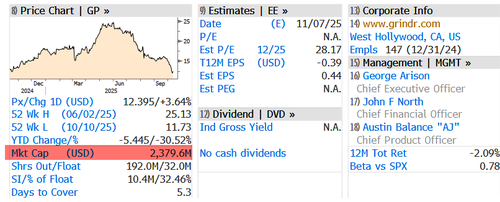

Before the Semafor's report was published, the dating app company had a market capitalization of about $2.4 billion.

Here's more about the potential buyout deal:

Zage and Lu have discussed a buyout price of around $15 a share, some of the people said, cautioning that number could change. A deal at that price would value the company at around $3 billion.

Before the report hit the wires, shares were down 30.5% year-to-date. Afterward, the stock jumped 16%.

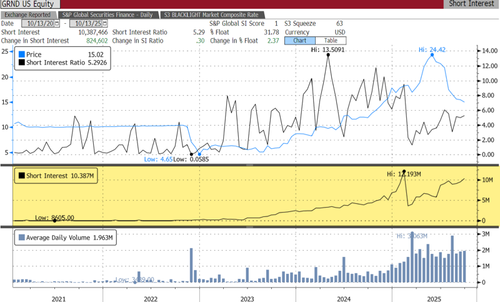

It's important to note that the float is 32.5% short, equivalent to about 10.5 million shares, with 5.3 days to cover.

More from Semafor:

Any deal would likely carry national-security implications. Grindr was originally owned by a Chinese firm, which sold it in 2020 after the Committee on Foreign Investment in the United States raised concerns about sensitive personal data — which could be used in blackmail attempts — being accessed by Beijing. Zage, a US expat who is now a Singaporean national, surpassed 50% ownership of Grindr just last month through stock buybacks. Lu is a Chinese-born US citizen, according to the South China Morning Post.

Taking Grindr private could arrest a stock slide that appears to have little to do with the company's financial performance: Profits were up 25% in the second quarter from a year ago, but the stock has fallen more than 20% since late September. Grindr went public in 2022 through a blank-check company.

Corporate filings show that Zage and Lu, who together owned more than 60% of Grindr's shares as of June, had pledged nearly all of their stock for personal loans. That lender, the people said, is SeaTown Holdings, a unit of Temasek, which seized the shares last week after the loans became undercollateralized.

Short squeeze?